Fibonacci strategies in the context of forex trading use the Fibonacci sequence of numbers, ratios and patterns to inform entry and exit points. In this guide, we explain how to implement Fibonacci retracement levels and extensions. We also cover what you need from a broker, the best analysis software, resources, and how to get started Fibonacci forex trading.

The Fibonacci Sequence

Italian mathematician Leonardo Pisano, nicknamed Fibonacci, introduced the West to what is now known as the Fibonacci sequence back in the 13th century.

The Fibonacci sequence is an infinite numerical sequence. Each number in the series is the sum of the proceeding two values (after 0 and 1): 0, 1, 1, 2, 3, 5, 8, 13, 21 etc. Each number is approximately 1.618 times greater than the previous. This ratio, 1.618, is also referred to as Phi or the Golden Ratio.

The Golden Ratio can be depicted in a spiral shape and, interestingly, is a shape that crops up across the natural world. From rose petals to seashells, architecture, human faces and even constellations in outer space. There are some that believe that the spiral shape extends beyond nature and can be used to depict human behaviour too. The theory goes that as people adjust their behaviour in response to change, they do so at a rate proportionate to the Fibonacci ratios.

In the context of trading forex, it’s not the numbers in the sequence themselves that we’re interested in, but the difference between them.

The ratios unveil patterns which, in turn, help highlight opportunities.

Setting Up A Fibonacci Forex Trading Strategy

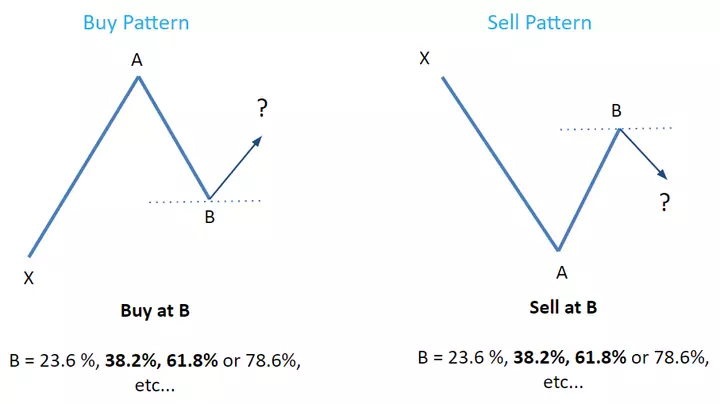

The application of the Fibonacci sequence to forex day trading is relatively straightforward. It is most commonly used as part of a trend-trading strategy. Traders adopting this strategy anticipate that the price will pivot at the points outlined by Fibonacci levels.

The basic premise is that in a market uptrend, you buy on a retracement at a Fibonacci support level, while during a downtrend, you sell at a Fibonacci resistance level. Ideally, you want to be looking at the highest and lowest swings.

Forex Trading Using Fibonacci Strategies

Fibonacci sequence ratios are used to predict retracement levels.

Retracements

The theory behind Fibonacci forex trading retracements is that after a significant market swing, the price will return, at least in part, to a particular point before it continues in its initial direction.

So in practice, the numbers and formulas that feed into your retracement levels may allow you to predict future price points.

As we have seen above, each new number in the Fibonacci sequence is approximately 61.8 percent of the consecutive number.

Which means that it is approximately 38.2% of the number after that, and approximately 23.6 percent of the number after that.These ratios: 61.8, 38.2, and 23.6 are our Fibonacci retracement levels.

On a chart, they are marked horizontally to make a grid within the parameters of the high and low levels chosen.When a trend is moving in a certain direction, the belief is that the price reversal point will coincide with the interception of these horizontal lines, before it resumes in the direction of the original trend.Fibonacci retracement levels help traders to identify potential price reversal points i.e points of opportunity.

Some models also use the 50 percent retracement level.Whilst it is not a Fibonacci ratio, it is widely acknowledged to be an important potential turning point as recognised in Dow theory.

The theory behind why trends unfold in this manner, is that human behaviour inherently follows the ratios of the Fibonacci sequence i.e.if a trend is moving too quickly in one direction, the market will respond relative to the ratios outlined in the sequence.

Extensions

The next step is supplementing your forex trading strategy with extension levels.Extensions use Fibonacci numbers and patterns to determine profit taking points.

Extensions continue past the 100% mark and indicate possible exits in line with the trend.For the purposes of using Fibonacci numbers for day trading forex, the key extension points consist of 161.8%, 261.8% and 423.6%.

Fibonacci Forex Trading Strategies In Action

Examples of forex trading strategies that use Fibonacci ratios include:

- Buying close to the 50 percent point with a stop-loss order just under the 61.8 percent mark

- Buying close to the 38.2 percent retracement point with a stop-loss order just under the 50 percent mark

- In a sell position towards the top of a substantial swing, using the Fibonacci retracement levels as profit collecting points

Limitations

Fibonacci retracement levels are not a guarantee.

Whilst useful indicators, Fibonacci forex trading levels cannot actually guarantee a pivot point. The price may not reverse at a Fibonacci level or any other estimated level for that matter. They can be used to identify areas of interest but cannot guarantee a specific point of change.

It is also worth noting that when looking at small price movements, Fibonacci levels may not offer much insight. When levels are very close together it can seem that every point is important. They are best used on larger swings.

Furthermore, using Fibonacci tools is somewhat subjective. In a single day there will be multiple price swings, meaning that not everyone will be connecting the same two points. To help you identify areas of importance, draw retracement levels on all major price swings and look out for areas with a cluster of Fibonacci levels.

Our recommendation is to always use Fibonacci forex trading strategies in combination with other tools and insights. Trend indicators such as moving averages or Bollinger bands are useful in determining the direction of an asset whilst relative strength index and Bulls and Bears powers are often used to determine whether an asset has been overbought or oversold.

Broker Tools

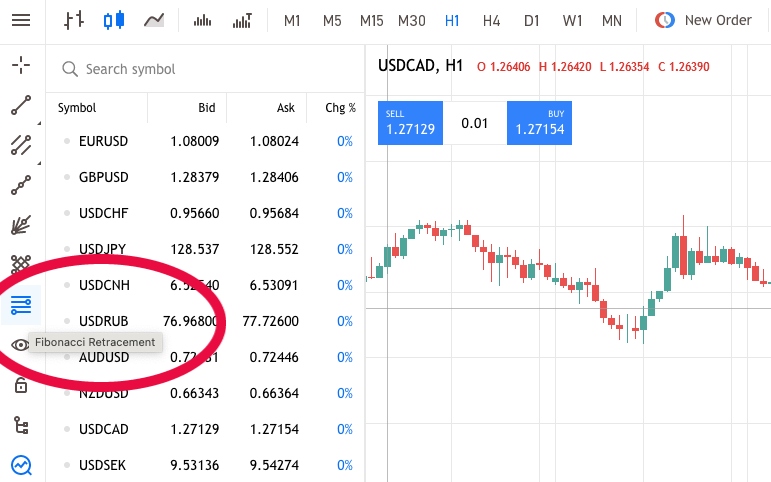

When forex trading using Fibonacci strategies, the numbers, formulas, ratios and patterns can appear daunting.

However, advanced charting software will do the heavy lifting for you, offering retracement and extension level tools. So make sure you choose a broker whose software you’re comfortable using.

As with learning any new forex strategy, the more resources you can get your hands on the better.

Therefore, it’s worth exploring whether your broker offers any Fibonacci forex trading strategy guidance, be it through PDFs or tutorial videos.

YouTube can also be a great way to see the numbers and patterns being applied in real life examples.

For further guidance, see our forex broker reviews.

Final Word On Fibonacci Forex Trading

Trading forex with Fibonacci strategies uses ratios and formulas to determine where support and resistance are likely to occur. Whilst the sequence itself can seem daunting, its application to forex day trading is relatively simple. Fibonacci forex trading strategies are widely used by retail and corporate investors and most investing platforms offer the feature as standard.

Of course, every trader is different and there are no guaranteed returns with a Fibonacci forex trading strategy. With that in mind, always consider retracements and extensions as tools to help inform your broader market angle.

FAQ

When Is The Best Time To Use A Fibonacci Forex Trading Strategy?

The Fibonacci forex trading technique is most effective when the market is trending.