Day trading brokers allow investors to trade on the daily price fluctuations of various assets, including forex, stocks, and cryptocurrencies. However, the services provided and fees charged by these brokers can vary, making it challenging to find the best platform for your needs. In this tutorial, we will discuss the most critical factors to consider when searching for the ideal day trading brokers.

What Is Day Trading?

Day trading refers to the process of buying and selling a financial instrument within a single financial trading day to profit from the asset’s short-term volatility. Traders can engage in this process anywhere from once to hundreds of times per day, with scalping being the most frequent type of intraday trading.

How Day Trading Brokers Work

Brokers act as intermediaries between traders and markets by connecting them to securities exchanges that individual traders may not have access to. They facilitate the execution of trades on behalf of the trader in exchange for a fee. This can be done across a range of instruments, including forex, stocks, commodities, and cryptocurrencies.

Day trading brokers can also provide leverage on instruments, enabling users to invest more with less capital.

This is a common strategy for day traders, who are looking to profit from smaller price fluctuations.

Full-service brokers offer additional services such as investment advice and portfolio management, while execution-only brokers (also known as discount brokers) are only responsible for carrying out the trade, usually at a lower cost.

How Day Trading Brokers Make Money

Brokers profit from the execution of each trade, which can be through the spread or by charging a commission.

A spread is the difference between the buy and sell price, whereas commission fees are usually charged as a flat rate per transaction.

Finding a platform with low fees is therefore particularly important when day trading, as carrying out a high volume of trades can result in fees that rapidly eradicate profits.

What To Look For In A Day Trading Broker

The services offered and fees charged vary, with the best day trading brokers for direct access often depending on your strategy.

Here we discuss the topics to review when selecting a day trading broker.

Markets

While some day trading brokers offer a wide variety of instruments, others may specialise in certain assets.

The best brokers for day trading stocks may be different to those for day trading crypto or forex.

For example, Pepperstone and Plus 500 are good day trading brokers that cover a variety of instruments, while eToro specialises in digital currencies, with its crypto platform, exchange and wallet services.

Interactive Brokers also offer futures accounts for day trading (subject to meeting the margin requirements), but only accepts customers from the US, UK and Canada.

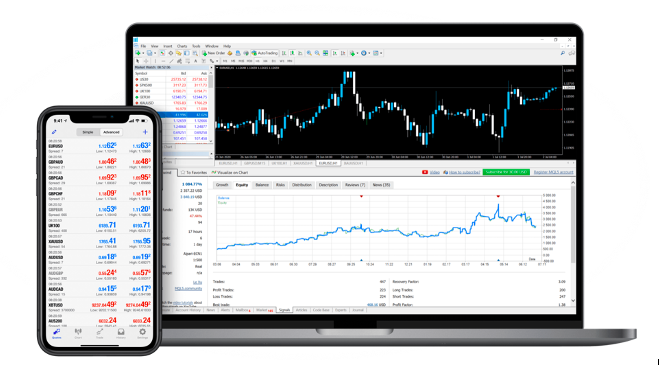

Platforms

A platform is the software provided by the day trading broker to carry out technical analysis and execute trades.

This could either be the day trading firm’s proprietary platform, or an industry recognised solution such as MetaTrader 4 or cTrader.

Most top rated platforms today offer terminals compatible with Mac and Windows.

The platform should include all the chart and indicator types needed to carry out any technical analysis as a minimum.

In addition, consider if more detailed features such as access to Level II quotes (the order book) and historical intraday price data is required.

Overall, the platform user interface should be intuitive and responsive.

While many day trading brokers offer the popular MetaTrader platform, customers of Interactive have the opportunity to trade on their proprietary Trader Workstation (TWS) platform, which has excellent reviews due to its high customisability.

Order Execution Speed

Speed of order execution is particularly important when day trading.

Quick execution enables an intraday trader to buy or sell closer to the entry price, preventing slippage during times of high volatility.

Order execution speeds can often be found in online brokerage comparison reviews, removing the need to test platform speeds yourself.

TD Ameritrade and Interactive Brokers are examples of day trading brokers with setups that provide rapid execution of trades.

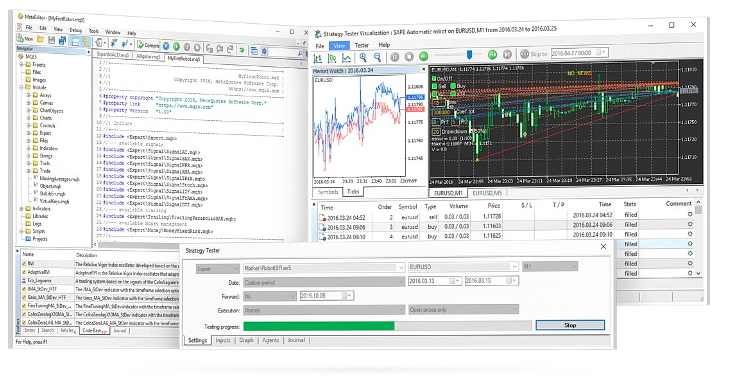

Automated Trading

Automated trading tools are another element to consider when selecting a day trading platform. Automated investing uses algorithmic robots to automatically find entry and exit points, then execute the trade if required.

These ‘bots’ are created by writing algorithms that define a set of rules, which could be written in tool-specific languages (such as the MQL language used on MetaTrader platforms), or open-source programming languages such as Python.

Some traders choose to develop their own trading robots, while others download free or paid-for versions from code libraries. Investors looking to take advantage of automated trading should research the range of compatible robots available with a selected day trading platform, or investigate the skills required to develop a bespoke bot.

Mobile Apps

Many day trading brokers now offer their services via mobile app, which is a convenient way to manage trades on the go.

The application may be specific to the platform, in which case checking the brokerage app reviews on the App Store and Google Play is recommended.

Fees

Platform fees are applied in the format of spreads or commission, although additional day trading brokerage firms account fees may be charged too. In particular, look out for account inactivity fees, overnight fees, deposit and withdrawal fees.

The spreads and commissions charged are often influenced by whether the platform is a Dealing Desk or a No Dealing Desk (NDD) day trading broker.

With an NDD broker, the platform has access to multiple providers to get more competitive trading prices. ECN or STP methods can then be used to execute this.

A dealing desk broker is also known as a market maker and will take all customer trades, regardless of whether they are trading in the market or not.

However, because they are taking on more risk, dealing desk brokers often have higher spreads meaning it costs more to trade with them.

Interactive Brokers LLC offers an STP account with competitive commission fees and rates which makes them especially suited to day traders, although they come with a huge initial deposit requirement of $10,000.

Alternative cheap day trading brokers include Pepperstone which offers tight spreads through its ECN Razor account or Robinhood which has a free trading account and is one of the best choices for beginners in the USA.

HDFC Securities offers low brokerage charges for customers looking to day trade in India.

Regulation

Choosing a regulated day trading broker is highly recommended when carrying out any type of investing, though not all regulators offer the same level of protection.

The most reputable regulators include the UK Financial Conduct Authority (FCA), the Australian Securities Investment Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

For the best day trading brokers across Europe, look for those with oversight from the European Securities and Markets Authority (ESMA).

Regulators have the authority to impose sanctions on a day trading broker if they do not follow defined standards, thereby protecting the investor from bad practices.

In some cases, the client’s funds are also protected, for example in the event the day trading broker goes into liquidation.

Investors using FCA regulated day trading brokers in the UK have up to £85,000 of their funds protected by the Financial Services Compensation Scheme (FSCS).

Although regulators can apply controls to broker practices, agencies in some countries may apply additional restrictions and rules to day traders.

In the US, the Financial Industry Regulatory Authority (FINRA) does not allow Pattern Day Trading (PDT) with less than 25k USD Net Liquidation Value (includes cash, stocks, options and futures).

This is enforced by first limiting a trader’s buying power and then closing the account.

Because of this, there are no regulated day trading brokers without the PDT margin rule available, including Interactive Brokers.

The best way to avoid the PDT rule without using offshore unregulated brokers is to carry out futures and options day trading.

Demo Account

Demo accounts enable day traders to practice strategies and become familiar with the trading environment, before depositing real money.

When day trading, practicing with virtual funds can be extremely beneficial, especially due to the heightened pressure caused by shorter timescales. Many day trading platforms now provide free demo accounts, eliminating the need to commit to a live account initially.

When selecting a day trading broker, it’s important to consider their customer support. The top 10 day trading platforms offer high-quality customer support through email, telephone, live chat, or submission forms. However, it’s important to check when the support lines are open, as they may not align with trading hours for all markets.

Additional resources offered by day trading brokers can also be beneficial. Many now provide resources beyond basic investing services, including online educational programs, blogs, step-by-step guides, and YouTube videos. For example, NinjaTrader offers daily webinars and help videos for training.

Security is a crucial factor when depositing funds with a day trading broker. It’s essential to check that brokerage accounts provide two-factor authentication, encrypted login, and segregated bank accounts as a minimum. Regulators may define security practices that a day trading broker must follow, making it another reason to choose a regulated platform.

The account requirements of day trading brokers vary depending on the services offered.

Additionally, many brokers offer a selection of account types, targeted at different types of day traders. For example, some accounts may provide higher leverage and tighter spreads, in return for a higher minimum deposit requirement.

FXTM is a leading day trading brokerage that offers a range of three online accounts to cater for different types of investing strategies.

Supported Countries

Many day trading platforms impose restrictions on where their customers are located, so checking the ‘supported countries’ section of the broker’s website is key. Offshore brokers will allow day trading customers to open accounts outside of their country’s jurisdiction, though these brokers are unregulated and therefore not recommended.

Deposits & Withdrawals

Day trading brokers set their own deposit and withdrawal restrictions for each account type. This includes minimum deposit and withdrawal requirements, speed of payments, plus transaction options and associated fees (e.g. credit card and e-wallet).

CMC Markets is one of the best stock brokers that allows day trading and offers an account with no minimum deposit requirements. They are also regulated in Australia, the UK, Germany and Canada. For customers looking to day trade with smaller accounts in India and South Africa, XM is one of the best day trading brokers with low minimum deposit requirements.

Final Word On Day Trading Brokers

Day trading platforms are a key enabler for carrying out short-term investing.

Despite this, the options can appear complicated, with many brokers offering different platform types, fees and account requirements. By reviewing this checklist, you can be confident you’ve considered the most important factors to find the best day trading brokers.

FAQ

How Do I Start Day Trading?

Finding a broker is the best way to start day trading as they provide access to securities exchanges. They also provide a platform that can be used to carry out technical analysis and execute trades.

What To Look For In A Day Trading Broker?

When selecting a day trading broker, the most important things to consider are regulation, market offerings, platform features, account requirements, fees and customer support.

What Are The Best Day Trading Brokers?

Pepperstone, Plus 500 and eToro are some of the highest-rated, regulated day trading friendly brokers that also offer a huge variety of assets.

Which Day Trading Brokers Have Low Minimum Deposit Requirements?

CMC Markets offers an account with no minimum deposit requirement and is regulated in Australia, the UK, Germany and Canada.