The Euro Index (EURX/EXY) represents the performance of the Euro compared to other major currencies.Traders can speculate on the movement of this currency index through a number of vehicles, including CFDs.In this guide, we explain how the Euro Index works, its history, the factors that impact the index’s price, plus trading tips.We also rank the best Euro Index brokers and trading platforms.

What Is The Euro Index?

The Euro Index gives an average value for the relative performance of the Euro against other key currencies.The value is calculated by comparing the Euro to a basket of other currencies from major nations, including the USA, UK and Japan.

The index has three common symbols: EURX, EUR_I and EXY.While EXY and EURX are used interchangeably, EUR_I is a separate index and is less commonly traded.

There are several ways to trade the Euro Index, including CFDs, options and ETFs.

Weighting

The components of the EURX/EXY are typically the USD, GBP, JPY, CHF and SEK.While this is the standard set of currencies that compose the forex basket for the Euro index, trading brokers may offer their own composition, with custom indices that include a different set of currencies or a larger overall basket.

The standard weighting of each currency is:

- 31.55% – US Dollar (USD)

- 30.56% – British Pound Sterling (GBP)

- 18.91% – Japanese Yen (JPY)

- 11.13% – Swiss Franc (CHF)

- 7.85% – Swedish Krona (SEK)

A common criticism of the Euro Index is that the basket of currencies does not encompass all the relevant major trading powers.

As such, a number of brokers may allow their clients to engage in trading on custom Euro indices that have varying weightings and involve additional currencies. For instance, CMC Markets offers the CMC EUR Index (source).

Live Price Chart

Euro Index History

The first Euro Index, EUR_I, was launched in 2004 by the exchange portal Stooq.com. This index was constructed with an equal weighting of the USD, GBP, JPY, and CHF components.

In 2004, Dow Jones & Company introduced two of their own Euro Currency Indices: the DJEURO and the DJEURO5. These utilized a basket of 10 and 5 currencies, respectively. However, neither index is currently operational (source).

The New York Board of Trade (NYBOT) launched its own index, EXY/EURX, in January 2006. This index employed the same weighting as the first Euro Index. It was traded through the Intercontinental Exchange (ICE) with both futures and options contracts. While ICE discontinued the index in 2011, many brokers and data streams continue to calculate and offer this index, including TradingView (source).

Over the past couple of decades, the currency index has experienced multiple crashes and recoveries due to various economic conditions and crises (source).

Some of the major events that have affected global economies in recent years include the worldwide financial crisis of 2008, the Eurozone crisis that occurred in the late 2000s, the impact of Brexit, the Coronavirus pandemic, and the cost-of-living crisis that was sparked by Russia’s invasion of Ukraine in 2022.

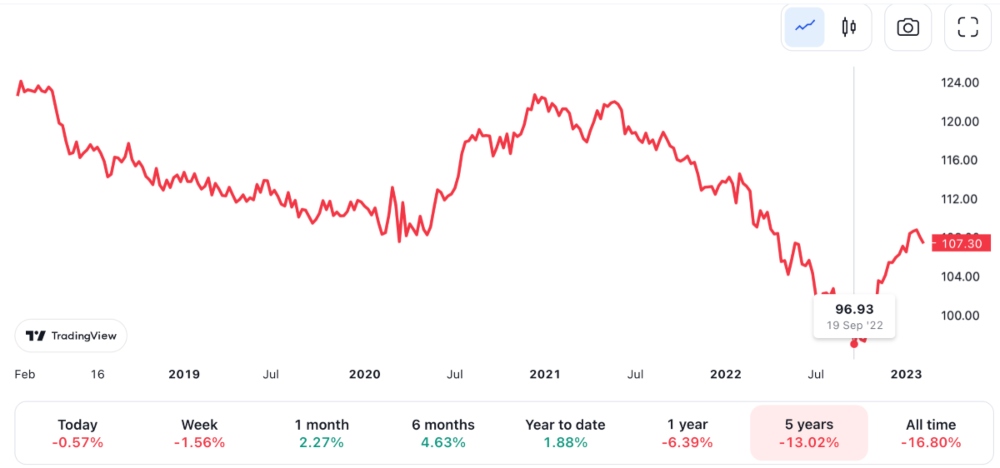

As of 2023, the Euro Currency Index (EXY) is in a recovery period, having recently crashed to its lowest point (96.93) in the past five years in September 2022.

Price Determinants

When trading the Euro Index, it is important to have a good understanding of the economics of the respective nations and the factors that influence the overall value of the index. Having a fundamental understanding as well as strong technical analysis skills will give you the best chance to capitalize on profit-making opportunities.

Here are some of the main reasons for price movement in the Euro Index:

Eurozone Economic Health

The Euro is the primary currency used in the Eurozone, making it crucial to track the economic health of the 20 Eurozone countries. The economic health of these countries has a significant impact on the price movement of the Euro Index. This determinant covers a variety of factors, including unemployment, stock market performance (such as Euronext, Deutsche Börse, and SIX Swiss Exchange), and political events (such as elections in key countries like Germany and France).

Euro Inflation

Inflation and interest rates are key factors that affect the value of the Euro and its currency index.

Inflation measures the increase in the price of major goods, such as food, raw materials, wages, etc. This can have a major effect on the value and volatility of the currency.

Being able to predict the amount of inflation or future interest rate changes puts you in a strong position to predict changes in the Euro Index.

Exposure To USD & GBP

Together, the USD and GBP make up around 60% of the index’s weighting. As such, events that affect these currencies will have a greater impact on the value of the Euro Index compared to other currencies. The value of Sterling fell, for example, following the results of the Brexit election.

Typically, inverse relationships are shown between the strength of the Euro and the comparative strength of the USD or GBP indices.

Pros Of Trading The Euro Currency Index

- Variety Of Investing Vehicles – There are plenty of ways for traders to get into trading the Euro index, such as CFDs, options or ETFs

- Long And Short Positions – Multiple CFD products are available, giving traders the freedom to find opportunities to go long or short

- Research – The Euro and the other components of the index are popular currencies that can be easily followed and researched online

- Diversification – The Euro Index is formed from a basket of different currencies, allowing for a more diversified portfolio

Cons Of Trading The Euro Currency Index

- Limited Composition – With the main Euro Index only consisting of a handful of component currencies, the index may not be the most accurate in representing all the key influences on the Euro

- Heavily Weighted – The index is heavily weighted towards the USD and GBP, thus arguably lending these currencies an outsized significance

How To Trade The Euro Currency Index

There are several ways investors can trade the Euro Index.

These include CFDs, ETFs, and options.

Because of the constant revisions and lower popularity of the Euro Index, brokers may have their own renditions of the asset and respective trading vehicles.

CFDs (contracts for difference) are a popular derivative among retail traders because they allow investors to easily speculate on an asset’s price movements in leveraged trades that do not involve purchasing the underlying asset. Pepperstone, for instance, offers a Euro Currency Index CFD.

Alternatively, investors may prefer to trade EURX binary options, which will have the same potential profit or loss regardless of the extent to which the price moves, limiting risk. Traders simply have to decide whether the value of the Euro Index will rise or fall over a set timeframe.

To start trading the Euro Index:

Find A Broker

Once you have chosen the instrument you want to trade, you will need to sign up with a broker that offers the EUR Index. This is an important decision as it will affect which trading platform and charting tools you have access to, the fees you will pay, the number of trades you can make per day, and the availability of risk management tools.

Key things you want to look out for when choosing between Euro Index brokers are:

- Regulation – Is the trading broker regulated by a trusted regulatory body like the CySEC or FCA?

- Execution – How quickly are trades performed?

- Will there be slippage and requotes?

- Trading Platforms – Which platform do you want to trade on? Which drawing and analysis tools will you need to identify entry and exit points?

- Payment Methods – Which deposit and withdrawal methods are available? Do they come with fees? How long will payments to your trading account take?

- Fee Structure – What are the bid-ask spreads like? Will you need to pay commissions or overnight fees? Pepperstone, for instance, offers spreads from 0.6 pips with an average spread of 1 pip on the Euro Index.

- Customer Support – How accessible is the support team? Are they available 24/7?

Sign Up

Once you have chosen a broker, it is time to sign up. Upload all the relevant information that is asked for. This will likely include some sort of government-issued ID, for example, a driver’s license or passport.

With a live account opened, you will need to fund your account using one of the broker’s deposit options. You may also have to choose your leverage and base currency. Pepperstone, for example, offers 1:5 leverage on the Euro Index.

Place A Trade

After opening a live account, it is time to place a trade. You will have to navigate the broker’s platform to find the EXY instrument. Many platforms let you set up alerts or shortcuts to find your favorite assets quickly.

Some Euro Index brokers also offer additional risk tools when you place a trade, including stop losses and take profits.

Trading Hours

The Euro Index trading hours will depend on the broker you are trading with.

CMC Markets, for example, allows you to trade their CMC EUR Index CFDs from Monday to Friday from 00:00 to 22:00.

Final Word On Trading The Euro Index

The Euro Index can be traded through several derivatives, including CFDs, options and ETFs.

Successful trading requires both strong technical analysis skills as well as a fundamental understanding of the factors that influence the price of the Euro Index. While it isn’t directly traded on exchanges like ICE, many brokers offer their own Euro Currency Index, expanding on the old model to create a more well-rounded indicator of the Euro’s performance.

Sign up with one of the top Euro Index brokers to start trading.

FAQ

Why Is The Euro Currency Index Important?

The Euro Index is a significant indicator that helps traders understand the value and movement of one of the world’s most important currencies. It is valuable for those trying to gauge the strength of the Euro compared to competitors like the US Dollar or Pound Sterling. Traders can make money by speculating on the Euro Index using a range of trading vehicles, including CFDs.

What Does The Euro Index Represent?

The Euro Index represents the relative strength of the Euro by measuring it against component currencies.

This allows traders to see the change in strength and value of the currency compared to the USD, GBP, JPY, CHF and SEK.

How Is The Euro Index Calculated?

The index is calculated by finding the geometrically weighted average of five major currencies compared to the Euro.The exact calculation formula is given by: EXY = 34.38805726 x (EURUSD^(0.3155) x EURGBP^(0.3056) x EURJPY^(0.1891) x EURCHF^(0.1113) x EURSEK^(0.0785))

What Moves The Euro Index?

Major contributors to the movement of the Euro Currency Index include the economic health of the Eurozone, interest rates and inflation affecting the Euro, and the effects on component currencies (particularly the USD and GBP given their heavy weighting).