NFP trading is one of the most consistent forms of news trading in the forex market. The Non-Farm Payroll Report is published by the Bureau of Labor Statistics (BLS) on the first Friday of every month and influences the value of the dollar against other currencies, providing NFP traders with regular rate swings. Read on to find out what NFP trading is, how it works and how to get started, before discussing some tips to avoid falling victim to irrational market movers.

What Is The NFP?

The Non-Farm Payroll (NFP) represents the earnings of 80% of the workforce in the United States and is published by the BLS on the first Friday of every month at 08:30 EST. It is used by economic analysts and investors as an indicator of where the U.S. economy may be heading. It is generally considered that the economy is growing when NFP numbers are rising and contracting when they are falling.

The definition of NFP trading is to trade financial instruments based on this news to attempt to profit from the impact of this report.

How Does NFP Trading Work?

NFP trading is possible as this news release almost guarantees a tradable market move.

Although the report has a knock-on effect on almost every currency, the most popular pair among traders is GBP/USD.

If the NFP numbers are below economist estimates, investors will predict a weakening dollar and sell the currency.

If employment levels and wages are high, this indicates a strengthening economy and investors will buy the dollar.

The release of the NFP also affects the price of gold, especially when trading against the USD.

Finding A Broker To Trade The NFP

To start trading the NFP report, you will need to find a broker that offers comprehensive forex trading options.A full guide to comparing and choosing brokers can be found here, though we discuss some key aspects below:

- Fees: Ideally, look for a forex broker with zero sign-up fees and flexible minimum account balances.Some brokers will charge commissions but it is more common for forex brokers to make their money through spreads.Depending on your NFP trading strategy, either commission or spread-based charges may suit you better.

- Features: NFP trading is highly technical, so you will want a broker that offers comprehensive analysis features.Candlestick and bar charts are at the core of most NFP trading strategies, so look out for these.You will also want an intuitive, user-friendly platform with easy access to 5- and 15-minute time frames.A wide range of signals and indicators, as well as stop loss and take profit orders, will aid your NFP trading strategy.

- Because the report releases require you to act quickly, you should only trade the NFP from an app or platform if you are very comfortable with using it.

- Markets & Currencies: You will likely want to find a broker that offers a range of currencies paired with the US dollar.As the forex market is open 24/5, NFP trading is possible for traders around the globe.Make sure to find a broker that offers trading in your preferred currency to avoid conversion fees.

- Customer Support: The NFP report causes immediate volatility and large swings can occur in short periods.If you encounter a technical fault or glitch, you will want to have a customer support advisor on hand to guide you through your problem.The best brokers will offer 24-hour customer support via telephone, email or live chat.

- Educational Features: If you are new to trading the NFP, look for a broker with clear tutorials on this report and how to profit from it.Otherwise, there are many free resources analysing previous releases and making predictions, like informational PDFs and the NFP trading section in Tradingview.You can even watch other traders do NFP live trading sessions.

NFP Trading Hours

The NFP is released on the first Friday of each month at 08:30 EST (GMT-5). The forex market is open 24 hours a day during weekdays and, in particular, the New York session starts at 08:00 EST. This means that traders can start opening positions immediately after the release, which leads to short-term instability.

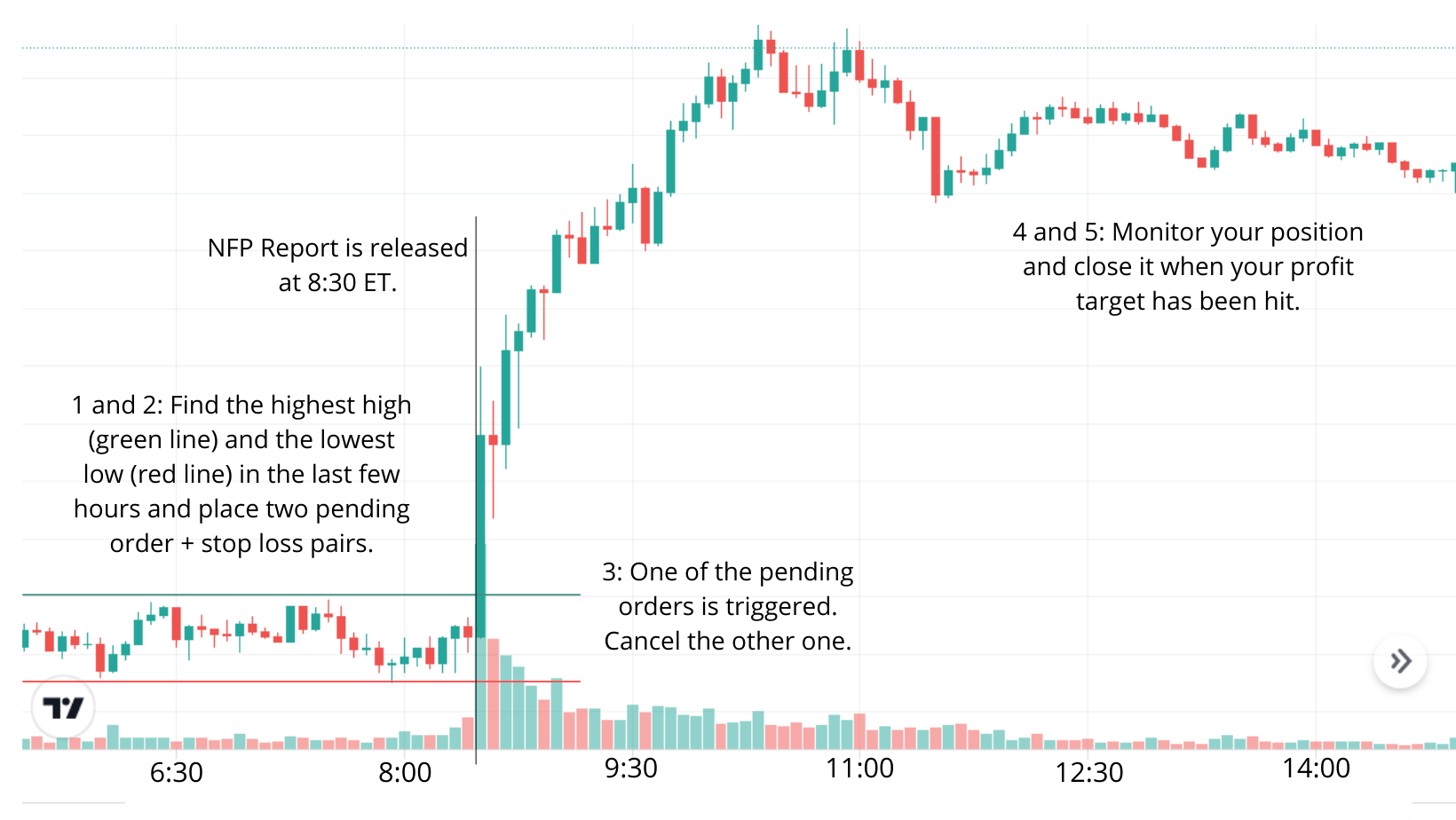

- The first pending order will open a long position if the market is on the rise and the second will open a short position if the price is decreasing.

- The stop losses will reduce your risk if the trends get reversed.

- When the report is released, one of your pending orders should be activated.Cancel the other one immediately.

- Monitor your position; the stop loss will avoid big losses in case of a trend reversal but it is more likely that the trend will be maintained.

- Before the report’s release, decide on a profit goal and stick to it.You could close your position when your profit doubles your risk range (the range between your two pending orders) or you could use trailing stops.

The biggest risk of this NFP trading strategy is the possibility of whipsaws.In more volatile markets, or if the two pending orders are too close, a spike might trigger both pending orders and both stop losses, which means that you will have a double loss within seconds.Use this strategy on stable currencies and choose your pending orders carefully.

Following The NFP Trend

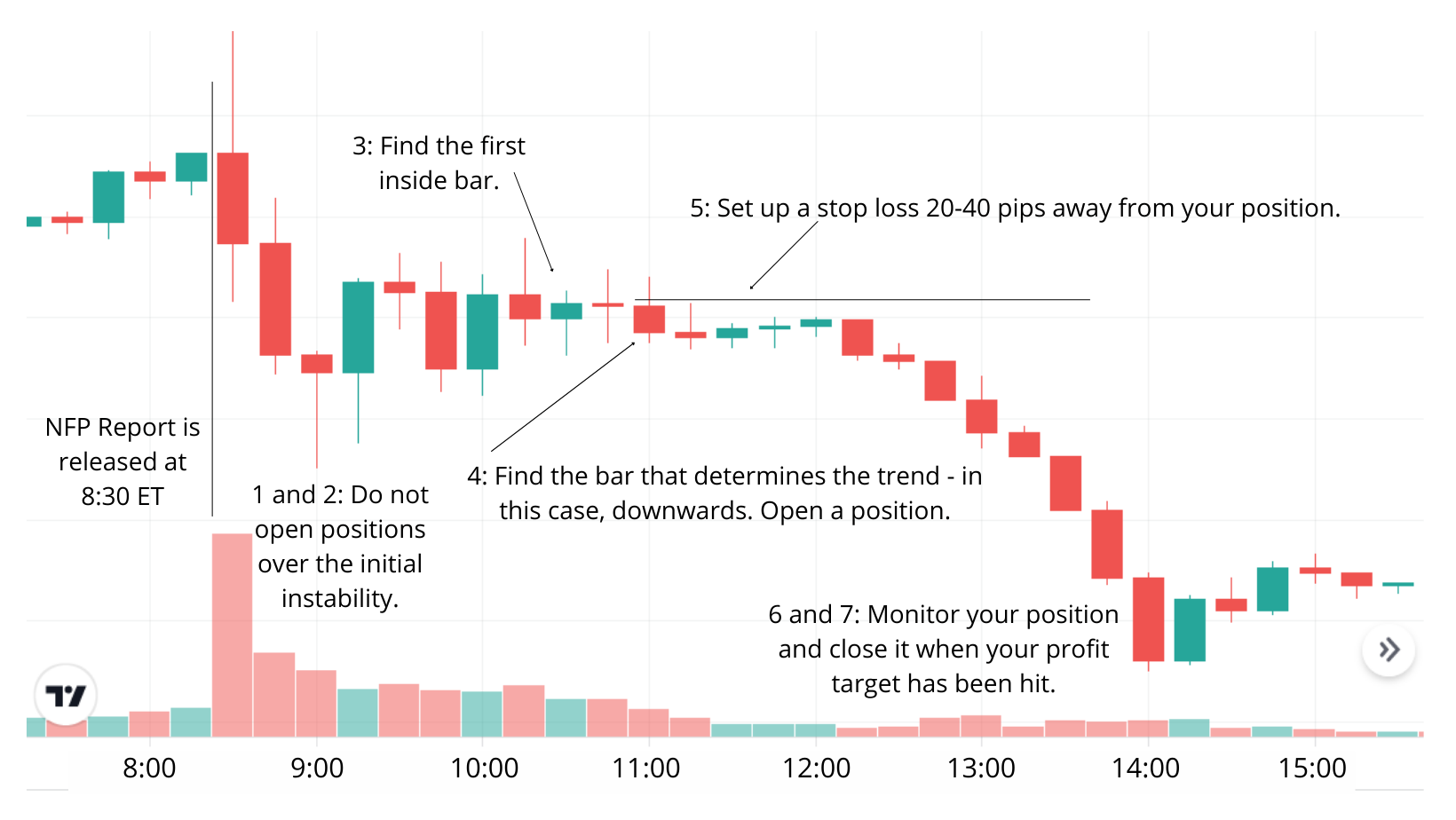

This NFP trading strategy is based on waiting until volatility subsides in your chosen currency pair and jumping on the resulting trend as early as possible.Here is how to trade the NFP trend:

- Open your chart in 15-minute timeframes before the release.

- Immediately after the release, there will be a short period of instability.

- It is important not to open a position during the first bar.

- The first few bars will likely be very tall. Look for a bar that is inside the previous bar. This first inside bar determines the high and low trade triggers.

- The bar following this first inside bar dictates which position you should open. If it closes higher than the high trade trigger, open a long position, otherwise open a short position.

- Place a stop loss 20 to 40 pips away from your entry price to manage your risk.

- If your trade gets closed by the stop loss, you can re-enter by using the original inside bar. Only re-enter once to carefully minimize your losses.

- Decide on a profit target. This could be by setting up trailing stops, setting up a price target or a time limit.

The major risk to this NFP trading strategy is missing out on the trend. Sometimes there may not be a strong trend or the trend is already fading when the first inside bar appears.

The major risk to this NFP trading strategy is missing out on the trend. Sometimes there may not be a strong trend or the trend is already fading when the first inside bar appears.

Final Word On NFP Trading

The NFP report is a monthly release by the US government that strongly influences the price of the US Dollar, gold and other currencies. NFP trading can be very profitable but you must have a clear strategy and keep a cool head. For those interested in getting involved with the monthly speculation wave, check out our broker selection guidance and strategies above.

FAQs

What Is NFP Trading?

The Non-Farm Payroll is a report released each month that represents the earnings of all workers that do not work in farms, private households, government, or certain nonprofit organizations.

It is an indicator of the strength of the dollar and its release almost guarantees a tradable market move. When the NFP number is higher than expected, investors will buy the dollar and when it drops, the dollar will be sold.