Many online brokerages offer new investors a demonstration, or ‘demo’, account to trial both their software service, and to allow you the investor to test and train your trading prowess. Here we look at why this is good practice, and provide a list of the best spread betting demo accounts.

Spread betting is an efficient way of taking a position, making a bet on a wide variety of assets, such as shares, indices, commodities, forex, composite funds.

It is efficient because, firstly, as you are not buying and selling the asset you can usually avoid the tax triggered by acquisition and disposal of assets (i.e., Stamp Duty and Capital Gains Tax). Read more about tax implications here.

Secondly, it is an efficient use of funds because you don’t have to buy the underlying asset (share, currency, and so on) thus your money can be used to cover bigger bets – this is called leverage.

The spread in spread betting means the difference between the broker’s buy and sell price, there is no commission to pay on a spread bet as the broker’s costs are built into the spread.

In order to understand how anyone thinking of entering this market can benefit from the best spread betting demo accounts, we need to look at leverage as it is the supercharger in the trading process, it magnifies your gains but also your losses.

Leverage And Risk

Leverage means that you only need to front up a small percentage of the asset value to take a position.

The amount you put up is your equity (or margin).

While this gives you more bang for your buck it also exposes you to greater risk, as a few points change in the price of the underlying asset can wipe out your stake.

For example, if you have £1,000 on your account and maximum leverage granted by the broker/platform of 10:1 then you can take a position with an asset value of up to £10,000.

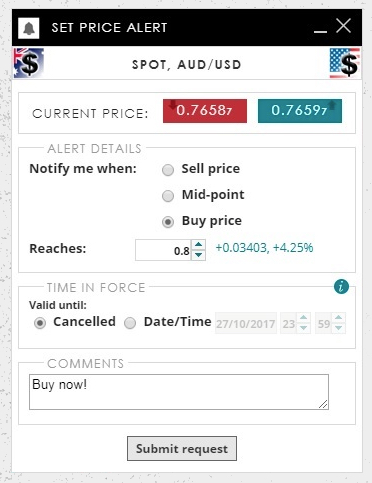

If the price moves against your bet your margin could be wiped out, however, brokers will offer a stop-loss limit, so that your position is closed at a pre-set level if the market moves against you.

Practise

We can see that leverage increases the size of the bet you can make, and thus the amount of profit, but it also increases your risk.

Most spread betting platforms are duty bound to report that between 65% and 75% of retail investors (out of an estimated total of 100,000 UK traders) lost money on spread betting.

Spread Betting Demo Accounts

In practice, it is tricky to track price changes and calls upon your margin, so it is vital to be familiar with the tools offered by the different brokers, how these are presented, their sensitivity, and how they work together.

The demo account should exactly imitate the live spread betting platform.This is crucial not only in order to familiarise yourself with a particular platform but also in helping you select the platform which best suits you.

You are currently in training in the demo, and like anything, practice will lead to perfection.

The ideal spread betting demo accounts are those that offer you the necessary information and tools to help you make quick decisions and execute them in a simple and clear manner.

Charts

Typically, brokers will use a Candlestick chart to display price movements over the period you have selected. Each day’s prices are represented by an icon that looks like a candle, complete with a wick at both ends (suitable for day traders).

The candle part shows the price movement during exchange trading hours, while the wicks track any upward or downward price movement in after-hours trading. This chart is usually the central part of the screen and takes up the largest area.

The key tools are the size, stop, and limit settings that you can use to govern the position you decide to take.

‘Size’ refers to the amount you wish to trade; ‘stop’ is your limit on losses for that trade, and the ‘limit’ setting allows you to determine when to take your profits.

Data, Market Sentiment, Discussion Groups

All of these sources of information play a role in influencing Wall Street and City professionals, so a good spread betting demo account should have a Twitter feed somewhere on your dashboard.

Bloomberg, Reuters, CNBC, AP, and a few mavericks are often featured. You will need to conduct research outside of the demo when you have a specific asset focus. There are many sources of good and not-so-good data, and no one knows what will happen for sure.

Learn

The most useful exercise a potential spread betting investor can undertake is to play in a demo account to test spread betting skills and stamina.

Taking a position is different from reading a headline and thinking, for example, gold might rise or fall over the next week.

You have to risk your virtual money.