Get Educated

The first step to becoming a professional forex trader is to get educated.There are numerous training courses, mentors, and online coaches who can provide valuable advice, tips, and secrets to help you succeed in the forex market.Do your research and find a reputable source of education that suits your learning style and level of experience.

2. Choose a Platform

Next, you’ll need to choose a platform to trade on.There are many different forex trading platforms available, each with its own features and benefits.Some popular options include MetaTrader 4, MetaTrader 5, and cTrader.Do your research and choose a platform that suits your needs and trading style.

3. Develop a Strategy

Once you have the education and platform sorted, it’s time to develop a trading strategy.A trading strategy is a set of rules and guidelines that you follow when making trades in the forex market.There are many different strategies to choose from, such as trend following, scalping, and swing trading.Do your research and choose a strategy that suits your personality and trading goals.

4. Manage Your Psychology

One of the biggest challenges in forex trading is managing your psychology.Trading can be a highly emotional endeavor, and it’s important to have a plan for how you will manage your emotions when things don’t go according to plan.Some tips for managing your psychology include practicing mindfulness, setting realistic goals, and keeping a trading journal.

5. Find a Reliable Broker

Finally, to become a professional forex trader, you’ll need a reliable broker.A good broker can provide you with the tools and resources you need to succeed in the forex market.Some things to look for in a broker include regulatory compliance, competitive spreads, and a user-friendly trading platform.

By following these steps and putting in the time and effort required, you can become a professional forex trader and achieve your financial goals.

Best Brokers for Professional Forex Investors in 2023

If you’re looking for a reliable broker to help you on your journey to becoming a professional forex trader, here are some of the best options in 2023:

Each of these brokers has a strong reputation in the industry and offers competitive spreads, user-friendly platforms, and excellent customer support.

Education and Training

It’s essential to learn the basics of forex trading, including technical analysis, fundamental analysis, risk management, and trading psychology. Many online courses, books, and mentorships can help educate aspiring traders.

Practice on a Demo Account

Before risking real money, it’s crucial to practice trading on a demo account. This allows traders to test their strategies and get a feel for the market without incurring any losses.

Choose a Reliable Broker

A reliable broker is critical for professional forex trading. Traders should research and compare brokers’ offerings, including trading platforms, fees, and customer service.

Develop and Test Trading Strategies

Professional traders have a well-defined trading strategy that they continuously test and refine. This strategy should include entry and exit points, risk management, and trade management.

Continuously Learn and Adapt

The forex market is constantly changing, and professional traders must continuously learn and adapt to stay ahead. This includes keeping up with news events, market trends, and new trading tools.

Best Brokers for Professional Forex Traders in 2023

Here are some of the best brokers for professional forex traders in 2023:

- Interactive Brokers

- TD Ameritrade

- FOREX.com

- OANDA

- IG

Set Realistic Goals

Professionals set achievable and quantifiable goals.

For example, make a 15% return on investment, generate $25,000 in profit, or gain 50 pips a week.

With that said, key objectives should be set over the longer-term, such as a year, as performance and income will vary from month to month.

Key characteristics of a professional forex trader also include being realistic. They know they won’t generate a salary in the millions if they have a few thousand to invest, even with leverage. They also ensure the size of their trades reflect how much they’re willing to lose, keeping a handle on overall risk exposure.

Once you have clear objectives, you can look at the strategies and tools you’ll need.

2.Test Strategies

Being a professional forex trader requires the use of carefully refined strategies. But a common misconception is that professionals only use complex techniques. In fact, many serious incomes use simple systems, including those below.

Technical Trading

To become a professional, your technical analysis needs to be excellent. Most top performers focus on price pattern analysis to identify and capitalize on market trends. However, people often ask, “do you really need to use indicators?” Some professionals believe indicators overcomplicate charts and decision-making. Instead, pros try to minimize distractions, focusing only on those alerts and tools they need.

Fundamental Trading

Those asking, ‘how do professionals trade?’ may be surprised to hear that many don’t heavily rely on market news.

Yes, fundamental news can steer price, but the challenge is predicting when the market will react and to what extent.

For this reason, lots of pros use fundamental analysis to complement their technical analysis.

A good example of this is considering the impact of major geopolitical events, such as the 2022 Russia-Ukraine war on the value of the Ruble.

The RUB dropped by around 30% in the space of a few days.

Equally, the COVID-19 pandemic had a dramatic impact on currency markets.

Some professional forex investors successfully pivoted trading strategies to take account of market events.

Automated Trading

Many professional retail forex traders rely on automated algorithms.

These systems are often flexible enough to adapt to sharp market fluctuations.

They also allow investors to monitor and execute positions around the clock, freeing up time to focus on other areas.

For further guidance on strategies, see here.

3.Never Stop Learning

The life of a professional forex trader doesn’t need to be a lonely one.

Most utilize the resources around them.

That might be getting tips from those in their network or from social copy platforms.

It could also mean reading books and getting coaching from a mentor.

Mentors & Coaches

Professional advice through an online coach or mentor can be helpful. Many individuals prefer to go solo and repeatedly make the same mistakes.

However, if you hire a professional forex trader, you can quickly identify errors and break bad habits. Essentially, the right mentor can expedite your journey towards becoming a successful professional trader.

The challenge lies in the vast number of online mentors and coaches who claim to be experienced investors and educators. So, what should you consider when hiring a professional forex trading mentor?

- Trading plan – The best online mentors and coaches will develop a plan that aligns with your investment objectives, risk tolerance, and lifestyle requirements.

- Personalized training – A reputable forex mentor should respect your trading style and customize their coaching to cultivate the right mindset.

- Ongoing support – You will naturally have many questions. Avoid coaches who only offer a few minutes of their time and are unavailable to answer your inquiries.

- Safe space – Seeking professional forex advice provides the opportunity to practice trades in a safe environment. A suitable mentor will have live demo indicators and strategies to help enhance your performance.

Professional Forex Trader Courses

Online courses can also be an effective way to learn from experienced forex professionals. However, with so many courses available, what are the key characteristics to look for?

- Up-to-date – Training should cover the latest technical advancements in trading tools and platforms.

- Engaging content – The best online forex courses keep users engaged. Demonstrations in real-time and an opportunity to ask questions will help keep a course lively.

- Professionally led – An online trading academy will often use a library of professional forex traders to deliver their content.

- Look for courses with enthusiastic and passionate instructors.

- Quality, not quantity – If part 1 of a course is littered with basic mistakes and technical issues, it’s likely a substandard program. You’ll learn more from a few high-quality sessions than hundreds of hours of mediocre content.

- Outcome – Make sure the course provides the outcome you’re seeking. For example, are you after certification, a place to test new techniques, or do you want to interview professionals about which indicators and tools to use?

Platforms for Forex Professionals

The professional forex trader is acutely aware of the importance of choosing a top trading platform. As your gateway to the currency market, the platform’s suite of tools, market coverage, and reliability can contribute to overall performance. And when margins are slim, every edge counts.

Today the aspiring professional forex trader has multiple platforms to choose from, some of which are listed below. Please note that these are general platform tips – all traders need to research and choose a platform that suits their needs individually.

MetaTrader 4

The MetaTrader 4 (MT4) system is the most popular choice among forex professionals.

The customizable platform and comprehensive repertoire of tools make it a fantastic option. The software is home to over 2,000 custom indicators, one-click trading, nine different time-frames, economic calendars, plus real-time market news.

However, the industry-leading platform for forex does have some drawbacks.

Firstly, some professionals believe that using the MT4 system for forex trading is slower than other options. Additionally, some brokers may offer wider spreads on the MT4 system compared to their primary platform.

Trading Station

The Trading Station platform from FXCM is another top provider for retail forex professionals. This system offers advanced charting capabilities, a range of indicators, and trade automation. It is available through the web or as a download on desktop and mobile devices.

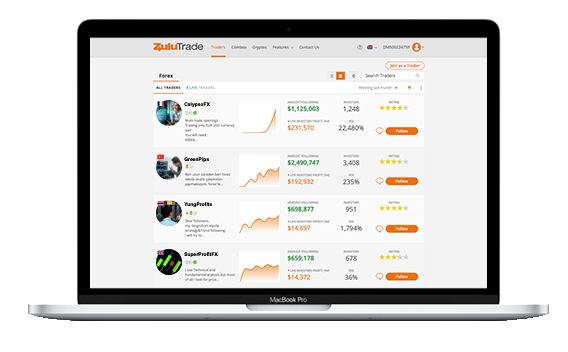

ZuluTrade

The ZuluTrade platform is an excellent option for automated investing strategies. It is also an active social platform, allowing you to interact and copy the indicators and strategies used by retail forex professionals from around the world.

NinjaTrader

The NinjaTrader platform offers customization through its Strategy Builder. The Market Analyser and Market Replay trading tools also allow you to test strategies on recent market data.

The platform designed for professional traders is both powerful and user-friendly, catering to their needs effectively.

For more information on forex brokers and platforms, visit this page.

Requirements for Professional Accounts

Some forex brokers offer professional accounts that require traders to meet specific criteria, such as:

- Investments and savings over $500k or an annual income of over $100k

- A minimum number of trades, usually averaging at $500k in a quarter

- Employment, a relevant degree, or sufficient experience in the financial sector

Traders who meet these requirements can enjoy various benefits such as tighter spreads, no commission, a dedicated account manager, faster customer support, higher margin, increased withdrawal limits, bonuses, lower fees, advanced trading platforms, invitations to special events, and more.

The Psychology of Professional Forex Traders

Professional forex traders possess a unique mindset that sets them apart from others. Some key characteristics include:

- Awareness – Professionals can gauge how perceptions influence market trends.

- Confidence – They dare to operate differently, developing innovative investment techniques.

- Risk control – They understand the risks and rewards of each trade, utilizing risk management tools to mitigate losses.

- Discipline – They recognize when strategies aren’t working and don’t succumb to emotional triggers such as fear or greed.

While some traders may possess these traits naturally, most develop them over years of training and experience.

Additional Resources

Professional traders may also use other resources such as:

- News subscriptions – To stay updated on global events that influence the forex market.

- Demo accounts – To test their strategies and run experiments.

- Trading journals – To understand the factors influencing their success rates.

- They take note of various factors such as why they decided to invest, the time of day, and their trading psychology when investing.

- Certified education – Some traders opt for a traditional approach by enrolling in a university course and obtaining a formal degree. These traders are usually interested in securing employment and advancing their careers. According to Indeed Salaries, the average base salary for a foreign currency trader is $91,749 per year.

- Funded accounts – Funded accounts are an excellent resource for individuals who want to become professional forex traders but do not wish to risk their own money. Programs such as FTMO and Fidelcrest provide a specific amount of funds each month that investors can use to trade. These programs often provide training, courses, and coaching. Profit shares typically range from 50-90%, which means that if you generate $1000 profit, you can keep $500-$900. Experienced traders can use this opportunity to increase their income, particularly if they possess the skills but not the funds.

What is the Average Salary of a Professional Forex Trader?

The income earned by professional forex traders varies, and a steady salary is uncommon. One month, you may earn several thousand US dollars, while the next month, you might not make a profit at all.

However, many professional traders aim to earn a 20% profit over the course of a year. The amount a trader earns is also dependent on their capital. For example, a 20% return on a $50,000 investment would yield $10,000 in profit, whereas a 20% profit on $200,000 would result in $40,000 in profit.

Final Thoughts on Becoming a Professional Forex Trader

Professional forex traders are continuously learning and expanding their knowledge, exploring new strategies and platforms, investing in online training and courses, and cultivating a strong mindset.

Firstly, you need to gain a deep understanding of the currency markets and how they operate. This can be achieved through education and experience, such as taking courses, reading books, and practicing with demo accounts. Secondly, you need to develop a sound trading strategy that suits your personality and risk tolerance. Thirdly, you need to manage your money effectively and have a solid risk management plan in place. Finally, you need to constantly analyze and adapt your strategy as the markets and your own circumstances change.