Day trading Ethereum has boomed alongside wider cryptocurrency growth. Our tutorial explains Ethereum (ETH) and how to trade it. We offer tips, analysis and day trading strategies. We also explain how and where to find the best exchanges to trade this, and other, cryptos. With trading hours, volume and volatility all suiting intraday trades, Ethereum offers great opportunities for active traders.

What Is Ethereum?

Ethereum is the second most valuable form of digital currency (after Bitcoin). But despite the Ethereum market being supported by a lot of the same exchanges and infrastructure that the bitcoin network has been built on, there remains an important difference.

Ethereum, unlike bitcoin was not created to be a global digital currency. It is designed to pay for only specific actions on the ethereum network, utilising blockchain technology. Anonymous purchases can be transferred all over the world and transactions stored in a decentralised ledger, the blockchain. As a result, ethereum has been adopted by online and physical stores all over the world.

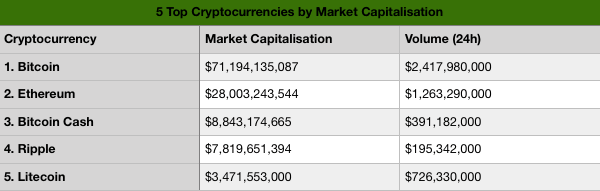

There are over 100 types of cryptocurrency that sell for more than $1 USD, but as the table below shows, ethereum is one of the big players, offering day traders attractive financial opportunities.

Why Trade Ethereum?

- Cost – Compared to traditional exchanges, you can pay just 0.25% if you choose your exchange wisely.

If you are looking to start trading Ethereum but don’t have a lot of capital, day trading is a great option for you.

- Accessibility – Ethereum is traded 24/7, 365 days a year, and can be accessed from anywhere with an internet connection.

- Leverage – Some exchanges offer leveraged trading, which allows you to take on greater price risk than your budget allows. This also means potential for greater profits.

- Simplicity – Day trading Ethereum does not require in-depth technical knowledge of the cryptocurrency or a long-term investment strategy.

Comparing Ethereum Exchanges

A year ago, there were only a handful of platforms for live trading Ethereum, including the well-known Coinbase. However, now there are many options to choose from. So, what should you look for in an Ethereum broker?

Financial Factors

- Fees – Ethereum trading fees vary among providers. Look for sites that charge a flat rate instead of a percentage model.

- Margin – Some websites offer generous Ethereum trading margins.

This will enable you to borrow capital, maximising profits on a potential move.

Look for brokerages that offer low interest rates when you trade on margin.

- Account types – The type of ethereum trading account you have can seriously impact on your success.

- Many providers will offer a number of account options.

- Look for companies that offer customisability, competitive spreads, and straightforward withdrawals.

- Going for the cheapest account may cost you profit in the long term.

- Liquidity – In the ethereum market day traders are looking to buy or sell, so it’s important to take into account the amount of liquidity the ethereum trading exchange can have.

- Liquidity enables you to sell without the price being substantially impacted.

Other Factors

- Trading robots – An ethereum trading bot could save you a lot of painstaking hours staring at a computer screen.

- An increasing number of firms offer these automated services, where once you’ve programmed in your rules, the bot will do all the heavy lifting.

- If you go down this route, find a company offering a continuously updated ethereum trading algorithm.

- It’s imperative their calculator bot changes along with market conditions.

- Customer service – With ethereum trading times running 24 hours a day, you need to choose a website who will be there to remedy any problems whatever the time.

- Check a brand’s customer service reviews before you sign up.

- Some providers promise less than a minute wait time for phone support.

- Trading platform – The platform you use is your gateway to the ethereum market. Look for a provider with a powerful and user-friendly platform. Test drive the software before committing and read ethereum trading platform reviews.

- Deposits – More brokers are accepting ethereum payments, making it easier to trade and finance ETH positions. Top sites also support deposits and withdrawals via other cryptos and fiat currencies.

- Mobile apps – Stay connected to the market with intelligent and easy-to-use trading apps. These may save you money when you can’t be at your computer.

- Regulation – Trading ethereum in Pakistan may be riskier than in the UK due to a lack of regulation. Choose a well-regulated exchange to protect yourself and the market from potential pitfalls.

Everyone’s day trading needs are different, so there is no perfect universal platform. Decide which factors are most important to you and do your research accordingly.

Ethereum Trading Forecast

Ethereum has flourished in recent years due to the cryptocurrency boom.

After the gigantic profits of some of the early bitcoin followers, cryptocurrencies have gone viral. 18 months after Ethereum’s launch in the Autumn of 2015, its market capitalisation had sky rocketed to $4 billion.

Everyone wants a slice of the action and that has led to extraordinary market valuations that some argue are difficult to justify.Due to the unpredictable future of ethereum and other virtual currencies, they remain a relatively risky asset to trade.

Maybe Tim Draper, venture capitalist will be proved right when he asserted “this is much like the internet was early on.It could be bigger than anything we’ve ever seen.” However, perhaps it will be Jamie Dimon, chief executive of JP Morgan who will be closer to the mark when he recently called cryptocurrencies little more than a “fraud” (sending bitcoin prices plummeting by 10%).

Who will be correct is likely to be determined in the coming years as governments and corporations scramble to regulate and find a place for cryptocurrencies in the modern world.Whilst this makes placing a long term bet on ethereum risky, the volatility and exceptional ethereum trading volume make it rich hunting ground for the day trader.

Video – Ethereum Explained

Ethereum Trading Tips

The price inflation that has come with ethereum’s success means your mistakes could be extremely costly.

ethereum) over a certain period of time. Day traders can capitalize on volatility by buying low and selling high, or by short selling when the price is high and buying back when it drops.

Technical Analysis

Technical analysis involves using charts and indicators to predict future price movements. Day traders can use technical analysis to identify patterns and trends, and make informed trading decisions.

News-Based Trading

News-based trading involves keeping up with current events and using that information to make trading decisions. Day traders can use news sources and social media to stay informed and react quickly to market changes.

Scalping

Scalping involves making multiple small trades throughout the day, taking advantage of small price movements. Day traders can use scalping to accumulate profits over time.

Swing Trading

Swing trading involves holding positions for longer periods of time, usually several days to a few weeks. Day traders can use swing trading to take advantage of larger price movements and maximize profits.

Періодичність зміни ціни Ethereum показує, що ціна може коливатися навіть на 31% за один день. Ethereum та інші криптовалюти відомі своєю великою волатильністю. Це приносить більше ризику, але також надає досвідченому трейдеру більше можливостей для заробітку. Тому, переконайтеся, що ви дивитесь на дані, патерни для сигналів, які вказують на волатильність.

Технічний аналіз

Ті, хто заробляють на денному трейдингу, ті, хто вдосконалюють свій рівень. Щоб зміцнити свій рівень, вам потрібно бути здатним приймати рішення на ринку, в основному, на основі цінових графіків. Володіння майстерністю в торгівлі Ethereum потребує часу та практики. Створіть демо-рахунок, щоб ознайомитися з основами графіків та патернів. Ці симуляторні рахунки фінансуються віртуальними грошима, дозволяючи вам виявляти будь-які помилки, перш ніж ви вкладете реальні гроші.

Управління грошима

Невід’ємною складовою вашої стратегії торгівлі Ethereum має бути управління грошима. Ви ніколи не можете передбачити з абсолютною точністю, що відбудеться на ринку, тому вам потрібна ефективна стратегія управління грошима в будь-який момент. Це мінімізує ваші втрати, коли ви допускаєте помилки та максимізує ваші прибутки, коли ви робите правильні рішення.

Ціна

Ціна Ethereum масштабно коливається, що є частиною причини, чому вона стає динамічним та захоплюючим інструментом для торгівлі.

Look for the ethereum trading symbol in the price chart below. Here you will be able to view the ethereum trading price and rate before you start day trading.

Regional Differences

Regulation

Ethereum trading in India and Singapore may differ from ethereum trading in Australia and the Philippines. This is primarily due to regulation. As countries and companies rush to respond to the emerging market, cryptocurrencies are vulnerable to significant setbacks. For example, in September 2017, the Chinese government announced a ban on raising funds through Initial Coin Offering (ICO). As a result, trading in ethereum plummeted by a massive 23%.

However, despite ICO bans in China and South Korea, ethereum trading in Malaysia, South Africa, the UAE, UK and Europe is on the rise. Japan plays a significant role in this revival. Retailers, airlines, and hotels have all begun to integrate cryptocurrency as a transfer method. No other region on earth comes close to Japan’s adoption of cryptocurrencies.

So, before you begin ethereum trading in Canada, Dubai, or anywhere else, find out how the country is or plans to regulate virtual currencies. Otherwise, you may find yourself in an expensive predicament.

Once you’ve received the green light, look for specialist trading platforms. Certain ethereum trading sites and platforms in India, for example, have been streamlined for ethereum trading. You may find that a specialist platform will provide you with faster execution speeds and more competitive spreads if you want to make ethereum your bread and butter.

Taxes

The other variable factor to be aware of is taxes.