Momentum trading is a popular strategy for forex, stocks and other assets that aims to take advantage of strong price trends. Below we uncover the key definitions and learn about some popular strategies, indicators and software. We also review whether momentum intraday trading works for beginners and provide some ideas and tips to boost your education.

What Is Momentum Trading?

The definition of momentum is the rate of acceleration of an asset’s price, or, the speed at which the price changes. Momentum day trading is therefore an investment strategy that aims to capitalise on this.

The goal for investors is to react to market information by buying rising securities and selling them when they appear to have reached a peak. This herding strategy follows other participants in the market who seek buying opportunities in short-term uptrends. The trader then sells when momentum drops and repeats the process on the next uptrend.

Momentum trading requires a good level of technical analysis, specifically measuring trends using oscillators and other indicators.

These tips can help analyze the three main factors in trading momentum:

- Volume – this is the number of assets traded during a given time frame (not the number of transactions). Entry and exit points rely on liquidity in the market, which is when there is a high number of buyers and sellers.

- Volatility – Volatility is the level of an asset’s price change. A highly volatile market is characterized by large price swings, while low volatility is more stable. Momentum traders take advantage of volatile markets, seeking profits from short-term rises and falls.

- Time Frame – Momentum trading generally works with short-term movements, though trades can be held for a long period of time if the trend is strong. This makes it suitable for both long-term position traders, as well as day traders or scalpers.

Now that we’ve covered the basics, let’s look at how to day trade momentum with some examples of popular strategies.

Momentum Trading Strategies

To start trading momentum, you will need to consider the asset that you are interested in. You can trade momentum with any market, including forex, penny stocks, futures, mutual funds, ETFs, or using options. You can even do high-frequency momentum trading with cryptocurrencies. Since momentum relies on volume, it makes sense to consider more liquid markets, such as EUR/USD, gold, or Bitcoin.

You’ll then need to develop a system based on a range of technical indicators and graphical tools.

If you’re new to trading, don’t forget to take advantage of your broker’s demo account, where you can practice risk-free on real-time charts.

The momentum indicator is the obvious first choice for most traders. The indicator shows how strong a trend is by comparing the most recent closing price to the previous one. Since it’s an oscillator, it is characterised by a single line that ranges to and from a centre line. The reading shows you how quickly the price is moving.

Let’s take a look at some strategies involving other popular indicators:

Moving Averages (MAs)

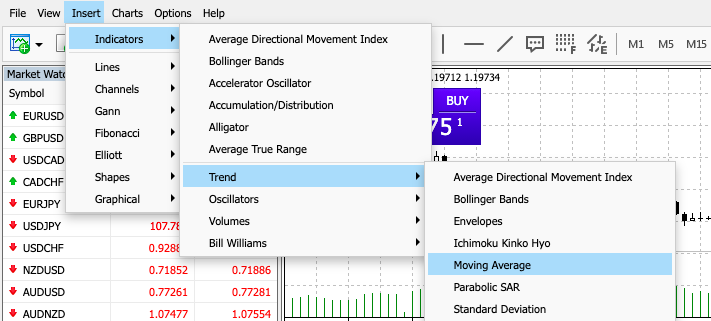

Moving averages allow you to identify price trends by filtering out market noise and short-term fluctuations. MA lines can be applied for different periods and can show traders whether a trend is accelerating. When the MAs crossover, this signifies a reversal in the trend.

Note that MAs tend to be lagging indicators, i.e. the signals occur after the price has already moved. It’s also important to combine MAs with other indicators to detect your exit points when momentum trading.

Alternatively, you could analyse the market with a moving average convergence divergence (MACD) to identify the relationship between the two MAs of an asset’s price. It’s also an excellent tool for playing breakouts as they can help to spot a reversal in a trend.

Relative Strength Index (RSI)

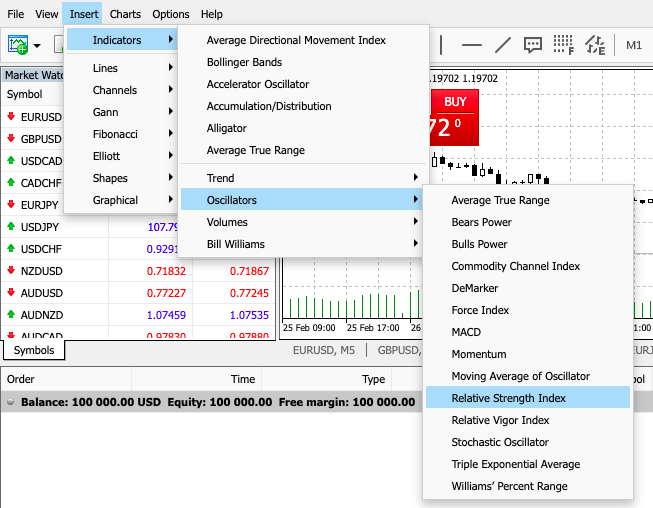

The RSI provides entry and exit signals based on whether the asset is overbought or oversold.

This momentum trading strategy can therefore tell you when to buy and sell, by oscillating between 0 and 100.

If it drops below 30, it is thought to be oversold, whilst a reading over 70 is considered overbought.

Momentum traders will look for opportunities within this range as it signifies a clear trend.

Note that RSI is most effective when used with other indicators because trends can unexpectedly stay in overbought or oversold territories for long periods of time.

Stochastic Oscillator

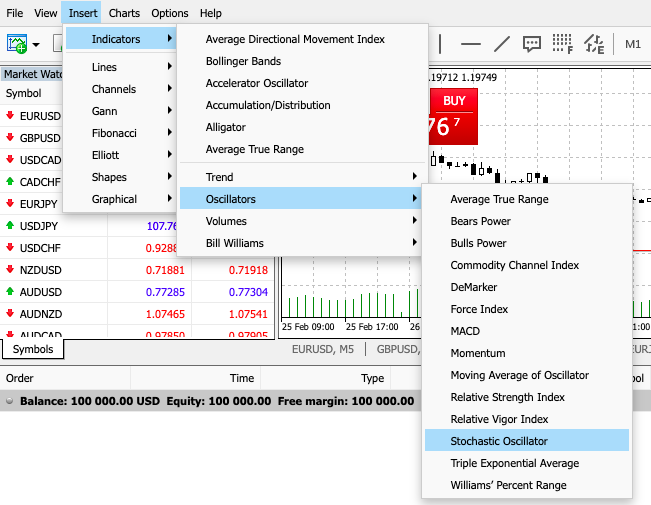

This indicator tracks the speed of an underlying market by comparing the most recent closing price to the previous trading range.

It’s therefore ideal for predicting price movements.

The stochastic oscillator consists of two lines on the chart: the indicator line and the signal line.

The indicator line oscillates between 0 and 100 (with a reading over 80 signifying an overbought market and a reading below 20 representing an oversold market).

The signal line will indicate to the trader a potential change in direction if it crosses with the indicator line.

In some cases, the stochastic might not fall back to 20, meaning the trend could continue upwards, despite pullbacks.

Regardless of which set-up you decide to master, proper risk management rules will help to protect your capital and ensure you don’t run into a disaster.

It’s important to learn how to calculate your risk per trade and the position size formula before committing any funds.

Your broker may offer advice and tips on forex strategies, but PDF downloads and video guides are also available from other sources.

Tools for Momentum Trading

Employing trading tools can be beneficial, whether you’re developing your current method or learning a new one. Your preferences and goals will determine which tools to use, so take time to consider them beforehand.

Automation

Automated tools and software are popular among traders who don’t have enough time to monitor trades. Trading bots are computer algorithm programs that determine buy and sell points based on signals. They can act as quick market scanners that, when conditions are good, can automatically submit orders on the trader’s behalf. You can find bots for virtually any strategy and algorithm, and they are widely available on most top platforms. These platforms use either proprietary or universal programming languages, such as Python or MQL4 and MQL5 in MetaTrader’s case. Such technology has already allowed traders to streamline their trading strategies, and we may see exciting future developments with the wider use of artificial intelligence and machine learning.

Software

The quality of the software you use will have a huge impact on your day-to-day trading models and setups.

Once you sign up to a broker, you will usually have a choice of at least two different platforms to choose from.

Think carefully about the features of the platform and what you require to start your momentum trading.The platform should offer a range of technical analysis tools, chart time frames and risk management features.Today, most brokers will also offer a mobile trading app for those who prefer to trade on-the-go.

If you’re an advanced trader, some platforms such as MetaTrader or cTrader allow you to code your own custom bots and indicators, which you can also backtest within the platform.A community forum, economic calendar and help guides can also be useful.

Alerts

Trading alerts are customisable, automatic notifications that trigger when prices move or certain conditions change.They are usually pre-included within your platform and can be sent via email, SMS or push notification.

Alerts are extremely useful tools that ensure that you never miss an opportunity in the markets and can be used as part of your risk management strategy.For example, price alerts will tell you when there has been a certain percentage change, whilst technical indicator alerts notify you of any buy and sell points.

Some momentum trading platforms even allow you to set reminders about global events and central bank announcements directly from your economic calendar.

Signals

Trading signals trigger buy and sell suggestions when a pre-determined set of criteria has been met.

These can vary from simple signals on earnings reports or volume changes to complex signals based on existing ones.

Signals can either be generated by another trader, or an automated forex robot, depending on the preference of the subscriber. You can get both free and paid momentum signals, but note that not all providers are reliable or robust.

In addition, be aware of any trading scams that claim ‘guaranteed’ success or unrealistic returns; these are especially targeted at beginners.

Is Momentum Trading Suitable For Beginners?

If we look at momentum trading vs scalping or day trading, the former is considered a much more straightforward view of the markets. The aim is to take advantage of expected price changes and close positions when the trend loses strength.

Momentum trading allows you to follow market sentiment within liquid and popular markets. Herding strategies like this can create the potential for high profits because you can use volatility to your advantage. You can also familiarise yourself with popular indicators and oscillators that can set you up for other strategies, including RSI, MAs and Stochastics.

However, momentum trading can be expensive, especially if you’re trading stocks with high turnover. If you compare this strategy vs trend-following or position trading, it can also be quite time-intensive for those who have busy lives outside of their trading platform.

It’s also worth noting that momentum trading focuses more on price action and technical analysis rather than long-term fundamentals, which might be a turn-off for some.

When it comes to momentum trading, it works best in bull markets where investors tend to follow the herd. However, in bear markets where investors are more cautious, profit opportunities are reduced.

Education

Depending on your trading style and experience, different forms of education, research tools, and trading tips may be necessary. With momentum strategies, much of the analysis is based on quantitative data and price action rather than long-term economic developments. To help with your technical learning, consider the following:

- YouTube video tutorials

- Online research papers

- Momentum trading podcasts

- Books (paper and digital PDFs)

- Broker or third-party blogs & newsletters

- Community group forum or trading chat room

- Momentum trading course or Forex Academy

Final Word On Momentum Trading

Now that we’ve covered potential strategies, popular indicators, and useful trading tools, you should have a good idea of how to do momentum trading in the forex market. It’s important to research which options would work best for you and look at online broker and trading platform reviews. Regardless of experience level, practice and dedication are necessary for success. Consider using a demo account to achieve your goals in your own time, and always stick to your risk management rules to protect your capital.

FAQ

What Is A Momentum Trading Strategy?

A momentum strategy reacts to market information by buying when price trends are strong and selling when the assets appear to lose momentum.

There are a variety of indicators needed for momentum trading, including moving averages and oscillators. You can also model your own strategy using custom bots or indicators if offered by your platform.

Does Momentum Trading Work?

Momentum trading is a herding strategy that aims to be ahead of the game by being the first to cash out and exit. This can work very well when markets are volatile and liquid but success is not always guaranteed. This is because the markets can change unexpectedly, causing investors to act more cautiously.

Is Momentum Trading Profitable?

Momentum trading can be profitable if you are experienced, patient, and have robust risk management calculations in place. Nonetheless, just because you’re using risk management tools, it does not mean that you are immune to a losing streak. Risk tools help to minimize your losses but they are not bulletproof.

When Can I Trade With Momentum Strategies?

There are certain hours of the day where the market traded is more active.