Uniswap is a crypto token with the ticker symbol UNI. In this article, we’ve explained what the coin is, how it relates to the Uniswap exchange, and the risks and potential rewards in trading the token. This review aims to give you all the information you need to join the UNI community, including strategies and a how-to guide for getting started trading Uniswap.

What Is Uniswap (UNI)?

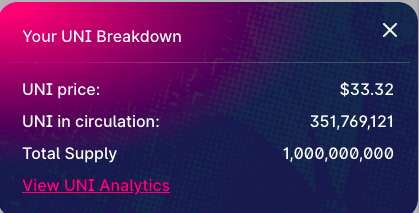

Uniswap (UNI) is a top ten cryptocurrency with a market cap of nearly $20bn. It is an Ethereum blockchain token that powers the Uniswap Exchange, a decentralised liquidity provider (or a DEX as they are sometimes known). The Uniswap token is a governance token. This means it allows holders to vote on development work and decisions such as new fee structures.

Unlike cryptos such as Bitcoin and Dogecoin, Uniswap does not use an order book to match buyers and sellers or determine the token price. Instead, holders of Uniswap create market liquidity by adding their coins to a liquidity pool (LP).

Whenever liquidity is added, new liquidity tokens are minted that represent the value of the coin deposited.

This allows Uniswap to be bought and sold by other traders while the owner holds onto the liquidity token. When any transaction occurs with the lent out Uniswap, the liquidity pool receives 0.3% of the transaction in return for lending their holdings. This is distributed proportionately among the pool. This is a form of decentralised finance (or DeFi), allowing users to create their own market liquidity rather than relying on banking institutions.

Uniswap liquidity providing is similar to staking and mining in that holders lend their coins to pools in exchange for interest. However, there are fundamental differences in the aim. Mining and staking aim to validate the network whereas liquidity pools replace the requirement for an order book. Staking is fairly risk free, but LPs have the potential for impermanent loss.

History Of Uniswap

Uniswap was created in September 2020 to prevent exchange users from using rival DEXs such as SushiSwap. At its initial coin offering (ICO), Uniswap handed out 400 governance tokens to everyone who had ever used the platform. At the time, these tokens were worth around $1000, the current value is nearly $15,000. The price more than tripled in the first quarter of 2021, the height of the latest cryptocurrency bull run.

Uniswap’s founder, Hayden Adams started the company in 2018, having received the backing of various venture capital funds.

In April 2020, over $25m of cryptocurrency was stolen during a hack of the Uniswap exchange and Lendf.me (a DeFi lending platform).

Uniswap, unlike Lendf.me, experienced only minor effects, with the website being temporarily taken down while developers addressed the vulnerability. Uniswap is generally safe from hackers due to its decentralized nature. While centralized exchanges like Coinbase manage crypto-wallets for owners, Uniswap operates on a self-custody system where individuals hold their own crypto, making it more difficult to hack on a large scale.

The Uniswap white paper for 2020 outlined plans for the core contracts of Uniswap version 2 (v2), including a fortified price oracle, flash swaps, and the introduction of a protocol fee. In 2021, the version 3 (v3) whitepaper was released, introducing concentrated liquidity and multiple fee tiers, allowing LPs to be appropriately compensated for risk.

There are numerous reasons to consider investing in Uniswap. Ultimately, investors should decide if they believe the technology behind Uniswap will be the future. Uniswap is a good buy for liquidity providers, as it is based on the emerging concept of DeFi (decentralized finance).

This concept aims to revolutionize the finance industry, taking the power of credit from institutional banks and putting it into the hands of anyone with capital.

By contributing to a liquidity pool, UNI holders lend their share to others and receive interest in return.

This is likely to be a better return on investment than banks are offering.

- DEX growth – In March 2021, the daily trading volume of Uniswap reached $7 billion, having increased 450% in 24 hours.

- This was partly due to a brand new ERC-20 coin called Delta, which aims to reduce volatility issues in options trading.

- To buy Delta you have to use Uniswap, and so the DEX saw a huge jump in trading volume.

- Growth in the exchange means that the price of UNI is likely to hold its value, or rise.

- Future coin distribution – When UNI was created in 2020, users of the DEX received free UNI tokens in what is known as an airdrop.

- An airdrop is when crypto coins are distributed for free as a way of gaining attention for the token.

- Since this initial distribution, users have been speculating on when the next airdrop will be.

- Holders of UNI or ETH on the exchange could profit hugely.

- However, no further airdrops have been confirmed yet.

Risks Of Trading Uniswap

Investors should be aware that there are risks involved with trading on this relatively new asset.

- Extremely high gas fees – Uniswap’s liquidity pool system means that gas fees increase as Ethereum usage rises.

Gas fees are paid by users to compensate for the energy usage required to complete a transaction on the Ether network. Currently, investors are finding that the price of gas fees, which can reach into the hundreds of dollars, are just too high. If this continues, it will impact the long term viability of the DeFi system Uniswap is built on, and therefore the value of the token itself.

- Risky tokens on the DEX – Anyone can create an ERC20 cryptocurrency on the Uniswap exchange and therefore new token listings, such as Hoge, Unistake and Ecomi, are added regularly. But, it’s vital that investors research an upcoming token thoroughly before investing. There has been news of fake versions of existing tokens popping up on Uniswap. Plus there’s no guarantee that a cryptocurrency will increase in value. If trust in the system fails, this could have an impact on the value of UNI.

- Uncertainty of price predictions – The Uniswap token saw growth of over 250% in the first quarter of 2021, causing optimism within the UNI community. Some coin commentators forecast that $100 is achievable by 2025. But investors should be cautious. Past performance is not an indication of future gain and there is no guarantee of ROI. Any price prediction should be fully researched and the risks taken into account.

Uniswap Trading Strategies

Arbitrage

Arbitrage is one of the best strategies to use with Uniswap because it utilises the automated market maker (AMM) system that bases coin prices on demand and supply within the pool.

AMM means that there is often a difference in a coin price on Uniswap vs other centralized exchanges, such as Coinbase or Binance. Arbitrage involves taking advantage of this price discrepancy. For example, if Kraken is offering Bitcoin at $50,000 and Coinbase at $50,500, you can buy BTC on Kraken and sell on Coinbase, pocketing the difference. Arbitrage is a vital part of the AMM system on Uniswap, as traders will continue to buy until the price is in line with the market.

Flash Swaps

Whilst arbitrage is a strategy reserved for those with capital in their back pocket (not everyone has 1 BTC lying around), flash swaps allow traders to take advantage of the risk-free strategy without the capital. Traders can withdraw up to the full amount of their ERC-20 holdings in any token to arbitrage providing that after the transaction, they pay for the withdrawn ERC20 tokens with the corresponding pair tokens or return the withdrawn ERC20 tokens along with a small fee. Traders can optimistically withdraw their coins using a flash swap, purchase the coin on the other end of the pair through another exchange, and then pay Uniswap back the original amount that was borrowed, keeping what’s leftover for themselves. This strategy is fairly risk-free, profitable, and actively encouraged by Uniswap to keep the price in line with the market.

How To Start Trading Uniswap

Uniswap is available to trade with a number of brokers, including Gemini and Coinbase.

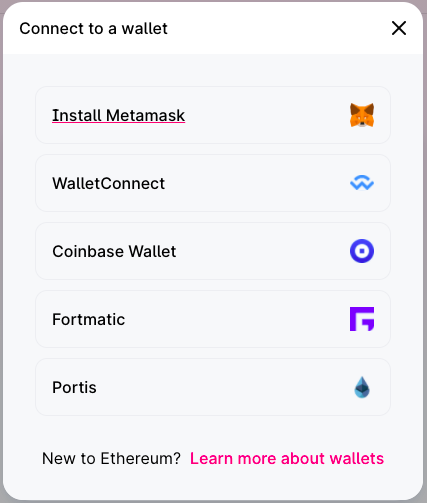

You can also swap tokens for UNI directly on the Uniswap exchange. To do this, you’ll firstly need to sign up to an ERC-20 compatible wallet service, such as WalletConnect, MetaMask, or Portis, and make sure you load it with ETH. Then, create a Uniswap account and login. Since Uniswap is decentralized, there are no KYC (know your customer) identity checks.

Login to your wallet and allow it to connect to Uniswap. You’ll then be able to swap ‘from’ one token ‘to’ another. Uniswap will provide you with a non-negotiable quote. Confirm the transaction and wait for it to be added to the blockchain. You can track its progress using Etherscan. The Uniswap exchange app is also available on mobile on both iPhone and Android.

If you’ve been waiting for confirmation of the transaction for a while, you might need to adjust your allowed slippage in the settings to account for the fee taken in the swap. Alternatively, you may not have enough gas for the fee. Top up your wallet with Ether and try again. If your transaction keeps failing or something else is not working, help and support for your query is available through the Uniswap community on Reddit, Discord, and Twitter. Users can also keep up-to-date with announcements via the Uniswap blog.

Final Word On Uniswap

Uniswap is one of the biggest cryptocurrencies by market cap and has seen a huge jump in value since its creation.

As a governance token for the Uniswap exchange, its price is determined by the success of the DEX technology it is built on. Investors should consider whether they believe in the concept of decentralised finance before investing. However, all indications so far suggest that rerouting power from institutional banks into the hands of the people could be the future of finance.

FAQ

What Is Uniswap (UNI)?

Uniswap (UNI) is an ERC-20 token that powers the Uniswap exchange. It is a governance token, which allows holders to vote on major decisions regarding the future of the exchange.

How Do I Use Uniswap (UNI) To Vote?

To vote on Uniswap exchange governance, visit the ‘Vote’ page of the Uniswap website. Here you’ll see a list of proposals that you can vote on. Create an account on gov.uniswap.org to participate in discussions and debates around the votes. Any holder can cast a vote, but you’ll need a minimum of 1% supply to submit a proposal.

How Do I Buy Uniswap?

Uniswap is available to purchase from some of the largest cryptocurrency exchanges, including Binance and Gemini.