One of the most popular and straightforward forms of binary options trading, high/low contracts are high-risk, high-reward. This guide will review how high/low options work, give examples of trading strategies and provide guidance on how to choose from the best brokers in 2023.

List all Binary Options Brokers

What Are High/Low Options?

High/low contracts are a type of binary option in which, as the name suggests, you predict whether the value of an asset will be higher or lower than the strike price at the expiration time.

They are also known as ‘all or nothing’ trades because an incorrect prediction means you lose your entire initial investment. If you are correct, however, you gain the full payout, which is typically between 70-90% of the stake.

Example

Let’s say stock A is worth $50 but you believe the value will rise…

You open a ‘call’ position for a strike price of $55 with an expiration of an hour. You stake $100 with a payout of 75%.

If at expiry the value of stock A is greater than $55, you gain $175 ($100 stake plus $75 payout).

If stock A is valued at $55 or less, your entire stake ($100) will be lost.

Traders bet on whether the price of an asset will rise or fall, making high/low options one of the most straightforward retail trading products.

Pros Of High/Low Options

- Potential for large profits per trade

- Easy for beginners to understand

- Available on traditional and emerging markets

- Multiple timeframes and expiries, ranging from seconds to weeks

- The most common type of binary options contract, offered by many online brokers

Cons Of High/Low Options

- High-risk investments

- Scams are prevalent in the binary options space

- Other types of binaries, such as ladders, offer higher payouts

Strategies

The News

News releases can provide valuable information for high/low trading strategies. When companies make announcements regarding acquisitions or new products, their stock prices often fluctuate. This is a viable option for traders who struggle with technical analysis because indicators are not necessary.

For example, if a car company is about to release a new, well-made model, you may place a call option based on the assumption that the company’s stock will increase.

Hedging

Puts and calls provide a flexible way to hedge your investments.

You can place both a put and a call on the same asset with the same expiration time. If the strike price for the ‘low’ position is greater than that of the ‘high’ position, at least one of the two positions will always end ‘in the money’, reducing your total losses.

For example, you place a ‘put’ with a strike price of $18 and a ‘call’ with a strike price of $15. If the stock’s value at expiration is greater than $18, the ‘call’ option ends ‘in the money’. If the stock’s value at expiration is less than $15, the ‘put’ option ends ‘in the money’. If the stock’s value at expiration is between $15 and $18, both options end ‘in the money’ and you receive twice the returns.

Note, you may want to open opposing positions with different brokers for the best returns.

Timing

A short-term high/low binary options trading strategy could involve opening positions with either 60- seconds or 5-minute expiration times. These allow you to capitalize on short-term swings during periods of high volatility. For active traders, this offers multiple opportunities to generate profits. On the downside, short-term strategies require more concentration to identify and capitalize on opportunities when they arise.

Note, investors with less time may prefer to buy high/low options with longer timeframes and expiries.

Best Indicators For High/Low Options

Relative Strength Index

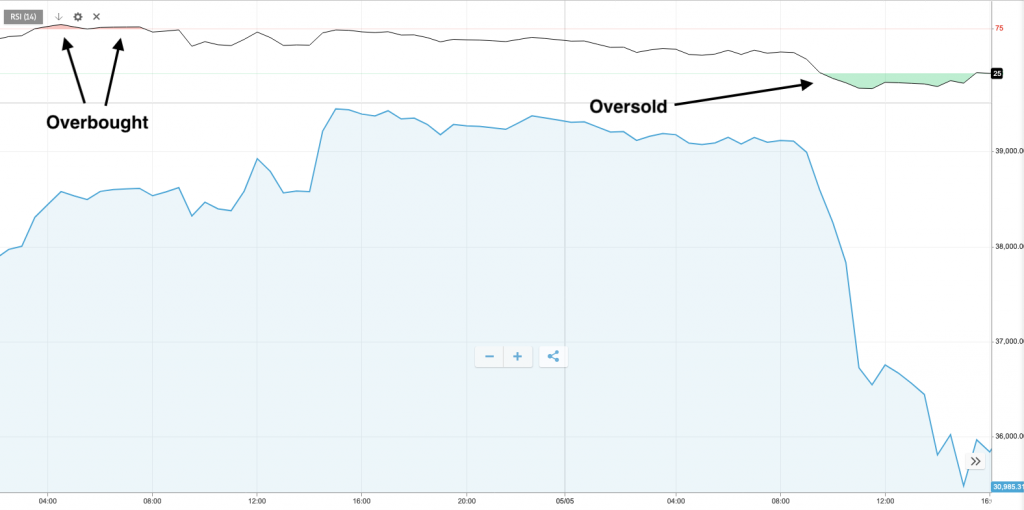

A useful indicator for identifying market conditions, the Relative Strength Index (RSI) indicator shows when an asset is overbought or oversold.

This can be helpful where a trend reversal is likely.

For example, if an asset is oversold, then it may soon start to increase in value. RSI uses a 0 to 100 scale whereby an RSI greater than 75 indicates an asset is overbought while an RSI less than 25 indicates an asset is oversold.

An example of RSI can be seen in the Bitcoin price chart below:

Bollinger Bands

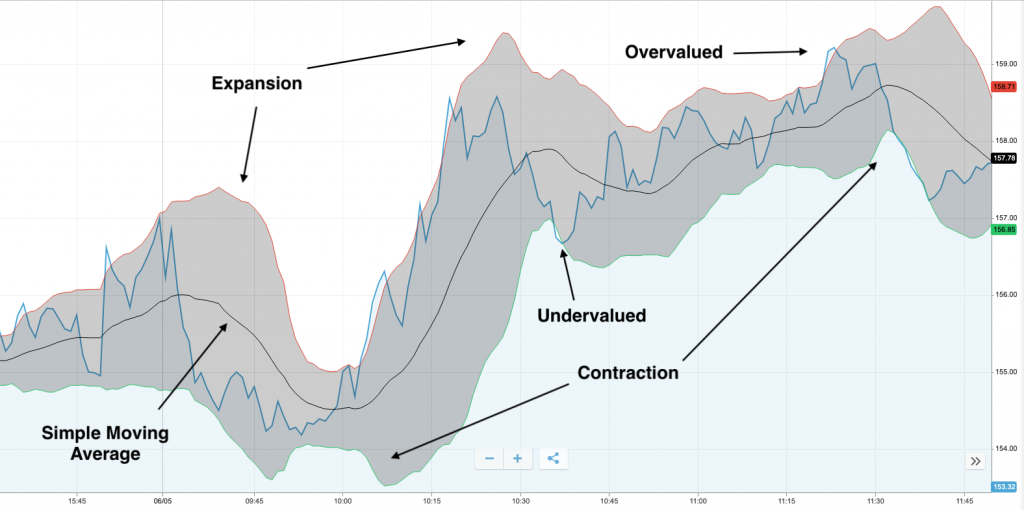

Considered one of the more detailed indicators for high/low binary options, Bollinger Bands consist of a centerline and two price channels (or bands) above and below it. The centerline is typically a simple moving average (SMA); the price channels are the standard deviations of the asset being studied.

The SMA is calculated from the closing positions of the previous 20 time intervals, for example, and used by traders to determine the strength of an uptrend or downtrend.

As with the RSI, it can be used to identify when an asset is overvalued or undervalued, depending on how close the current price is to these outer bounds. Furthermore, the distance between the two lines indicates volatility. High volatility is shown through expansions where the lines are far apart. Contractions, which are seen when the bounds are closer together, indicate periods of low volatility.

Pivot Points

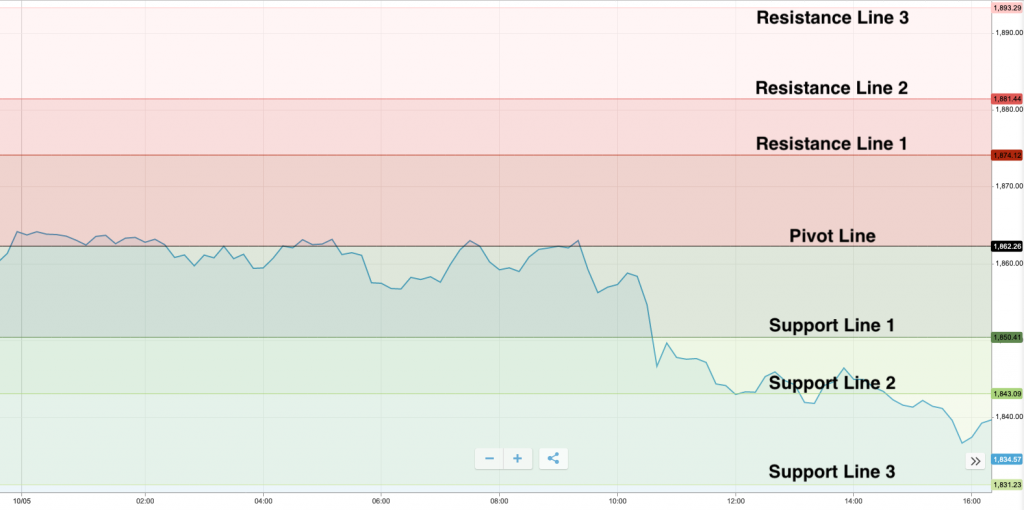

Taking the high point, the low point and the closing price from the previous day to create resistance and support levels, pivot points are helpful for high/low options in showing the strength of a trend.

The central pivot line demonstrates the direction of the trend while the support and resistance lines indicate the trend’s momentum.

If an asset’s price passes one of the outer lines, it can be assumed that the trend continues.

See the example below for pivot points across gold in USD:

Executing A Trade

To enter a high/low position, follow these simple steps:

- Complete research and analysis to find a suitable asset in which to invest

- Review and agree the strike price and expiry time

- Decide whether the asset’s value will be greater or less than the strike price at expiry

- Execute the trade and wait for the outcome

How To Choose A Broker

Selecting the best high/low broker is important but it can be a complex process. To help make your decision, see our brokers list and evaluate how well each platform will suit your needs.

These are some of the most important factors to consider:

Trading Platform

Where you conduct technical analysis and carry out high/low trading, the platform forms a big part of the investing experience. It could be worth choosing a broker that offers one of the world’s leading retail platforms such as MetaTrader 4 or MetaTrader 5.

Regulation

You should try to find a highlow binary options broker that is regulated by a recognized authority, for example, the ASIC of Australia or the SEC in the USA.

Regulators ensure that high/low binary options brokers follow operating guidelines, including security measures such as separation of customer and broker funds as well as mandatory risk disclosures.

This helps ensure customers are better protected and aware of the risks of high/low binary options trading.

Customer Support

The biggest brokers have an easily accessible, responsive customer support team which can be contacted around the clock through live chat, a phone hotline or social media accounts.

Customer service representatives should be able to explain payouts, contract terms and conditions, plus withdrawal instructions.

Fees

Brokerage fees cut into trading profits with costs such as deposit and withdrawal charges and monthly service subscriptions. Carefully consider your trading strategy, taking into account fee structures and a broker’s experience level.

Note, the top brokers typically take their cut from losing stakes when opening high/low options.

Final Word On High/Low Binary Options

Highlow binary options can be profitable but you need to prepare well to maximize your chance of success. Finding the best opportunities often relies on using indicators to predict if an asset will finish higher or lower than the current price, so do your research and choose the strategy that best suits your investment objectives.

FAQ

Can I Use A Trading Robot For High/Low Binary Options?

Robots can be useful aids for automating the highlow trading process.

You can set up a bot to execute your strategy and it will identify assets and make trades accordingly. As a result, high/low trades can be made 24/7, without requiring you to login to your computer to execute positions yourself.