AlgoTrader (now Wyden) software facilitates the development, automation, and execution of numerous strategies at the same time. The software download enables automation in forex, futures, options, stocks and commodities markets. It is also one of the first to allow automated trading of bitcoin and other cryptocurrencies. This page will break down their system, including features, benefits, price, and performance.

Breaking Down ‘AlgoTrader’

Swiss-based AlgoTrader GmbH has contributed to the rise in automated trading systems. In fact, 80% of all stock market orders now placed by such systems.

Since 2009, AlgoTrader has introduced a number of comprehensive versions, from 2.2 and 2.3 to the popular 4.0 version of today. Below you will find details on the developments.

AlgoTrader is built on open-source technology, frameworks, and methodologies. These include Java SE 6 Model Driven Architecture and Code-Generation based on AndroMDA CEP-Engine based on Esper Persistence Framework.

Features

General Capabilities

Before getting technical with source code downloads, Python and Github, the platform offers a number of basic but beneficial features.

It supports multiple currencies and enables automatic conversion of currencies.

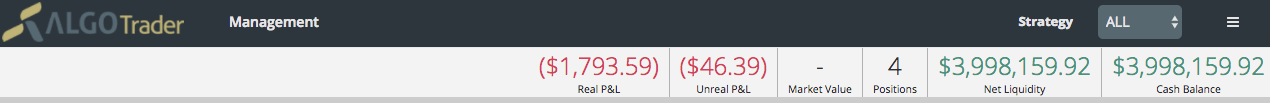

Within the web-based platform, you have the option to select a view and menu for rarely used functions. A financial overview will appear at the top of your screen. These features help to declutter your platform, allowing you to focus on what is important and relevant to you.

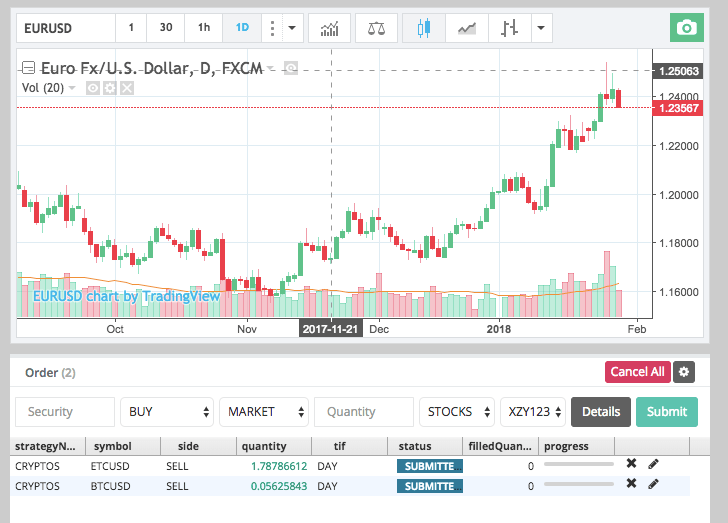

Charts & Indicators

FX, stocks, and futures day trading can be challenging, but AlgoTrader and Wyden reviews have highlighted the TradingView chart library. This library provides access to a variety of popular indicators such as ATR, Bollinger Bands, Donchian, Keltner, and Parabolic SAR, all of which can aid in market analysis.

In addition, there is a generous choice of chart types. You can choose from lines, bars, candles, area, selected linear, percentage, and log axes for sharp price movements. Customizable charting and drawing tools are also available, including Fibonacci and Gann tools, as well as Elliot Waves.

4.0 Enhancements

In response to client feedback and market analysis, the firm has introduced a number of new features. Reviews show users are content with many of the changes.

The new offering allows multicolumn grouping, plus you can display all tables at once. This gives day traders the ability to make fast decisions. You will also now find a number of alarms and notifications.

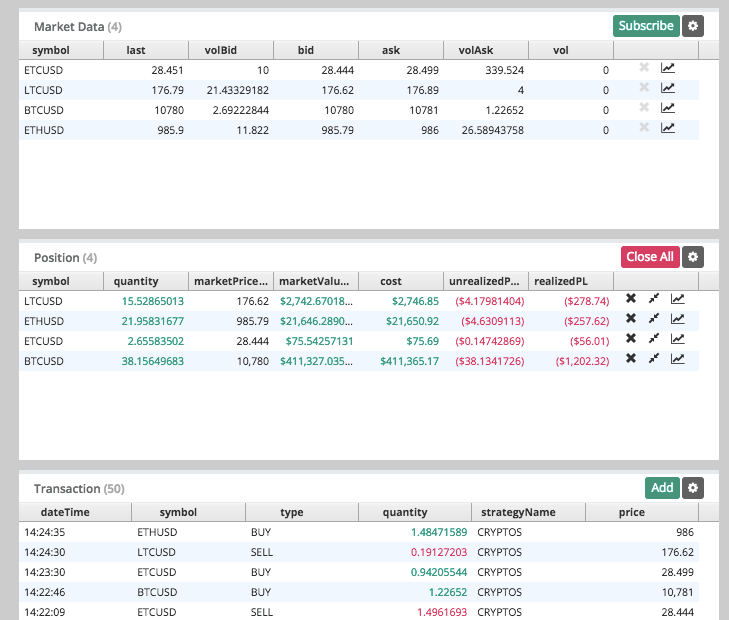

On top of that, you will not have to wait or refresh to see market data. Instead, live market data and updates are automatic and in real-time.

The cost of AlgoTrader 4.0 will vary depending on individual circumstances, including the size of assets traded and the strategies you want to employ. For an accurate price, head over to their website and submit a request. You can also check out their demo offering to get a feel for the platform before you sign up.

Automated Bitcoin Trading

With Bitcoin and cryptocurrency experiencing a phenomenal rise in popularity, Wyden has been quick to introduce the first professional algorithmic trading solution to support such trading. Through integration with Coinigy, Wyden connects to over 45 of the world’s most commonly used cryptocurrency exchanges. This enables individuals to day trade hundreds of cryptocurrencies, including Ethereum, Litecoin, Ripple, and Dash.

Below are just some of the available exchanges:

- Bitfinex

- Kraken

- Poloniex

- BTC

- OKCoin

- Bitstamp

The system has a lot to offer technical traders.

You have the ability to process live market data, plus automated downloads of Coinigy accounts, exchanges, as well as currency pairs into AlgoTrader.

On top of that, you can trade your cryptocurrencies against fiat currencies via forex brokers.There is also arbitrage trading of digital currencies between exchanges, as well as the automated rebalancing of portfolios.

New Adapters

You will find Wyden can now support 15 interfaces and adapters, including:

- Quandl – This is a popular source of economic, financial, and alternative datasets.

- QuantHouse – This uses extremely low-latency market data QuantFEED.

- Coinigy – Often used to trade bitcoin and other cryptocurrencies.

- Nexus Prime – This is a popular MetaTrader 4 server, FIX interface supplied by IS Risk Analytics.

Strategy-Specific User Interface Extensions

AlgoTrader 4.0 allows you to extend the HTML 5 user interface with a number of strategy-specific customised widgets.The benefit of this is day traders can visualise strategy-specific data or amend functionality, such as parameters.

These widgets are created with straightforward JavaScript and empty web sockets over STOMP to communicate with Wyden servers and your strategy.

InfluxDB

Wyden uses highly regarded time series database InfluxDB, to store both live and historical market data.

As a result, you get to benefit from the following:

- Hassle-free installation with no dependencies

- Storage of up to one million values each second

- Sophisticated compression to limit storage footprint

- Data tagging to allow for flexible queries

- The possibility of accelerated backtests by up to 200%

- Real-time aggregation of tick data into straightforward bar data

Unique Capabilities

In terms of AlgoTrader vs Marketcetera, Ninja, and other similar systems, you realise the platform offers a number of unique features that you simply cannot get elsewhere.These include:

- Creating a signal based on a number of securities and then trading alternative securities.

- Automatic rolling allows you to continuously trade futures and options.

- Using time-based strategies that aren’t able to be programmed with traditional programming languages.

- There are a number of time-based window functions.These include, during, between, afterwards, parallel with, along with, finishes and begins.

- You can benefit from a sleek combination of Java and Esper.The former is used for procedural actions, such as placing an order.The latter can be used for time-based market data analysis and signals.

- You can automate quantitive strategies that use formal trading rules, based on MATLAB or Excel that previously had to be manually traded as a result of an inadequate trading platform.

Many of the FX indicators and features you can find tutorials and PDFs for in their support documentation.

It’s important to note that Wyden takes a different approach to their platform.

They avoid using chart-based software like NinjaTrader and TradeStation that have many indicators and simple menus. However, Wyden has a fast integrated Esper engine that is better suited for handling complex trading logic rather than latency in the nanosecond range.

Unique Features

When you download the open source software, you also gain access to several unique features:

- You can customize the Execution Model for Back Tests, allowing you to include custom logic for spread, slippage, and fill ratio.

- In addition to Esper-based strategies, the software also supports simple strategies based on Java code.

- The examples strategies box, pairs trading, and IPO all have an HTML 5 interface.

- You can use Tick Events, but Wyden also circulates raw quotes and trade events in live trading.

Benefits of Using Wyden

With so much software available on the market, why should you consider using Wyden?

- Customization – The open-source architecture allows for high levels of customization to meet individual needs and preferences. Integration with third-party libraries is also possible.

- Speed – The Wyden system automatically processes large volumes of market data using the Esper engine, with impressive speeds of 500,000 events per second.

- Support – Transitioning to automation can be challenging, but the Wyden team provides support and assistance.

However, after installing Wyden, comprehensive guidance in the form of documentation, onsite and remote training are provided.

- Reliability – The Platform is built on robust architecture and up-to-date technology. Therefore, it is relatively reliable. It employs Java, Esper, Hibernate, ActiveMQ, QuickFix/J, Grails, Docker, Spring, and others.

- Cost-effectiveness – Utilizing an effective automated trading system with built-in features may increase total profits. It could reduce strategy development times and trading costs.

- Removes emotion – Wyden eliminates the emotional influences that can lead to costly mistakes in manual, human trading. Even experienced traders doubt their strategy after one loss. Instead, the platform offers a purely systematic approach.

Drawbacks

There are undoubtedly some distinct advantages to the system. However, trading blogs and customer reviews have also been quick to highlight certain drawbacks and risks:

- Limited charting capabilities – Wyden does have limited charting functionality. It can only monitor a currency strategy’s trading activities during live trading.

- Increased volatility – The speed of trading with systems such as AlgoTrader is appealing. However, algorithms can widen the bid-ask spread when reacting to changes in market conditions.

- Chain reaction – As a result of high integration in global markets, a slowdown in one market may transition to other markets and assets.

- Customisability – If you do not utilize the customizability options, there is a danger of using broad standardized approaches, which may not best suit your individual circumstances and investment objectives.

- Monitoring required – Like many automated trading systems, Wyden still requires attention.