Spread betting has gained popularity in recent years, allowing retail traders to potentially earn large profits without owning the underlying asset, such as gold or crude oil. However, one question that many spread bettors ask is whether spread betting is tax-free.

At first glance, the answer seems to be yes. Many of the taxes that apply to other investment methods, such as capital gains tax and stamp duty, do not apply to spread bets. In most cases, income tax is also exempt.

However, the situation is more complex than it appears. This guide will delve into the details and examine whether spread betting can generate non-taxable profits for investors. Read on to discover whether spread betting will be tax-free in 2023.

Please note that this article is not intended to be professional tax advice. Consult an accountant for specific guidance.

Spread Betting Tax Headlines

- Spread betting is considered tax-free in the UK and Ireland.

- Profits from spread bets are exempt from capital gains tax and stamp duty tax.

- Spread betting is viewed as a speculative activity and is treated as gambling rather than investing.

- Rules on taxation may change, and individual circumstances may affect a spread bettor’s tax liability.

Spread Betting Tax Implications

Firstly, it’s worth understanding what spread betting is…

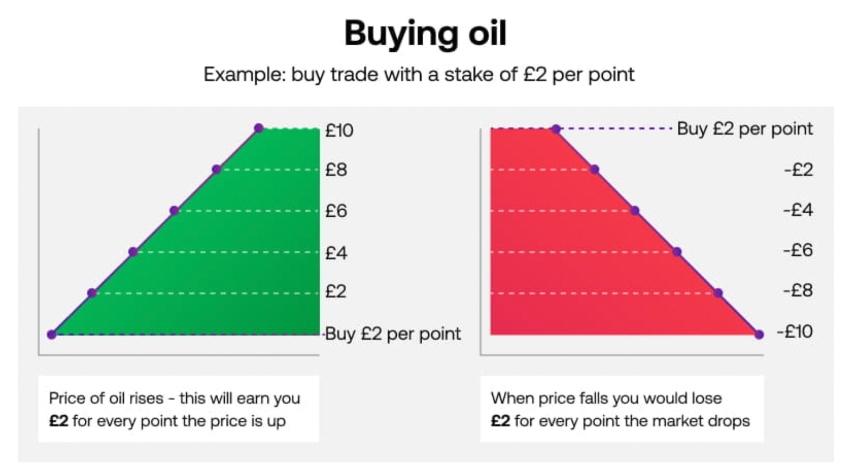

Spread betting is a leveraged financial product and derivative.

It is an intangible bet – ownership of assets do not change hands. Spread bets also come with high risk but potentially high rewards.

Yet when considering the tax implications, it is important to separate spread betting from similar forms of investing. It is often confused, for example, with trading CFDs (Contracts for Difference). But profits from CFDs are usually taxed under capital gains tax rules, whereas spread betting profits are not. The way that profits are calculated on each type of financial product is slightly different.

Spread Betting Taxes Breakdown

There are a variety of taxes to think about before spread betting. Most traders will probably jump to the conclusion that the only one they need to think about is income tax – but the reality is that retail trading is complex, and it can activate many aspects of the taxable system that the average investor may not have considered.

Capital Gains Tax

The most obvious potential charge is perhaps capital gains tax, known as ‘CGT’. But qualifying returns made from financial betting are not liable for this tax, which given that it can, in some cases, have a 20% rate, is a good thing.

So is spread betting tax free when it comes to capital gains? Yes.

Stamp Duty Tax

Those who have become land owners and bought and sold properties will be familiar with stamp duty tax.

Stamp duty generally applies to more assets than just property, and some aspects of stock trading fall into its sphere of liability, especially under stamp duty reserve tax (SDRT). Luckily though, spread betting profits do not.

This is because spread betting products are actually derivatives that track the asset in question, and do not confer any ownership of the underlying asset. So while it might appear that you’re trading Meta stock, for example, what you’re actually doing is investing in a financial product that tracks the stock’s value and delivers profit or loss based on how the share price performs. From a tax perspective, therefore, spread betting is arguably better as it does not give rise to a tax liability.

So is spread betting tax free when it comes to stamp duty? Yes.

Income Tax

It is also important to consider any income tax implications when spread betting. This is where the exact definition of ‘betting’ comes into play.

Spread betting is, for income tax purposes, treated as gambling – which means that profits do not give rise to a liability.

The Money Advice Service does, however, caution that this might change in the event that a person relies on their income from spread betting to earn a living. In that case, it could be re-categorized as ‘trading’, which could mean there is income tax to be paid.

For that reason, it is worth consulting a tax professional if you execute a higher number of spread bets versus lower volume investors as this might push you into the ‘trading’ category, especially if your profits are high.

Your tax percentage will also depend on the income zone you are in.

A high earner will need to pay more depending on the total value of their received (liquid) income.

So is spread betting tax free when it comes to income tax? Yes – unless spread betting profits are your primary source of income.

Offsetting Spread Betting Losses

So far, this article has investigated only whether or not the profits earned by spread bettors are taxable.

But what about losses?In some circumstances, losses made through trading can be treated as tax-deductible – which means that they can be offset (hedged) against other taxable profits made in other ways, bringing down the overall tax liability of the individual.

It is not, however, the case that spread betting losses can be used in this way.So while tax efficiency is the order of the day when it comes to profitable returns, a trader can’t bank on their spread betting losses being used to reduce the overall amount of tax they owe.

A useful tip for offsetting taxes on other trading products is to keep a journal.This will help collate key figures and information that can be used when filling in your tax return at the end of the year.

Individual – And Changing – Circumstances

Currently, the situation for most traders is that spread betting is quite tax-efficient.

However, it is important to note a couple of things regarding spread betting and taxes.

Firstly, it is crucial to consider the individual’s circumstances and the wider tax regulations, as demonstrated by the example of income tax. Whether spread betting is used for full-time income or part-time speculation can affect its tax implications. Additionally, if the earnings exceed the income limits in the region, a quick 10% monthly yield can become taxable. Therefore, tax-free spread betting may not be a long-term solution, and seeking advice from a qualified tax professional is recommended before gambling on an online platform or exchange.

Secondly, traders should stay updated on any changes in the government’s approach to spread betting tax treatment. Although profits are currently not subject to capital gains tax, this may change in the future, and it is the taxpayer’s responsibility to keep track of any new rules or announcements.

In conclusion, while spread betting is generally tax-free, it is still important to consult with a professional tax advisor and stay informed of any changes in tax regulations.

Is Spread Betting Tax Free?

Spread betting profits are typically considered gambling returns and are not taxed. However, individual circumstances can affect the tax liability, and seeking professional advice is recommended.

Also, it cannot be guaranteed that tax laws won’t change in the future.

But to answer the main question: is spread betting tax-free? The answer is yes for most individuals.

FAQ

Do You Have To Pay Income Tax On Spread Betting?

If spread betting is not your primary source of income, and you do not rely on the profits from it, it is generally considered gambling and does not give rise to a tax liability. However, it is recommended you check with an accountant for the exact laws applicable to your circumstances and region.

Why Is Spread Betting Tax Free?

Spread betting is typically regarded as gambling, so if it does not constitute a significant source of income, it is usually not taxed as a way of speculating on popular financial markets. However, the rules vary globally, from England and Jersey to Australia.

Is Forex Spread Betting Tax Free?

Spread betting on currency is usually tax-free.

This is also the case when spread bets are placed on other markets, such as cryptos and bonds.

Note, this is different to the traditional buying and selling of stocks, for example, where individuals get paid dividends and may need to pay tax.

What Countries Is Spread Betting Tax Free?

Spread betting is legitimate and not taxable in the UK and Ireland – profits are free from tax liabilities.

This means local tax authorities, such as HMRC, do not ask for a proportion of your winnings.

With that said, keep up with the latest regulations regarding this type of gambling because laws can change.

Also contact an accountant if you are unsure whether you owe tax on spread betting profits.

Is Spread Betting Legal?

Spread betting is legal in several countries, including the UK and Ireland.

However, the financial product is banned in other regions, including South Africa, Canada, Zambia, Zimbabwe, the US, Germany, France and Japan.