IQ Option Deposit Methods

When it comes to depositing funds into your IQ Option trading account, the platform offers a variety of convenient and secure methods to choose from. One of the most popular options is using a credit or debit card, as it allows for instant deposits and is widely accepted by the platform. Another common method is bank wire transfer, which may take a bit longer to process but is a reliable way to transfer larger amounts of money. E-wallets such as Skrill and Neteller are also accepted by IQ Option, offering a quick and easy way to fund your account. Additionally, you can use cryptocurrencies like Bitcoin to make deposits, providing a more anonymous and decentralized option for those who prefer it. Overall, IQ Option provides a range of deposit methods to suit the needs of all traders, ensuring a smooth and efficient process for funding your account.

Credit Cards And Debit Cards

Credit cards and debit cards are two popular forms of payment that have become essential in today’s society. While they may look similar and serve the same purpose of making purchases without using cash, there are important differences between the two.

Credit cards allow the cardholder to borrow money from the issuing bank up to a certain limit. This borrowed money must be paid back with interest if not paid in full by the due date. On the other hand, debit cards are linked to the cardholder’s bank account, and purchases made with a debit card are deducted directly from the available balance in the account.

One of the main advantages of using a credit card is that it can help build a good credit history. By making timely payments and keeping balances low, cardholders can improve their credit score, which can be beneficial when applying for loans or mortgages in the future. Credit cards also offer rewards programs, cashback, and other perks that can incentivize cardholders to use them for everyday purchases.

Debit cards, on the other hand, offer the convenience of accessing funds directly from a bank account without the need to carry cash. They also help cardholders stay within their budget, as purchases are limited to the available balance in the account. However, debit cards do not offer the same level of fraud protection as credit cards, and unauthorized transactions may be more difficult to resolve.

In conclusion, both credit cards and debit cards have their advantages and disadvantages, and the choice between the two ultimately depends on the individual’s financial habits and goals. It is important for cardholders to use their cards responsibly, monitor their transactions regularly, and be aware of their rights and protections under the law.

Bank transfer

Bank transfer is a convenient and secure way to send money from one account to another. It allows individuals and businesses to make payments quickly and easily, without the need for physical cash or checks. When making a bank transfer, the sender provides their bank with the recipient’s account details, including the account number and sort code. The bank then processes the payment and transfers the funds electronically to the recipient’s account. Bank transfers are commonly used for paying bills, making purchases, and sending money to friends and family. They are a popular alternative to other payment methods because they are fast, reliable, and cost-effective. Additionally, bank transfers are often preferred for large transactions, as they offer a high level of security and protection against fraud. Overall, bank transfers are a convenient and efficient way to manage financial transactions in today’s digital world.

E-Wallets

E-Wallets have revolutionized the way we handle our money in the digital age. These online payment systems allow users to store, send, and receive funds electronically, making transactions quick, convenient, and secure. With an e-wallet, users can make purchases online, transfer money to friends and family, and even pay bills with just a few clicks on their computer or smartphone.

One of the key advantages of e-wallets is the ability to store multiple payment methods in one secure place. Users can link their credit cards, debit cards, and bank accounts to their e-wallet, giving them the flexibility to choose how they want to pay for their purchases. This also adds an extra layer of security, as users don’t have to share their sensitive financial information with every merchant they do business with.

E-Wallets also offer a convenient way to track spending and manage finances. Users can easily monitor their transactions, set budgets, and receive notifications about their account activity. This level of transparency helps users stay on top of their finances and make informed decisions about their money.

Another benefit of e-wallets is the speed at which transactions can be completed. Whether you’re paying for a cup of coffee at a local cafe or splitting the bill with friends at a restaurant, e-wallets make it easy to transfer money instantly. This is particularly useful for businesses, as they can receive payments quickly and efficiently, without the need for cash or checks.

Overall, e-wallets offer a convenient, secure, and efficient way to manage money in today’s digital world. With the rise of online shopping and mobile payments, e-wallets are becoming an essential tool for consumers and businesses alike. Whether you’re looking to simplify your finances, streamline your transactions, or just make your life a little easier, an e-wallet is a smart choice for managing your money in the digital age.

Bitcoins

Bitcoins have revolutionized the way we think about money and transactions. As a decentralized digital currency, Bitcoins are not controlled by any government or financial institution, making them immune to inflation and manipulation. This has made them increasingly popular among individuals who value privacy and autonomy in their financial transactions.

One of the key features of Bitcoins is the blockchain technology that underpins them. The blockchain is a public ledger that records all Bitcoin transactions, ensuring transparency and security. This technology has the potential to revolutionize not only the financial industry but also other sectors such as healthcare, supply chain management, and voting systems.

Despite their growing popularity, Bitcoins have faced criticism for their volatile value and association with illegal activities such as money laundering and drug trafficking. However, advocates argue that these issues are not inherent to Bitcoins themselves but rather a result of how they are used. With proper regulation and oversight, Bitcoins could become a mainstream form of currency accepted by businesses and governments worldwide.

In recent years, more and more companies have started accepting Bitcoins as a form of payment, signaling a shift towards mainstream acceptance. This has led to a surge in the value of Bitcoins, making them an attractive investment for many individuals. However, the volatility of the market means that investing in Bitcoins can be risky, and it is important for individuals to do their research before diving into the world of cryptocurrency.

Overall, Bitcoins have the potential to change the way we think about money and transactions, offering a decentralized and secure alternative to traditional currencies. While there are challenges to overcome, the future of Bitcoins looks promising as they continue to gain acceptance and adoption around the world.

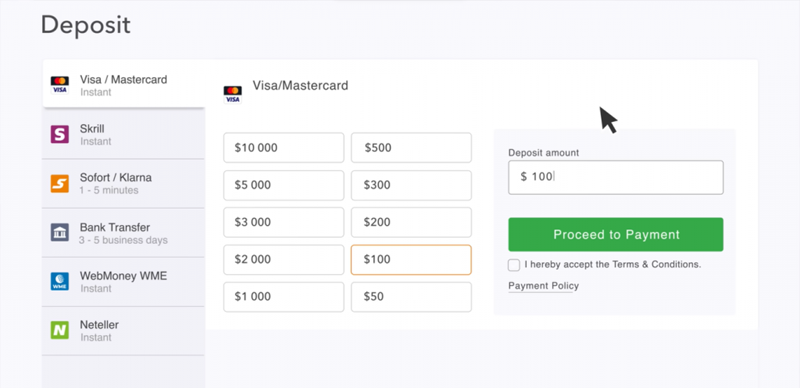

Steps to Deposit Money in IQ Option

To deposit money in IQ Option, follow these simple steps. First, log in to your account on the IQ Option platform. Once logged in, click on the “Deposit” button located in the top right corner of the screen. Next, choose your preferred payment method from the options provided, which may include credit/debit card, bank transfer, e-wallet, or cryptocurrency.

After selecting your payment method, enter the amount you wish to deposit and provide any necessary payment details. Double-check the information you have entered to ensure accuracy before proceeding with the deposit. Depending on your chosen payment method, you may be required to authenticate the transaction through a verification code or password.

Once the deposit is confirmed, the funds should be credited to your IQ Option account almost instantly. You can then use the deposited funds to trade a variety of financial instruments available on the platform, such as stocks, commodities, currencies, and cryptocurrencies. Remember to always trade responsibly and within your means to avoid potential losses.

Overall, depositing money in IQ Option is a quick and straightforward process that allows you to start trading and investing in the financial markets easily. By following these steps, you can fund your account securely and efficiently, enabling you to take advantage of the various opportunities available on the IQ Option platform.

How to Check Deposit Status on IQ Option?

If you want to check the deposit status on IQ Option, it’s actually quite simple. Once you have logged into your account, you can navigate to the “Wallet” section. Here you will see a list of all your recent transactions, including deposits. If you have recently made a deposit, you can click on the specific transaction to see more details. This will show you the status of the deposit, whether it is pending, completed, or if there were any issues with the transaction. If you are unsure about the status of your deposit, you can also contact the customer support team for assistance. They will be able to provide you with more information and help resolve any issues you may be experiencing. Checking the deposit status on IQ Option is important to ensure that your funds are safely and securely deposited into your trading account.

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose