Trading signals are a popular investing tool, providing a prompt for action, either to buy or sell a particular asset. They can be useful for day traders looking to discover new strategies, take a fresh position or modify a portfolio. This trading signals guide covers how they work, why investors use them, plus regulations and license requirements. We also explain how to use trade signals and how to find the best signal providers in 2023.

Some traders want independent trading signals that can be used with any broker the trader prefers. Below are top independent signal providers:

What Are Trading Signals?

Trading signals alert investors when an asset, such as a forex pair, hits a certain price, indicating that it is time to buy or sell. Daily signals for trading can be implemented when speculating on various assets, including cryptos (such as BTC and XRP), commodities (such as oil and gold), forex, binary options and stocks.

By definition, signals are an idea or recommendation for a specified financial asset, to be executed at a predetermined price and time. Using investing signals is sometimes free and is now a common practice found across the globe, including in the UK, India, South Africa, USA and Australia.

For our asset-specific signals guides, head to:

How Trading Signals Work

Trading signals usually follow a technical analysis-based strategy implemented automatically within a provider’s servers.

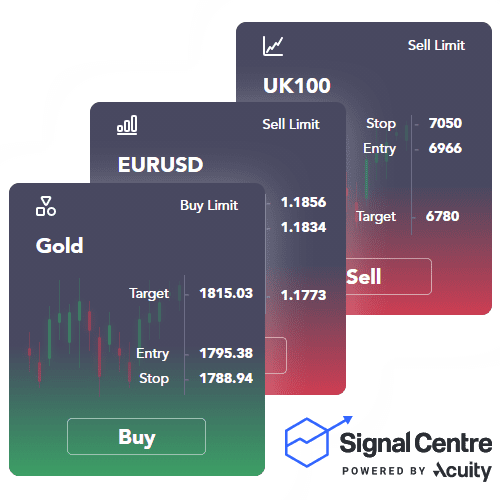

Once a potentially profitable opportunity is identified, you will be sent an email, SMS text, or social media notification with the suggested position parameters. Nowadays, some signals can even integrate directly with your trading platform, so you never have to leave your investing software.

When you retrieve a trading signal, it is up to you whether you follow through with the suggestion. Some traders might assess the perceived risk (usually included in the notification) as too high or have carried out their own fundamental or technical analysis that leads them to believe the signal may not be successful.

If you have unwavering faith in the signals that are sent to you and use a program that integrates with your platform, you can automate your response. This will mean that there is less delay between the opportunity being recognized and the position being opened, likely improving the extent of any profits that are made. However, if you implement this, you will not be able to reject signals on a case-by-case basis.

Generally, you can filter the signals that you receive with a large number of variables. For example, you could specify the assets for which you are notified of opportunities. You can also limit the timeframes over which the signals should require a position to be open. Shorter-term day traders and scalpers may request one or five-minute signals, while others may prefer hourly or eight-hour chart notifications.

Perhaps most importantly, you can pick a strategy from which your signal provider will send you notifications. Some of the most popular strategies are outlined below.

Technical Analysis

- Support & Resistance Breakout: Breaches of support and resistance lines might suggest that the price of an asset or market is about to rise or fall substantially.

- Volume-Based Signals: If there is a spike in the trading volume of an asset being actively traded, this could suggest a potential move in the market and will be reflected in such signals.

- Moving Averages: Moving averages are a common indicator used by traders, which analyze the relationships between shorter and longer-term price trends.

Fundamental Analysis

- Interest Rates: Changes in interest rates announced by governments can directly impact stock, forex, and commodity markets.

- News Stories: Trading signals designed to alert traders to news stories that may impact the price of the asset they are speculating on can be a valuable tool.

- Company Financials: For traders focusing on stocks, reviewing key fundamentals such as earnings, assets, liabilities, and dividends can provide insight into stock health.

- Market Perception: Assets are regularly rated and analyzed by large financial organizations, which can influence prices significantly.

Why Use Trading Signals

Improve Trading

The best forex trading signals could enhance your overall results.

There are numerous technical, fundamental, and sentiment strategies and forex signals available for traders to follow, allowing them to track market opportunities. Signals can significantly reduce the time required to monitor price movements. Comprehensive guidance is typically provided by the bot or signal system, enabling day traders to sit back and execute individual trades (enter, exit, and take profit).

Signal providers often utilize complex algorithms and high-performance computing setups to rapidly and effectively analyze markets. As the value of investment products can be challenging to predict with just one or two simple approaches, providers analyze a vast array of strategies and market characteristics to optimize results.

Easy to Understand

Trading signals strategies are simple to learn and do not require an in-depth understanding of a particular market. Notifications are typically very clear, stating a prediction that an asset’s value will rise or fall over a specified period. Traders can then go long or short as required. Educational courses, pages, and blogs provide examples of how to set up a signal for a specific price alert, regardless of whether it’s on a crypto, commodity, or any other asset.

There is also a vast library of online trading signals support available on YouTube, Reddit, Twitter, and trading information sites. Alternatively, many experts have documented their methodology offline, and you can find guides on using signals in your local book store. Some online resources and tutorials are available to download in Excel or PDF format, allowing traders to practice using trading signals offline or on the go.

Market Accessibility

Signal providers exist for almost any market imaginable, especially major ones that have been traded for decades, such as the S&P 500 index and top stocks on the KSE, JSE, NSE, LSE, and NASDAQ exchanges.

When choosing a broker, it is important to ensure that they offer relevant products for your industry, geographical region, asset types or strategies.

Cost

Although it may be tempting to look for the cheapest investment support, it is essential to understand that cost and quality often go hand-in-hand. Free signals may come from disreputable sources with ulterior motives.

Our research found that most signal providers offer a monthly subscription fee, which can range from $10 to over $500. Some brokers may absorb these costs for retail traders. For instance, eToro, IG, XM and IQ Option offer free online trading signals to their registered clients with integrated API access through platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

While quality is crucial when entrusting your capital to others, paying for these services can quickly reduce your profits. Therefore, you should ensure that your gains can cover these expenses.

Safety

Ensure the safety and security of a trading signal provider, just as you would when selecting an online broker.

You are putting your trust and personal capital into the hands of a robot designed by someone else.

It is often dangerous to assume all signal providers possess a great degree of knowledge and experience.

Trading signals service providers are typically not regulated by a financial body like the FCA, ESMA or ASIC.

This can make it difficult to distinguish between the best and safest trading signals companies in the market.

Moreover, there is limited protection to bar you from falling for a scam.

There have been several reports of commission scammers throughout 2021 and 2022.

For example, several thousand young investors subscribed to a WhatsApp group for regular app messages with updates on assets and trading opportunities.

Many of these investors lost considerable sums.

The reason for the lack of licensing and regulation is that signal providers do not have access to the portfolios held by their customers.

As the service is anonymous, there is no customer/provider relationship and the system is not classed as a financial service in the same way that brokering is.

With that said, Signal Centre is a signalling platform that is regulated and authorised in the UK by the FCA, making it one of the safest options out there.

Of course, regulation and success are far from the same.

Regulation will ensure that there is no dishonesty in the services provided by the firm and that clients will have a route for legal recourse if they are lied to.

However, it makes no guarantee about the quality of the signals offered.

Therefore, there is a risk that some providers who are not regulated and appear suspicious may offer the best trading signals.

Messaging Apps & Trading Signals

Trading signals have become integrated into popular messaging apps like Discord, Telegram, and even Instagram (IG). These apps take advantage of modern technology to provide fast and accessible signals to anyone with an internet connection. While the signals you can receive from these apps are similar to regular ones, they offer the added benefit of an accessible community. As these apps tend to work with big group chats, you can pick the brains of your fellow traders and see what strategies they have in place and what wisdom they can impart. The most popular markets for using these apps are for crypto, stock CFD, and forex traders.

Access to these apps is typically free, and the list of different groups available on the Telegram and Discord user base is very broad.

How To Compare Signal Providers

Comparing providers can be a difficult task, particularly with the amount of misinformation out there. We recommend carefully considering the following factors before selecting a provider:

Customer Reviews

Often, when traders receive good service, they will post a positive review on rating sites. The best trading signal providers should have hundreds of positive comments and few negative ones. It is worth checking popular review sites and hubs such as TradingView, Reddit, and TrustPilot to understand what the signals provider’s existing users have to say about its service.

Past Performance

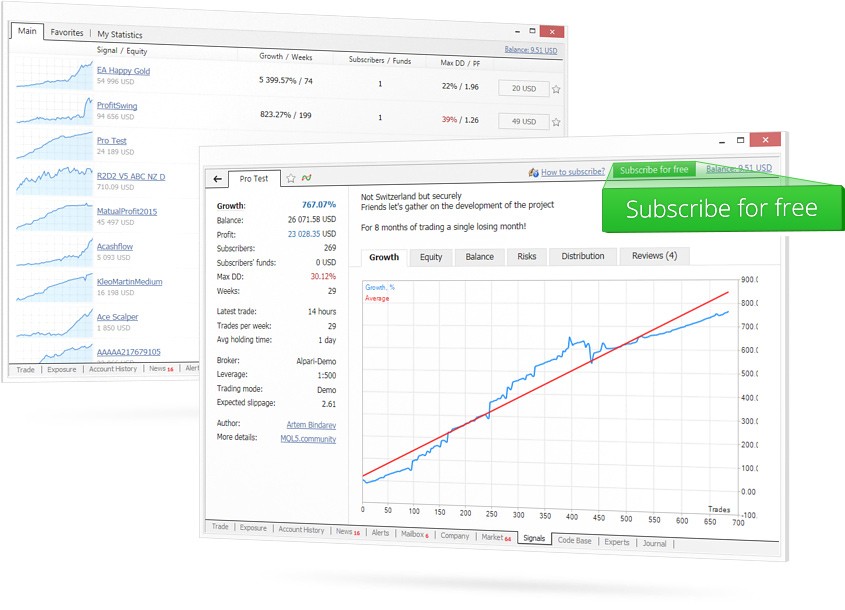

The best trading signal providers will publish reports that provide details on how well their signals have performed over the past few years.

This may also be grouped based on a specific timeframe such as within one year. We would recommend reviewing historical performance over a longer period as unexpected price volatility may blur an outlook.

These reviews can contain details of how many signals were published, how many tips earnt money and additional details of key factors that influenced the price actions clients profited from. These reports may also indicate which assets the provider has distributed the maximum number of accurate prompts and how profitable these ideas have been.

Be careful, though, as some providers may doctor their results to try and entice new customers. See if customer reviews match up to the claims made by the firm to be safe.

Alerting System

If you are happy receiving signals through whatever means, then this may not be a massive issue. However, some people may not want to provide their email address or mobile number to a signals provider, instead preferring another contact method. Ensure that you are happy with the options available from a provider and that your preferred method is available.

If you are looking for maximum ease of use or automated execution, filter through trading signals providers by requiring that they integrate with your trading platform. This can be done directly or through an API offered by the firm, though this will require a little extra work on your end to set it up.

Asset List

There is no point subscribing to a crypto signals provider if you exclusively scalp soft commodity CFDs.

Therefore, ensure that the list of assets and instruments that you have access to and wish to speculate upon are analysed by the signals provider.

Moreover, you should cross-reference the company’s performance history and customer reviews with these assets to ensure you are getting the best, most suitable service for your needs.

Strategies

Different signals providers will follow different strategies and build different algorithms to inform their trading alerts.

If you know that you trust or do not trust a certain strategy, ensure that the provider offers that system, or a range of others, as applicable.

Some companies have begun using machine learning and deep learning neural networks to simultaneously consider a wide range of characteristics and factors.

Such analysis can be very difficult to carry out personally.

If this is of interest, keep an eye out for AI-powered trading signals.

Cost

Carefully consider the cost of each provider before signing up with them.

There is no point in getting incredible signals if your available capital will not afford you enough profit to pay it off.

Check the forecasted (or historical) performance of a provider and apply it to your account capital to see how much you will be able to afford and whether a more expensive service will be worth it.

How To Get Started With Trading Signals

Pick A Provider

Before you can start responding to trading signals, you need to start receiving them.

Follow the advice above to narrow down your search and find the best signal provider for your needs. Be sure to consider your goals, strategies and the assets available to you with your brokerage firm.

If you do not yet have a broker, check out our guide here and consider combining your search with that for a provider to find an ideal combination.

Set Up Your Trading Signals

Most providers will have a stock package but also allow you to customise your services. As you probably do not want to be inundated with notifications that you will just ignore, we recommended narrowing down the signals you will receive. Carefully consider asset types, position timeframes, strategies, industries, risk level and position sizes in this step.

Start Trading

Once you have set up your trading signals service, you should start receiving notifications. You may want to check over each live alert before executing a suggested trade, just to ensure that it sits well with you. However, this can reduce your potential profits and maybe even cause you to miss an opportunity altogether, so some choose to forgo this. If you can set up automatic signal execution and trust the alerts, simply sit back and relax.

Most signals will provide information on when you should close the position, whether that be by adding a stop-loss or take-profit or simply a specified number of minutes or hours. However, some firms will send another alert when it is time to close a trade, so keep an eye out for this during active trading hours.

Pros Of Using Trading Signals

- Customisable

- Alleviate some risk

- Ideal for beginners

- Can increase profits

- Reduce labour requirements

- Available for almost all assets

- Can be integrated with platforms to execute automatically

- Does not require knowledge and understanding of charts and analysis

Cons Of Using Trading Signals

- Can be costly

- Software reliant

- Profits not guaranteed

- Lots of scams out there

- Requires trust in the provider

- Reduce personal development and learning

Final Word On Trading Signals

Investing using trading signals can be an advantageous way to realise gains, though it is important to understand that profits are not guaranteed.

Signals comprise technical, fundamental and quantitative analysis, which provides predictions and forecasts of how an asset or market is going to move.

These predictions sometimes do not materialise and any traders reliant on using them should employ strong risk management systems.

There are also many scammers out there looking to prey on inexperienced traders with false signals.

However, following the guidelines outlined above should get you started with trading signals in no time with minimal risk.

FAQ

Are Trading Signals Legal?

In most countries, trading signals are legal and can be offered by a broker or specialist without the requirement of a licence or regulation. It is important to note that providers are simply offering recommendations to invest and are not providing financial advice.

Are Trading Signals Worth It?

Using signals from a reputable provider with a high reported success rate could be worth it if profits are returned.

However, this is never guaranteed. Still, providers with good past performance, lots of positive reviews and low costs will likely be more worthwhile than others.

Are Trading Signals Legit?

Most trading signals are legitimate and offered by trustworthy sources. However, there are many firms out there that look to scam unwary traders. The best way to assure yourself that a provider is legit is through customer reviews and historical performance.

Do Trading Signals Work?

No trading signals work 100% of the time. If a company is claiming this, run and do not look back. While the market is unpredictable, many providers offer better than average returns and are more often than not successful. However, you never know what will happen and analytically-focused strategies can be shocked by sudden political events. A prime example of this was when during Donald Trump’s presidency, oil analysts would have spent years researching how the price of the commodity is expected to move, providing signals that match that analysis.