Multipliers offer the benefits of leveraged trading along with the fixed risk provided with options. Profits are multiplied while losses are limited to the trader’s initial stake. Multipliers are primarily offered by the online broker, Deriv, but can also be traded on several other leading platforms.

In this trading tutorial, we explain how money multipliers work with examples and formulas. We also list the pros and cons of the multiplier effect and compare the instrument to CFDs and spot trading.

What Are Multipliers?

Multipliers are a way of benefiting from leveraged trading while capping maximum losses. Trading on leverage is essentially used to increase purchasing power by borrowing capital from your broker. This is also known as trading on margin.

However, while borrowed funds can be used to magnify winning positions, they can also lead to larger losses. And this potential for loss is one reason why some traders, particularly beginners, avoid this investment style. Fortunately, multipliers limit risk exposure to your initial stake.

How Multipliers Work

As the name suggests, the multiplier concept amplifies potential profits.

Let’s look at an example…

Without a multiplier, if the market moved in your favour by 25%, your return would be 25% of your position size (e.g. $1000), meaning a return of $250 (25% X $1000), minus any fees.

However, with a 5x multiplier, your position size would be $5000 (5 X $1000) and your return would be $1,250 (5 X $250).

Now, if the market had moved by 25% in the opposite direction, your loss with a multiplier would be capped at your initial stake, in this case, $1000.

But, if you had used a leveraged CFD under the same conditions, your loss would have been $1,250 (5 X $250).

With the multiplier, your trading platform would essentially have closed out your position when the loss reached your stake amount.

Note, that not all supporting brokers offer automatic stop-out features, including IQ Option.

History

Multipliers were originally introduced into the forex market because some currency pairs didn’t offer the large price swings and volatility needed to generate significant profits.

Multipliers enabled traders to put down $100, for example, with a 10x multiplier, increasing potential position sizes to $1000.

As a result, any change in price, and therefore profit, also increased tenfold.

After its success in forex, brokers sought to introduce multiplier products on a range of traditional and emerging markets, including stocks, commodities and cryptocurrencies.

The top brokers offer multipliers up to 200x, though this varies between providers.

Benefits

There are several benefits to trading with multipliers…

The key advantage is larger profits than your starting capital would typically allow.

And the higher the multiplier you use, the greater the potential returns. But equally as important is that losses are limited to your stake, unlike with CFDs on some platforms, as demonstrated in the example above.

In addition, multipliers give traders upfront visibility on potential wins and losses. Clients can quickly calculate how much they stand to make or lose before entering a position. Some of the best brokers also provide user-friendly profit and loss calculators on their websites and trading platforms.

It is also worth pointing out that some brands, such as Deriv, offer real-time risk management features that allow you to adjust trade parameters:

- Automatic stop out – This ensures that you never lose more than your stake amount.

- Deal cancellation – You can cancel your trade within a specified period and take back your stake.

- Take profit – You can set a level of profit you wish to achieve, and once it is met your position will be closed.

- Stop loss – This allows you to state what you are willing to risk, so you can decide how much of your stake you are comfortable losing. For example, if your stake was $100, you can only lose $100 due to the automatic stop-out, but if you specify that you would only like to risk $50, then your trade will close when this threshold is hit.

Finally, it’s worth noting that multipliers are beginner-friendly due to their straightforward structure.

And the top brokers offer them on a suite of popular financial markets and via desktop platforms and mobile apps, 24/7.

Drawbacks

Even though multipliers offer decent risk management capabilities, there are still disadvantages and repercussions…

Firstly, the position will still be closed if the market moves against you and your loss equals the stop-out price.This means that your loss can still be as large as your stake.With this in mind, never risk more than you can afford to lose.

It is also worth bearing in mind that some of the risk management features found on broker’s trading platforms cannot be used simultaneously.For example, on Deriv, stop loss and deal cancellation cannot be used at the same time; the same goes with take profit and deal cancellation, and also close features and deal cancellation.

Finally, multipliers still require careful market analysis and a good understanding of trading fundamentals.There is no guarantee of profits – even for experienced investors.

Getting Started

Finding the right platform to trade multipliers will enhance your trading experience.Brokerages offer different multiplier amounts, risk management tools and market access.The suite of trend analysis tools, minimum deposit requirements and withdrawal timelines can also vary.

When trading multipliers on Deriv, you can practice using simulated funds before investing real cash.

When you open a demo account, you have an unlimited virtual bankroll. This means you can get first-hand experience of how multipliers work and test out different strategies. Once you feel confident, you can then switch to a real-money account.

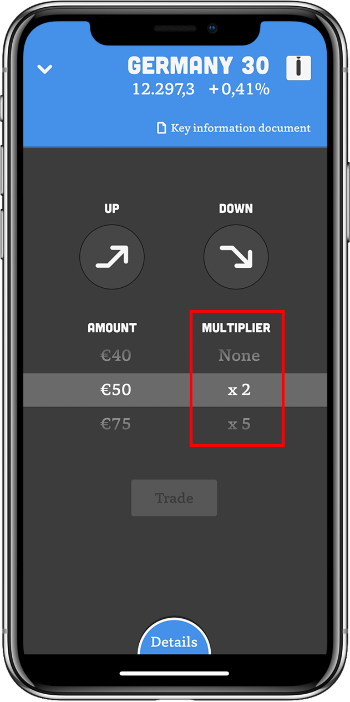

To start trading multipliers in a live account, follow these steps:

- Select the market that you wanted to trade on; there will be a list of markets to select from

- Choose the type of trade, which is multipliers

- Enter the stake amount

- Select the multiplier value

- Add any risk management parameters

- Confirm the position

Note, when you choose your multiplier (the amount your profit or loss is multiplied by); it is often flexible between 1 and 5 for US multipliers, but preset for EU and UK traders.

Final Word On Trading Multipliers

Multipliers are an increasingly popular retail trading product that offers the advantages of leverage with capped losses. Deriv is currently the best broker offering multiplier products, but several other platforms also support this style of trading, including IQ Option, Bux, Olymp Trade, and Libertex. For beginners, a useful tip is to practice in a demo account before upgrading to a real-money account.

FAQ

What Is A Trading Multiplier?

By using multipliers you can open positions that are larger than your initial stake.

For example, if you open a position and stake $10, adding a 5x multiplier, then your total position size is $50 (5 X $10).This means if the market moves in your favor then any returns are also multiplied by 5.But importantly, losses are capped to your initial stake, $10.

Where Can I Trade Multipliers?

What Assets Can Multipliers Be Used On?

Multipliers can be used in various markets though the size of the multiplier may vary.The best brokers offer multiplier products on forex, stocks, commodities, ETFs, and cryptocurrencies.

Is It Risky To Trade Multipliers?

Any kind of investing comes with some risk, and multipliers are no different.