Swing trading crypto is popular among investors of all experience levels. Strategies appeal due to the longer timescales compared to day trading and the volatility of digital currencies like Bitcoin. This investing guide covers the basics of how to swing trade cryptos using charts, bots and our top tips. We also list the best brokers and platforms for swing trading cryptocurrencies in 2023.

Swing Trading Crypto Explained

Swing trading is a strategy whereby traders aim to profit from price movements across a short to medium time frame. The idea is to catch any ‘swings’ in the market over days, weeks, or months.

There are two swings that investors generally look out for:

- Swing highs– When the market peaks before pulling back, providing an opportunity for a short trade

- Swing lows– When the market dips and bounces, providing an opportunity for a long trade

Swing trading strategies work well with trending markets, including forex, stocks, and cryptocurrencies. The best crypto coins for swing trading, especially if you’re a beginner, include Bitcoin, Ethereum and Tether.

This is because they have the largest market capitalization and are some of the most actively traded and volatile coins on the market.

Successful crypto swing traders typically use technical analysis to observe short to medium-time frame charts to catch daily and weekly trends. The use of fundamental analysis is also helpful, as economic events can often unroll over days or weeks.

Day Trading Crypto Vs Swing Trading Crypto

The timescale is the main difference between day trading cryptos and swing trading cryptos. Day traders aim to profit from short-term price moves within a day. As a result, they are more active than swing traders and typically do not leave their positions open for longer than one day.

There is also normally a greater emphasis on technical analysis in day trading. In contrast, swing traders tend to focus on fundamentals. In fact, some crypto investors may base their analysis solely on news events and company announcements, for example, when Binance halted Bitcoin withdrawals in June 2022 following a downturn in the market.

Deciding between day trading or swing trading crypto ultimately depends on individual investing styles and goals. While some prefer to carry out all their trades during the day, others are not phased by the prospect of holding positions overnight.

In addition, some investors may thrive in high-pressure environments, while others prefer to take a more passive approach.

Either way, trying out different strategies within a demo account is often a good idea before rolling it into your trading plan.

Swing Trading Crypto Strategies

There is a range of approaches that you can implement when swing trading crypto, though it will take some time to determine which one you prefer most. We’ve provided two popular examples below.

‘Stuck In A Box’

This strategy follows a market range by utilizing support and resistance levels. As a result, the market is sometimes known as being stuck in a box between the two lines above and below.

Once the price breaks below support, the trader waits for a strong price rejection (a candle closed above support) and then goes long on the next candle open. The aim is to essentially exit the trade before the selling pressure comes in at resistance.

To ensure success with this swing trading crypto strategy, you will need a sound understanding of your daily candlestick chart and support and resistance levels. Your stop-loss and take-profit will also be important to ensure that you don’t exceed these levels.

‘Catch The Wave’

As the name suggests, this strategy aims to catch one move in a trending market, whereby you enter after the pullback has ended.

To catch the wave, investors identify a trend concerning, for example, a 50-period moving average.

Suppose the Bitcoin market approaches the moving average. In that case, traders will wait for a bullish price rejection before going long on the next candle.

As a rule of thumb, you should set your stop-loss below the candle low and set the take-profit just before the market swings high.

Swing Trading Crypto Tools

Whether you’re investing in Bitcoin or other altcoins, multiple tools can enhance your swing trading strategy and give you confidence when things get challenging.

Social & Copy Trading

Suppose you’re a beginner curious to see swing trading cryptos in action. In that case, you could always look for a broker offering copy trading. This allows you to share trading ideas and copy other successful deals, making it a useful feature for investors still finding their feet.

You can also search for copy-trading providers who have mastered their swing trading strategy within the platform. eToro, for example, has one of the best social and copy trading platforms for cryptocurrency beginners.

Automation & Signals

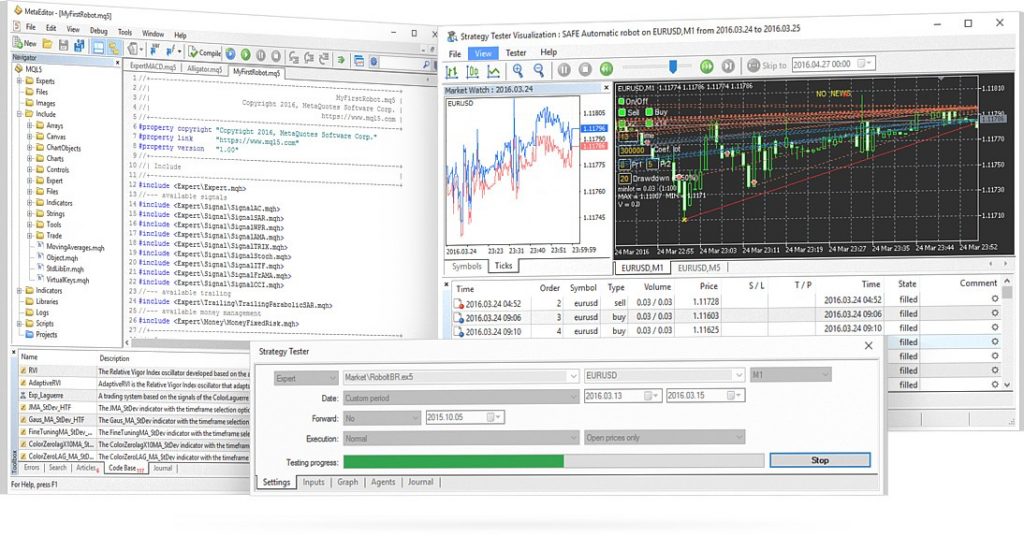

Automated tools such as crypto bots and signals can help you execute more positions faster. Trading robots basically scan the market and automatically buy and sell assets once defined criteria have been met.

There are many types of robots to choose from, which can suit various swing trading strategies.

You can program bots based on volume, orders, time, and price to suit your preferences.

Similarly, some platforms offer a range of signal providers, which can be managed by another trader or fully automated. These can work well with swing trading crypto strategies as they can operate overnight when positions are still open.

Furthermore, because cryptocurrency markets are open 24/7, 365 days a year, robots can conduct deals beyond regular trading hours in any time zone. This applies even on weekends.

Technical Analysis

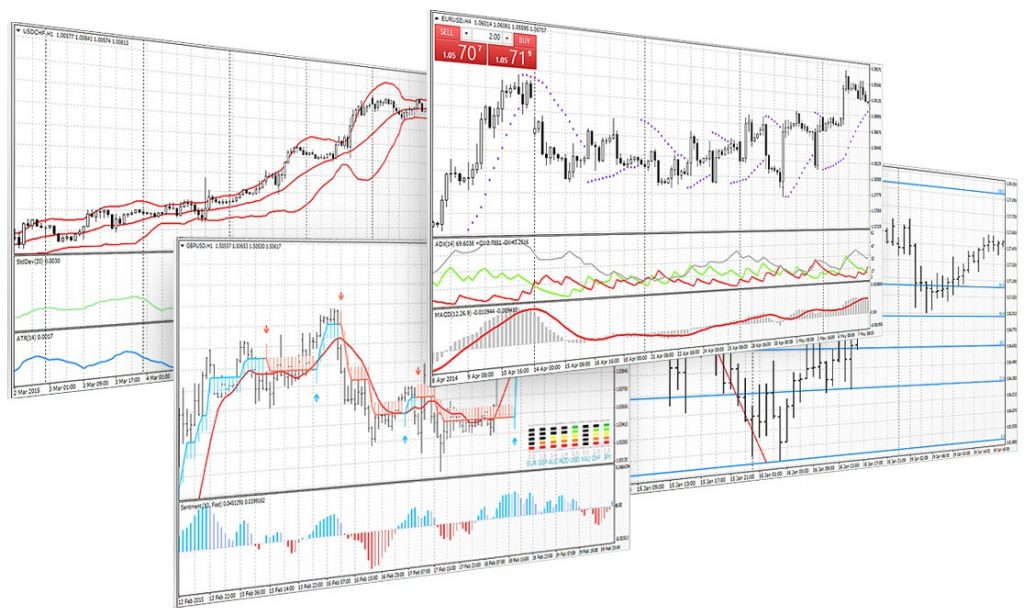

Crypto swing traders typically aim to analyze price action and candlestick chart patterns using support and resistance levels, Relative Strength Index (RSI), Bollinger Bands, Fibonacci Retracement, Volume, Stochastic oscillator, and moving averages.

Technical tools help investors identify bullish and bearish zones within the chart where they can buy and sell. Traders will therefore aim to identify two types of opportunity: trends and breakouts. Trends are long-term market movements characterized by short-term oscillations. Breakouts mark the beginning of a new trend.

Moving averages are one of the most popular tools used in swing trading. These calculate the mean of a crypto asset’s price movement over a period of time.

If a crossover is identified, this can indicate a bullish or bearish momentum. You can also use moving averages as your support and resistance levels.

Risk Tools

A golden rule with any swing trading crypto strategy is not to risk more than you can afford to lose. Once you’re in a trade, setting stop-loss parameters is the best way to mitigate your risk. And since swing trading often requires holding positions overnight, stop losses can be set to protect your funds while you’re not at your computer.

These ensure that any losses do not entirely wipe out your account and that you take profit at a reasonable level. The idea here is to keep your losses small and manageable so that over time, they will be outnumbered by your crypto gains.

Other useful tools include risk management features, profit calculators, and live streams from official news platforms. Some brokers also provide simulators or demo accounts that can be used to practice swing trading strategies on crypto products.

Storage & Safety

Those interested in swing trading cryptocurrency over longer durations may discover that physically acquiring and retaining tokens is the best choice. This strategy is usually only possible without leverage, yet significant fluctuations can still provide gains. Here are a few ways to protect your long-term investments:

Hot Wallets

Hot wallets, such as MetaMask, are digital wallets that remain online. These software wallets enable speedy crypto trading by immediately connecting to exchanges.

However, because the wallet is continually linked to the internet, this easier access creates a greater danger of hackers.

Exodus, Binance Chain Wallet, MyEtherWallet, and Mycelium are some popular hot wallet options.

Cold wallets

Cold wallets are a more secure means of storing cryptocurrency on a hardware device that may be unplugged from the internet, such as a hard disk drive. Because they are entirely offline and can only be attacked when plugged in, they are more protected than hot wallets.

However, because these are physical wallets, you must be mindful not to neglect the drive, or you will lose the crypto you have stored permanently. Popular options include the Ledger Nano X and the Trezor Model T, both are suitable for swing trading crypto.

Security

While investing in digital currencies, keeping your accounts and assets safeguarded is important. Risk management alerts and two-factor authentication (2FA) should be included in software systems to provide easy risk assessment and account login validation.

Regulations & Rules

Because crypto trading is still a fairly new business, laws and policies are not as detailed versus those for forex or stocks and shares trading.

Furthermore, decentralized finance (DeFi) is exactly that: decentralized. This implies that no government has the ability to trace, regulate, or ban cryptocurrency purchases (unless you use regulated derivatives brokers). Having said that, authorities are gradually catching up and imposing laws and limits.

Swing Trading Crypto Tips

Demo Account

A demo account will let you access the crypto markets in real-time and practice trading systems and techniques.

Most brokers provide a free demo account with virtual funds for testing swing trading strategies without risking capital.

Bitcoin Importance

Bitcoin affects the movement of most altcoins. If BTC price surges, the value of other cryptocurrencies may drop. People exit the altcoin market to ride the Bitcoin wave. Conversely, if BTC price falls, the crypto market follows suit.

Fees & Costs

Swing trading involves fewer trades over longer periods, resulting in a smaller and less frequent spread. However, swap fees accumulate for swing traders. Daily interest rate charges apply to overnight positions. Some brokers may charge high commissions or other account-related fees. Check these before signing up. Crypto trading taxes may also apply depending on your jurisdiction.

Education & Analysis

Swing trading crypto is attractive to novices who want to ease themselves into medium to long-term trading. Good educational resources and additional tools, including a crypto training course, a community forum, or an online swing trading book, are essential. Some platforms even run dedicated investing academies. Effective swing trading crypto strategies require technical tools and fundamental analysis. A good understanding of daily candlestick charts and basic indicators is crucial.

Still, it is important to keep on top of fundamental events and financial reports that can cause swings in the market.

For cryptocurrencies, it could be worth following reputable sources such as Binance, Coin Metrics, CoinDesk, or Coin Telegraph.

Identify the Appropriate Token

The cryptocurrency market is growing at a rapid pace. There are now around 10,000 tokens available. Of course, some cryptocurrencies are more unpredictable than others. Focus on digital currencies with a significant market capitalization if you’re new to investing. These frequently traded tokens are available on numerous exchanges and marketplaces. Several of the most interesting cryptocurrencies to start with are Bitcoin (BTC), Tether (USDT), and Ethereum (ETH).

News

Announcements, events, and news are all elements to keep an eye on since they can impact the value of cryptocurrencies. Look out for what popular cryptocurrency traders, celebrities, corporations, and limited companies have to say.

Also watch for tokens to be accepted as legitimate payment by businesses, cities, or nations. Bitcoin was accepted for city fees in Zug – Switzerland, and as a legal tender in El Salvador.

Pros Of Swing Trading Crypto

Swing trading can be an excellent strategy to master and is ultimately not as demanding as other crypto investing strategies.

In addition, there are other benefits:

- Longer term strategy– Compared to other forms of investing, there is no need to spend hours monitoring positions because trades can last days or weeks.

- Lower intensity– Many traders consider swing trading cryptos less stressful than day trading because of the longer timescales and lower frequency of investments.

- Trade part-time– Because of the above, it is possible to trade around your lifestyle and maintain a full-time job.

- Volatility– Due to the nature of swing trading cryptos such as Bitcoin, volatility is key.The cryptocurrency market is highly volatile, which can be lead to substantial profits.

Cons Of Swing Trading Crypto

Unsurprisingly, swing trading cryptocurrencies can also present challenges both for the inexperienced and the professional investor:

- Overnight risk– Swing trading can lead to large losses because you are holding positions for longer than day traders.You also need to take into account any overnight swap fees.

- Price gaps– Some investors may experience price gaps when holding positions overnight or over the weekend.This can happen when developments and reports occur during the after-hours market.

- Market timing– Timing market swings can be tricky, even for the experienced investor, especially in the notoriously volatile cryptocurrency space.

Final Word On Swing Trading Crypto

The allure of swing trading in the crypto market is primarily thanks to its comparatively lower level of time commitment and stress versus other forms of investing.

Day trading may be better suited for those who can handle the stress of making quick decisions and monitoring the market constantly, while swing trading may be better for those who prefer a more relaxed approach and can handle holding positions for longer periods of time.

What Are Some Common Crypto Swing Trading Strategies?

Some common crypto swing trading strategies include trend following, mean reversion, and breakout trading. It’s important to find a strategy that aligns with your personal goals and risk tolerance.

For more information on swing trading cryptocurrency, check out our comprehensive guide.

Day trading is ideal for individuals who have the time to commit to frequent daily trades. In contrast, swing trading crypto works better for those who prefer to hold investments for longer.

How Are Crypto Swing Traders Taxed?

This depends on the jurisdiction but in the UK, for example, the HMRC taxes day trading activities based on different classifications (depending on what you are investing and how you trade them). To find out how you might be taxed, visit the respective governmental agency’s website in your jurisdiction.

What Is The Best Crypto Trading Bot?

For the best technical features, a good option is 3Commas, a web-based crypto trading bot that can implement multiple strategies. If you are looking for unique automated trading bots, Bitsgap is a popular choice for any experience level, offering a 14-day free trial for new users.

What Is The Best Indicator For Swing Trading Cryptos?

This depends on the trader, but among the best indicators for swing trading cryptos is moving averages (MA), which calculates the mean of a market’s price movements over a certain period.

Can I Swing Trade Crypto on Robinhood, and Is It Safe?

Yes, you can swing trade cryptocurrencies on Robinhood. However, the brokerage has come under fire for mistreating and misleading retail traders and should be avoided. It should also be noted that Robinhood is not yet available to clients outside of the United States.

Is Swing Trading Crypto Halal or Haram?

Many Islamic scholars believe that cryptocurrency trading is permissible. Therefore, Muslims can buy, keep, and trade Bitcoins under Sharia law. This applies to Muslims worldwide, not only in nations and places like Dubai, Kuwait, and Qatar. However, consult a local religious leader for official guidance.

Are There Any Swing Trading Crypto Platforms with No Fees?

It is doubtful that you will find a swing trading crypto exchange with zero fees.