When looking at forex trading vs binary options, it’s important to understand the similarities and differences. Here we’ll cover binary options and forex trading definitions, signals, strategy nuances and more. So before you start trading forex or binary options, find out which is better for your requirements.

What Is Forex?

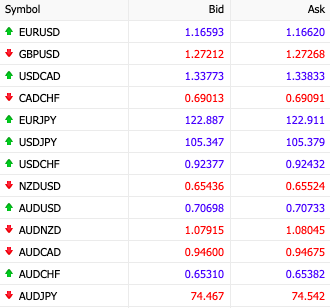

Foreign exchange (FX or forex) is the most liquid and actively traded market in the world, with a daily trading volume of over $5 trillion. Trading forex involves predicting the movement between two currencies, such as the Euro vs US Dollar (EUR/USD), which can be affected by changes in global supply and demand.

There are three main types of forex market: spot FX, forward FX, and futures FX. Spot currency trades are settled ‘on the spot’ or within a short time-frame. Forward and futures contracts both involve buying and selling assets at a set price and date in the future, but forward contracts are arranged over-the-counter (OTC), whereas future contracts are traded on exchanges and are legally binding.

Find out more about forex trading, including the best brokers.

What Are Binary Options?

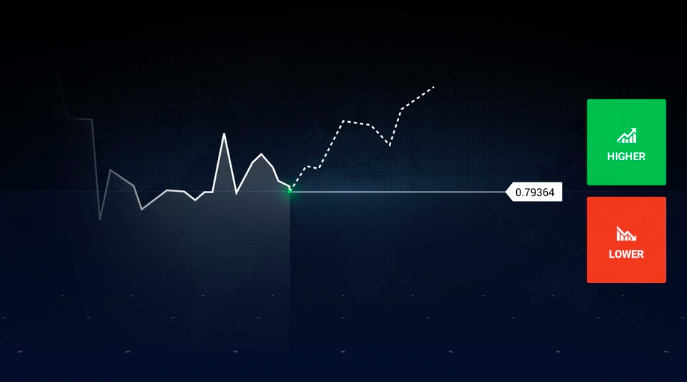

Trading binary options involves investing in an asset such as a currency, commodity, or stock, for a predetermined period (usually between one minute and a few hours, though longer expiry times are also possible).

Binary options are based on simple ‘yes’ or ‘no’ propositions – will an asset’s price go up or down within a given period?

Unlike forex trading, the expiry time, profits, and losses of the trader are established up-front. The investor will then either receive a fixed payout or lose their investment at the point of expiry. Traders can profit up to 95% if their predictions are correct. However, if their prediction is wrong, they can lose 100% of the initial investment.

Find out more about binary options trading.

Binary Options Vs Forex Trading – Key Differences

A summary of the key differences can be found below, along with some examples of popular brokers and signals providers.

| Characteristic | Forex Trading | Binary Options |

|---|---|---|

| Strategy | Traders speculate on price movements of a currency pair and take a short or long position | Traders earn a fixed payout based on a win or lose outcome only |

| Access | 24/5 | Asset trading hours |

| Costs | Broker spreads and/or trading commission | No costs other than what is factored into the final payout |

| Risks | Losses can be high and unpredictable & high margin for trader error | Losses are capped at the initial investment & low margin for trader error |

| Time period | Not scheduled – traders can close at any time (usually long-term) | Scheduled – expiry date and time set by the trader (usually short-term) |

| Leverage | Yes | No |

| Volatility | High | Low |

| Brokers | IG / Forex.com / CMC Markets | Binary.com / IQ Option |

| Signals | Learn 2 Trade / Forex Signal Factory | SignalHive / Blue Sky Binary / Signals 365 |

Pros & Cons Of Forex Trading Vs Binary Options

Access

- Forex trading – The currency market is not a centralised marketplace but instead spans across several major financial centres in different time zones.

, , and can therefore trade flexibly , .

Volatility & Risk

- Forex trading – The moves and fluctuates depending on a variety of factors that affect supply and demand, such as global geopolitical events. This makes the highly volatile and unpredictable.

- Binary options – With , the trader establishes the profit and loss upfront. This means trades are less affected by market volatility. There is also less risk involved, as losses are capped at the original investment.

Profitability

- Forex trading – Due to market volatility, profits can be high. can also be leveraged. This means you can borrow capital beyond your initial investment to increase your position size (up to 500 times), leading to larger returns but also greater losses.

- Binary options – are generally not as profitable, but they do involve less risk. Leveraged investing is not possible with .

Fees

- Forex trading – When , fees usually come in the form of spreads and commissions set by the online brokerage company.

- These vary from competitive and transparent to complex and significant.

- Binary options – Costs are typically factored into the final payout when binary options trading. Of course, some brokers offer lower fees than others, but traders usually have a clearer picture as to what those costs will be before entering the trade.

- Forex trading – Flexibility to enter, amend or exit an order can be attractive to currency traders. However, this also means there may be a high margin for error if trades are not monitored properly. Also, other factors, such as liquidity, slippage or downtime on the trading broker’s platform can be harder to keep a handle on.

- Binary options – There is some level of control with binary options trading. Profits and losses are pre-determined and the trader chooses the expiry. This means there is a lower margin for trader error.

Control

Forex Vs Binary Options Trading – Which Is Better?

When looking at forex trading vs binary options, it’s important to consider your requirements. If you’re looking for high profits, real-time flexibility, and have the time to carefully research and monitor positions, forex trading may best suit your needs. If you’re looking for a straightforward financial trading system requiring less time and more defined risk, binary options trading could be a sensible option.

FAQ

What is forex trading?

Forex trading involves speculating on the price of two respective currencies, such as the GBP and USD.

FX is the most liquid financial market in the world with a daily trading volume over $5 trillion. Find out more about forex trading.