He then moved on to work for a hedge fund before deciding to start his own investment firm. William has always been interested in fact-checking and ensuring that information is accurate and reliable.

He joined the projectfla.com team in 2021 as a fact checker and has been an invaluable part of the team since.

He has done consulting for fintech working with simplifying payments and POS information gathering for retailers.

William has also helped a leading trading software and a number of different forex trading software with their localization. He has worked as a writer and fact-checker for a long row of different web publications.

Gothenburg School of Business, Economics and Law at the University of Gothenburg,

Moscow State University

DayTrading.com

Which forex broker is the best? Our list of top forex brokers will help you find the best forex trading platform for you. DayTrading.com explains everything you need to know, with honest in-depth forex broker reviews that includes which trading platforms the broker provides access to.

And in the world of forex trading, reputation is everything.Look for brokers with a solid reputation in the industry to ensure that you are dealing with a trustworthy and reliable company.Read reviews and ask around to get a sense of a broker’s reputation before committing to them.

- Payment Options – Be sure to choose a forex broker that offers a variety of payment options that work for you.Some brokers only accept certain forms of payment, which could be inconvenient for you.

- Forex Trading Platforms – Look for a broker that offers a user-friendly and reliable forex trading platform.This will make it easier for you to execute trades and manage your account effectively.

- Charting Tools – Having access to comprehensive charting tools is essential for successful forex trading.Choose a broker that offers a range of charting tools and analysis options to help you make informed trading decisions.

- Customer Support – Finally, choose a forex broker that offers reliable customer support, preferably 24/7.You never know when you might need assistance, so it’s important to have access to help when you need it.

It is well worth listening to what traders say about their forex broker. Is it their favorite broker or are they dissatisfied with it? The top forex brokers generally have a good word of mouth.

- Operating Model– Forex brokers usually operate one of two operating models: dealing desk or no dealing desk. A dealing desk broker owns its order book, meaning they create liquidity for clients. These are known as ‘market makers’ because if there is no one to take the other side of a trade (i.e buy what you’re selling), they’ll take it themselves. No dealing desk brokers (also known as ECN brokers) connect to a larger market where filling orders is not an issue.

- Market Coverage– The selection of assets on offer. Does the forex platform provide the FX pair or product you’re looking for?

- Accessibility and Affordability– Beginner forex traders and small-timers need love too. You should never be forced into making a minimum deposit that you cannot afford to lose. Minimum deposits range from $10 to $1000 (or the £/€ equivalent). It might be worth investing more to get access to a platform that suits you better, so stay open-minded.

- Platforms– The forex trading platform and the tools it provides are your primary weapons in your personal war for profits. Personal preference will play a large part here, as many platforms offer very similar services, but look and feel very different.

Remember that many platforms are configurable, so they can be tailored to suit your needs.

- Strategies – Not all forex brokers allow every strategy. For instance, it’s common to see limitations on scalping, hedging and automated trading strategies (EAs). If this is what you’re interested in, you’ll need to check before you sign up that you’re selecting a forex broker suitable for scalping, for example.

- Mobile Apps – Being able to trade on the go may be important. Some mobile apps are superior to others. Usually, the features available on desktop are not matched on a mobile app, so access to both is recommended.

- Deposits and Withdrawals – The ability to move funds to and from the platform, quickly and preferably cheaply is key. Forex brokers with instant deposits for debit/credit cards and PayPal are common, so look out for these where possible.

- Customer Support – You need someone to talk to if you run into problems. Competent support is a must. From opening an account, to help with the platform – customer support is important.

- Company Background and History – Knowing the past exploits of forex brokers can give you a better idea of what it is up to now. A listed company has to publish numerous elements of information about their balance sheet, for example.

- Education – It never hurts to improve your understanding of how the forex markets work. Some forex brokers offer comprehensive educational tools that allow you to capitalize on market movements when they occur.

- Account Opening/Registration – Is opening an account an easy process? Do clients require verification? These procedures are not always the same and may be worth considering if you have had difficulty opening an account in the past.

Broker Costs

The services provided by forex platforms are not free. You pay for them through spreads, commissions, and rollover fees.

The fee structures differ from one forex broker to another and even from one account type to another. There are two widely used basic setups.

- Spread Only – All other fees (except for the rollover rate) are included in the spread

- Blend Of Fees – In addition to the spread, a commission may also be charged

Spreads

The majority of forex brokers earn money through spreads on currency pairs. This may be fixed or variable. Fixed spreads are always constant, regardless of market volatility. Variable spreads change depending on the traded asset, volatility, and available liquidity.

Daily spreads may only vary slightly among forex platforms, but active traders (or even hyper-active traders) open positions so frequently that small differences can add up.

Traders should always search for forex brokers with the lowest spreads. 1 pip fixed spread forex brokers exist, and ECN brokers may even offer zero spreads.

Commission

A commission-based fee structure is more suitable for other tradable assets, such as stocks and shares.

However, you may encounter instances where a commission is charged by forex brokers. Use a profit calculator to understand whether low spreads make up for this.

Rollover Rate

Forex positions kept open overnight incur an extra fee, known as a rollover rate. This charge results from the difference between the interest rates of the two currencies.

Assets

While most forex brokers offer an impressive-looking selection of currency pairs, not all of them cover minors and exotics.

For example, if you want to trade Thai Bahts or Swedish krona, you will need to double-check the asset lists and tradable currencies. These currencies are less commonly traded and therefore may not be offered by all platforms.

If you’re interested in major pairs (see below), then all brokers will cater for you.

The Aussie dollar and Swiss Franc, while considered ‘minor’ pairs, are often traded in high volume. You can read more about those here: AUD/USD or USD/CHF

That said, there are brokers out there that will truly go out of their way to cater to their traders’ needs. Some will even add international exotics and currency markets on request.

Such flexibility is obviously a major asset.

What About Crypto?

Cryptocurrency pairs are ubiquitous nowadays. Crypto/fiat and crypto/crypto pairings are both popular. This allows retail traders to match real currencies against alt-coins in order to profit from exchange rates.

The massive volatility associated with these products makes scalping a viable strategy for profitability.

Forex brokers do not usually offer spot crypto, instead, they’ll trade CFDs. The regulation of cryptocurrency varies globally. For example, for US residents, there are often difficulties accessing some of the largest exchanges due to SEC regulations. And, in the UK, all crypto derivatives are now banned.

Micro Accounts

Not everyone trades forex on a massive scale. In fact, many forex traders are small-timers. These clients require forex platforms’ micro accounts, some of which have the US Dollar as their base currency.

Often, forex micro accounts do not even have a set minimum deposit requirement. Such cheap trading options make sense for those looking to use real money, without risking their life savings.

Forex Trading Platforms

Besides fees, a forex broker’s trading platform is one of its largest selling points. Platforms are your portal into the investing world – giving you the ability to open and close trades but also monitor price changes and complete analysis.

They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc.

Some may include sentiment indicators or event calendars.

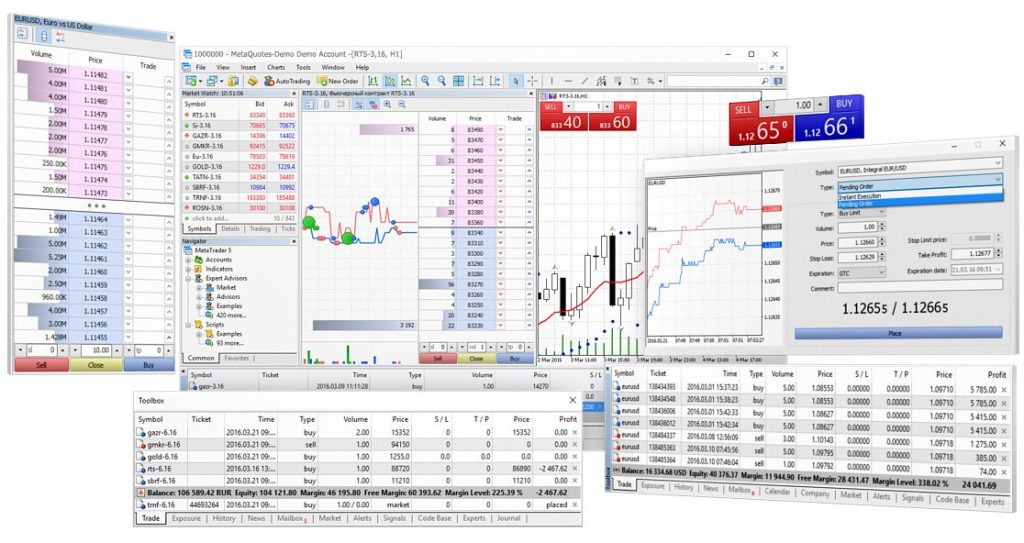

We have provided an overview and comparison of the top trading platforms used by forex brokers below.

MetaTrader 4

MetaTrader 4 (MT4) is the original platform created by MetaQuotes. It has set many of the standards we have come to expect today for online analysis.

It is famous for its in-depth analytics, which go way beyond the usual graphs and charting you would expect. In fact, all in all, you can bring 31 different graphical studies to your results, including Fibonacci studies and Elliot wave drawing tools.

Plus, it was also one of the first to deliver analytics to mobile. You can access almost all these powerful tools on your phone just as easily as you can on a desktop.

MetaTrader 4

Read a more in-depth analysis of MetaTrader 4 here.

MetaTrader 5

It is five years younger and sounds like an upgrade, but in fact, MT5 isn’t considered to be the better version of MT4. It really depends on what you want it for.

MT5 is geared more towards the US market and automatically complies with more US regulations than MT4 does.

While it’s true that it has more bells and whistles, like 44 graphical studies instead of 31, it’s really set up to deal better with high frequency automated trading.

If that’s what you’re looking to do, then MT5 is for you, but if you’re not then you may find most of these additional features unnecessary and bulky.

The base operating software used by MT4 is not thought to run any slower than MT5, so think of it more like a slimline version of the same thing with more of what you need, and less of what you don’t.

MetaTrader 5

Forex brokers will usually offer both MT4 and MT5 as options. Although MetaQuotes has stopped selling licences for MT4, so new brokers may not offer this.

Read a more in-depth analysis of MetaTrader 5 here.

Other Popular Platforms

TradingView is also a popular choice that consistently ranks within the top 10 platforms. As the world’s top social trading network, it’s used by numerous forex brokers and is especially popular among professional investors.

NinjaTrader is praised for its advanced features and technical analysis tools. In particular, the NinjaTrader Ecosystem allows access to thousands of apps, EAs, and other add-ons created by external developers.

Bespoke Proprietary Platforms

Another popular option for forex trading platforms is the bespoke route. Many forex brokers will offer their own “home-made” proprietary platforms alongside the usual MT4 and MT5 solutions.

The great benefit of these is that they’re usually designed specifically around a certain kind of market, strategy or currency pair. In this way, you’ll find they can often be better suited to your specific needs.

However, it should be noted that while some forex brokers offer proprietary solutions, they may be less versatile and optimal for traders who rely on EAs and VPS compared to MT4 and MT5. In fact, some proprietary platforms may not even offer the necessary functionality. It is also important to consider if a forex broker supports strategies like hedging, scalping, and EAs before signing up.

Mobile App

For traders who prefer to trade on-the-go, a mobile app is crucial. While most forex brokers offer mobile apps, some may lack advanced analysis and market research features. To find the best forex broker apps available, you can refer to this list.

Software

Trading software developers are constantly adding new and unique functionality to their platforms, with some allowing user-developed AI or tools to be added. Many forex brokers even allow users to load their own functionality to a code base where other users can download the add-ons for free. This added configurability can be very attractive for certain traders.

Signals

Signal platforms are specifically designed to alert users when certain market conditions are met. With this type of software, users can specify when they want to receive signals and how they are sent.

Speed is essential in using signals.

One significant benefit of using this software is that you do not have to monitor currency fluctuations or keep up with world politics because you will receive alerts when price targets are reached. Systems can also recognize specific patterns.

Signals can provide discipline to trading, as trades will only be executed when specific conditions are met, reducing impulsive trades. However, this is a double-edged sword because it still relies on your judgment to make the right decision once the signal is sent.

Automated Trading

Automated trading software takes forex signals to the next level. Opportunities will be identified based on your configuration, and trades will be automatically placed according to your commands.

While this may seem more accessible than a signal platform, it requires extensive research and fine-tuning before the algorithm can be set on the market to earn you money.

In simple terms, automated forex trading software systems, known as robots or bots, use pre-determined entry and exit criteria that you decide in advance to trade your money.

You can download apps to track the progress of your forex bots on the go, but ultimately, it is up to them to make the correct trades. Compared to signal platforms, the frequency of trades placed by automated forex platforms cannot be matched.

This is because bots can execute faster than any human – and they can do so 24/7.

This means there is far more potential to make money, but you’re also exposing yourself to far more risk.

The robot will follow the trading rules until the balance runs out, and that can all happen very quickly if things start going wrong. Automated forex trading platforms are a domain for experienced trader only.

Tools & Features

From charting to futures pricing or bespoke trading robots, forex brokers offer a range of tools to enhance the experience.

Again, whether the availability of these as a deciding factor in opening an account or not will be down to the individual.

Level 2 (or Level II) data is one such tool, where preference might be given to a brand delivering it.

Education

Some traders may rely on their forex broker to help them learn to trade. From guides to classes and webinars, educational resources vary from brand to brand.

However, a broker is not always the best source for impartial advice. Consider checking other sources too – such as our Education page.

Deposits and Withdrawals

There are some massive disparities between the costs associated with deposits and withdrawals from one broker to another. Such disparities mostly result from the internal procedures observed by different forex brokers.

At one platform, it can take as much as 5 times longer to fund an account than it does at another.

The incurred costs differ quite a bit as well.

Otherwise, the payment process largely hinges on the accepted money transfer methods. It would make sense for forex brokers to adopt as many such methods as possible, yet some still fall well short of the mark.

Most forex brokers also specify minimum deposits with their accounts, which can range from $10 to $10,000. This can act as an entry barrier to less experienced clients with less capital to invest.

Payment Methods

The most common methods are bank wire, VISA and MasterCard. The majority of forex platforms tend to accept Skrill and Neteller too.

Forex brokers with PayPal are much rarer. The same goes for forex brokers accepting bitcoin.

We are not talking about bitcoin trading, but actual deposits made using the top cryptocurrency.

Customer Feedback

Based on actual user feedback, a forex broker’s reputation can best be gleaned from various community review sites and forums.

You have to take this type of feedback with a grain of salt, to say the least.

First of all: disgruntled traders are always more motivated to post feedback. They are not likely to be unbiased.

Secondly: not all of this feedback is factually correct. Furthermore, there is no way to actually fact-check/verify this data. Even sites like TrustPilot are blighted with fake posts and scam messages.

There is no quality control or verification of posts.

That being said, it is still relevant. If there’s a forex broker about which no one has ever said anything good, chances are it might have issues. To the trained eye, genuine trader reviews are relatively easy to spot.

The utter lack of community feedback is a red flag as well. People always have something to say about forex brokers. Therefore, something is definitely amiss if there is no information available in this regard.

Regulation

Regulation should be an important consideration. Across the world, there are different regulatory bodies that govern the rules a forex broker must adhere to. Forex brokers regulated in Russia, Canada, UAE (Dubai) or Pakistan may have different responsibilities to those in the USA, Philippines or South Africa, for example.

Europe

In Europe, ESMA (the European Securities and Markets Authority) has jurisdiction over all regulators within the European Economic Area (EEA). This includes the following regulators:

If a forex platform is regulated by one of the above, they are permitted to provide financial services throughout Europe.

Therefore, you’ll often find that forex brokers are regulated by CySEC, but accept clients from Germany, Switzerland and the rest of Europe.

Within Europe, forex leverage is limited to 1:30 (or x30). Outside of Europe, leverage can reach up to 1:500 (x500).

Traders located within Europe can apply for professional status with their forex broker which removes their regulatory protection and allows them to trade with higher leverage.

Other regulations include the requirement for forex brokers to display warnings about the “risk of losing all your money” when engaging in CFD trading and the prohibition of offering binary options.

Other Global Regulators

Outside of Europe, the most stringent regulators of forex brokers include:

Forex brokers offering services in these jurisdictions must register with them to provide financial services legally.

In other nations, the regulators are more “Laissez-faire” and regulation is not mandatory. Therefore, forex platforms operating in India, Hong Kong, Ghana, Kenya, Qatar etc. are likely to be regulated in one of the above, rather than their national regulator.

Offshore Regulation

Regulators based in Vanuatu, Belize and other island nations are called ‘offshore regulators’. Sadly, this is not a sign that should instil confidence in the forex broker. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protection.

Leverage

Leverage can be a factor to consider when selecting forex platforms. However, regulation often takes the choice out of this. Leverage is capped at 1:30 by the majority of forex brokers regulated in Europe. Assets such as gold, oil or stocks are capped separately.

Note that higher leverage increases potential losses, as well as profits.

Security

Most forex brokers will follow regulations and segregate client and company funds into separate bank accounts. This protects traders in the case of broker liquidation.

Data protection is usually legislated at a government level. In the EU, GDPR regulation applies. This restricts what forex brokers can do with your personal data, offering that added level of protection.

Account security also differs among forex brokers. Some platforms may offer the additional layer of protection of 2FA (two-factor authentication) which will protect against hacker intrusion.

Demo Accounts

If this is all sounding like too much already and you’re feeling daunted, you can ‘try before you buy’ using a demo account. Many forex brokers will allow you to open a simulation account.

This trading training software utilizes imaginary money to simulate how you would perform if you made the same decisions in the real forex market. This can be beneficial for new traders seeking to test the waters and alleviate their nerves, as well as for experienced traders wishing to trial new strategies and ideas in a risk-free environment. It provides the best “on the job” training available. The top forex trading platforms for beginners will offer this feature, and it is highly recommended that you give it a try. It is a real advantage.

Check out our list of top forex demo accounts.

Company History

A legitimate regulatory agency will not hesitate to issue cease and desist orders to unscrupulous brokers, and they may even blacklist them. This practice creates an online trail, an operational history of sorts, which highlights the past wrongdoings of presently “reputable” forex brokers. What is fascinating about this history is how little attention it receives. You must delve into regulatory archives to find such relevant information.

Bonus Offers

Forex brokers previously offered a plethora of promotions, ranging from cashbacks to no deposit bonuses, free trades, or deposit matches. However, regulatory pressure has altered this. Forex platforms that provide bonuses are now rare. Our forex bonus page lists them when available, but they should seldom influence your choice. Always review the terms and conditions to ensure that they do not cause you to over-trade.

Many forex brokers offer welcome bonuses, low or no deposit bonuses, but these bonuses often come with time limits or turnover requirements. It is especially important to consider these factors when evaluating a forex broker’s no deposit bonus offer. Keep in mind that bonuses given without a deposit may not be withdrawable.

Order Execution Types

When you click the “Open Trade” or “Enter” button on your trading interface, you initiate a complex process. Forex brokers use various methods to execute trades, and the method used for a particular trade will affect the price you pay. Some forex platforms only support specific order execution methods. For example, your broker may act as a market maker and not use an ECN for trade execution. If you are looking for an ECN forex broker, you will need to search for one specifically.

ECNs are ideal for limit orders because they automatically match buy and sell orders within the network. Other options that your forex broker may use include:

- Order To The Floor – This execution type is mainly used for stocks and is handled manually through trading floors or regional exchanges, making it very slow.

- Order To Third Market Maker – This execution type involves a third party, usually a market maker who handles trade execution. Some market makers pay brokers to send them orders, so your order may not end up with the best market maker.

- Internalization – With this method, forex platforms match the order from their own inventory of assets.

- This execution method is therefore extremely fast.

Order execution is extremely important when it comes to choosing forex brokers. It also goes hand-in-hand with regulatory requirements.

Broker Reporting

Regulators aim to make sure that traders get the best possible execution. In fact, forex brokers in Europe and the US are required by ESMA and the SEC to report the quality of the execution their services provide.

MiFID II sets clear guidelines in this regard. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis.

In this reporting, the prices paid by forex platforms are compared to those quoted to the public. If the broker executes trades at better prices than the public quotes, it has some additional explaining to do. Plus, if it routes the trader’s order through a less-than-optimal path, it has to disclose this fact to the trader.

These examples yet again showcase the importance of a proper regulatory background.

Forex Account Types

From cash, margin or PAMM accounts, to Bronze, Silver, Gold and VIP levels, account types can vary. The differences can be access to 0 pip spreads, Level II data, settlement or different leverage and commission. Comparison is recommended to ensure you’re getting the best deal for your capital allowance.

Micro accounts might provide lower trade size limits for example.

Retail and professional accounts will be treated very differently by both brokers and regulators.

An ECN account will provide you with direct access to the forex contracts markets.

So, do your research and compare it to what you currently have on your forex platforms.

Distinguishing Scams

Unfortunately, some forex brokers are simply scams. Avoid being deceived by checking:

- Have you been cold called? Reputable firms will not contact you out of the blue (this includes emails, Facebook, or Instagram channels).

- Are they offering unrealistic profits? Stop and think for a moment – if they could make the money they are claiming, why are they cold calling or advertising on social media?

- Are they offering to trade on your behalf or use their own managed or automated trades? Do not give anyone else control of your money.

If you have any doubts, simply move on. There are plenty of legitimate, legal brokers out there.

We have ranked forex brokers and platforms based on our own opinion and offered ratings in our tables – read more about why you can trust our opinion here – but only you can award ‘5 stars’ to your favorite!

Read about who won the DayTrading.com ‘Best Forex Broker 2023’ on the Awards page.

Broker vs. Market Maker

Forex brokers are intermediaries whose primary (and often only) goal is to bring together buyers and sellers by matching orders automatically, without human intervention (STP).

For this service, it collects its due fees.

Market maker forex brokers, on the other hand, actively create liquidity in the market by acting as a counterparty to traders.If there’s no one to take the other side of your trade (buy when you’re selling), they’ll take the other side of the trade. This does lead to a conflict of interest.Market makers will be profiting from your losses.

The Bottom Line

Hopefully, you now understand some of the methods we’ve used to create our forex brokers ranking list.

Picking the right platforms for you from the extensive list of forex brokers is no easy task.But it is imperative that you get it right.While we can point you in the correct general direction, only you know your personal needs.Take them into account, together with our recommendations.

FAQs

What Is The Best Forex Broker?

There is no single top forex broker as every client has different needs, strategies and geographical locations.For example, of the top 8 brokers in South Africa, only 5 may make the list in Dubai or India, and even then they may be topped by other firms built around the local markets.So, whether you are in New Zealand, Japan, Lebanon, China, Mexico or beyond, finding the right broker will be a completely different experience.

Follow our guide above for how best to compare local brokers, or see our ranked list of brokers that accept clients in your area.

Are All Forex Brokers Licensed?

Forex broker regulation is split among the various financial and geopolitical jurisdictions in the world. While most brokers will conform to rules imposed by regulatory agencies, there are some that do not. For example, some companies intentionally set themselves up in regions not affected by the ESMA but still advertise to European customers. These are generally either scams or specialist firms that provide anonymous brokering to best protect their client information through means like not requiring KYC data on account setup.

Are There Forex Brokers That Accept Bitcoin?

Forex brokers around the world accept various payment methods for funding and emptying accounts. There are many brokers that accept wire transfer and payment (debit or credit) cards, with a growing number using and accepting PayPal, Bitcoin, Venmo and other e-wallets and payment systems.

What Is The Best Forex Trading Platform?

Much like brokers, finding the best forex trading platform is a personal and subjective task.

With so many commercial and private platform providers, brokers offering their own trading software and clients with unique strategies out there, there are no clear best forex trading platforms. Plus, if you are in Nigeria, Australia, South Africa, the Philippines or Canada, the range of forex trading platforms on offer will vary with the available brokers.

MT4 and MT5 are generally safe bets and strong all-rounders, but you should do your research into what is available to you, see our list of forex trading platform for more information. Platforms may also be limited by the operating systems they can run on, so if you are looking for the best option for Mac, make sure you factor this in.

What Additional Software Do Forex Brokers Offer?

Software for forex speculation is not limited to platforms and mobile apps. Signals forex trading software provides buy and sell signals, while automation systems and bots support algorithmic investment strategies. Some automated traders use a paid or free VPS, which cuts out the middle man and allows faster order execution. Before signing up for additional features, check our automated forex trading software reviews.