Volatility trading aims to exploit how much price moves within a market and is often capitalised on using the Volatility 75 Index. In this guide, we look at high and low volatility strategies, robots and how to trade volatility using options. We’ll also cover some key pros and cons to help you decide how to approach volatility trading.

All Brokers with Volatility Index

What Is Volatility Trading?

Volatility is the measure of how the price of a financial product is dispersed over time and is a key factor of profit potential. The forex market often experiences high volatility, meaning prices are changing rapidly in a short period of time.

When volatility is traded, you’re predicting the stability of an instrument’s value, so rather than trading on quotes rising and falling, you predict how much the price will move. By understanding volatility trading in this way, investors can harness profit potential by tracking price changes and implementing technical indicators and strategies.

Volatility is measured by both short-term and long-term traders who focus on daily and weekly price movements.

There are various ways to trade volatility. One way is to take advantage of volatile markets, such as forex, shares, commodities, options, futures, ETF products, and crypto-assets.

The most volatile products in these categories include the Dow Jones, Dax, NASDAQ 100, gold, oil, GBP/USD, and EUR/USD. Options contracts are also popular for volatility trading as they allow traders to take a position on any market direction. We will cover how to trade volatility with options later in this article.

Another method involves taking advantage of indices that track volatility. The most popular example is the Volatility 75 Index (VIX), although some also use the EU Volatility Index (VSTOXX) or the NASDAQ-100 Volatility Index.

Volatility Trading Strategies

Here are some examples of volatility systems using breakouts and options trading. These are some of the most popular ways you can trade volatility, but ultimately, it’s up to you to decide what works best.

Volatility Breakout Strategy

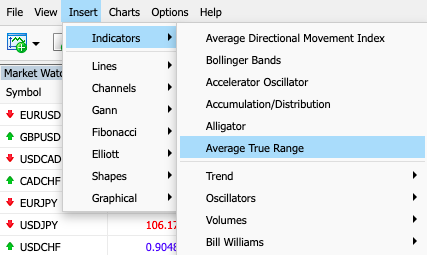

A breakout occurs when an asset’s price breaks above or below resistance and support levels on a chart, indicating a new trend direction. Traders typically use the average true range (ATR) indicator to measure breakouts and track how much the asset moves within each candlestick.

For example, if the ATR surges, this could indicate a strong price movement ahead that will signal a breakout. A one-hour chart time frame could be useful for this strategy, with a 20-period simple moving average added to your ATR.

When the ATR crosses above your SMA, and when the price is breaking above or below recent swing highs or lows, there is a potentially good trade.

You can also set your stop-loss below the recent swing low if you’re going long, or above the recent swing high if you’re going short.

Leveraged trading with Bitcoin volatility can be done using similar strategies.Since cryptocurrencies can fluctuate rapidly between volatile and quiet periods, a breakout strategy can be particularly useful for keeping out of trades when volatility and profit potential is low.

Options Volatility Trading Strategy

Volatility trading in options is another popular strategy for traders.Options are security derivatives, where contracts give you the right, but not the obligation, to buy or sell an asset at a predetermined price and expiry date.

There are several leveraged strategies you can use for options volatility trading, including the straddle and strangle methods, as explained below.Note that dividends on a stock can affect how options are priced.

Straddle Vs Strangle

The straddle method involves buying an equal number of call and put options with the same expiration date and a common strike price.Straddles are particularly useful when it is unclear which direction price might move.As such, the trader is protected regardless of the outcome.

The strangle method also involves buying an equal number of call and put options with the same expiration date.However, this time there are two different strike prices.Strangles can be useful in cases where the trader expects the price to move one way or the other but wants to be protected in any case.

Some traders also opt for a delta hedging strategy, which aims to reduce (or hedge) the risk to funds associated with the price movement of the underlying asset.

As such, the investor will aim to reach a directionally neutral state by offsetting long and short positions in the underlying asset.

Software & Automation

Quantitative volatility trading uses computer algorithms and automated software to track and exploit changes in volatility. This allows traders to implement strategies on shorter timeframes, meaning trades can be executed faster than a human. Volatility trading with automation and machine learning also means there’s no need to stay at your desk constantly to monitor trades.

Some top platforms offer such software tools and facilitate quantitative high volatility trading with a range of bots and signals. These are often unique to certain programming languages, making it possible to execute volatility trading analysis with Python, MQL4 or C#, for example.

If you’re looking for a broker that can facilitate trading strategies and offer a volatility index, check out reviews of our top brokers, including Binary.com, IG or Robinhood. Most brokers offer the popular MetaTrader platforms along with a range of other features including courses, newsletters, blogs, e-books, forums and investing ideas.

VIX Volatility

The Volatility 75 Index (VIX) of the Chicago Board Options Exchange (CBOE) is often referred to as the ‘fear index’.

The VIX is based on the calculation of the implied volatility (IV) of a basket of trading options on the S&P 500 index over the next 12 months.

A high reading of the VIX suggests higher volatility in the S&P 500 (signalling rising fear among market participants) whilst a lower reading signals less implied volatility over a 12-month period. The index therefore usually rises in line with global instability and falls again when the market steadies.

Traders can ascertain the likely direction of the VIX market by observing the prices of safe-haven assets including the USD and gold (which will rise in line with growing demand during uncertainty).

Trading volatility can also involve tracking the yield curve or term structure of interest rates. Trading when there’s a drop in long-term yields combined with a surge in short-term yields usually means that there is growing fear in the market. Note that this is usually prevalent in the bond market.

It’s also worth noting that there is no ideal time to trade the Volatility 75 index, though you may need to check your broker’s trading hours.

Pros Of Trading With Volatility

There are several good reasons to trade volatility, as long as proper research and practice have been carried out:

- Short-term and long-term opportunities – Volatility trading works well with both short-term and long-term strategies, including scalping and swing trading.

- Volatility risk premium – When trading options, investors can benefit from what’s known as a risk premium, which is the compensation that investors earn for protecting themselves against market losses.

There are numerous research papers online that explain the behavioural bias towards risk and loss.

- Circuit breaker halts – If a stock suddenly moves up or down too quickly within a 5 minute period, it can cause an automatic circuit breaker halt that will pause trading temporarily. This can happen in anticipation of a major news announcement and can be a huge opportunity to profit if the asset reopens higher.

- Benefits of options – Options are a great way to diversify your portfolio. They also have low capital requirements and allow you to trade on leverage.

- Profit potential – Volatility is a key metric of profit potential and can come with big rewards if risk management tools have been applied appropriately.

Risks Of Trading With Volatility

Volatility can be an excellent market to break into, but at what cost to the trader? You should be aware of the following risks before you start trading:

- Requires patience and resilience – Trading volatility can be stressful and anxiety-inducing for beginners or unprepared traders. It’s worth carrying out some virtual trades within a demo platform before committing.

- Limitations of options – The options market offers lower liquidity and trading volume and therefore higher spreads, compared to other markets.

- Circuit breaker halts – Some trading pauses have been known to go on for hours or sometimes even days.

If you’re stuck in a halt for a longer period of time, this can cause anxiety, especially if the price reopens lower. Note that different assets may have different circuit breaker rules.

- Risk to funds – As with all trading, high volatility comes with greater risk because the market can move erratically and unpredictably.

- Leverage risk – Trading on margin can boost your gains but it can also amplify losses if not used correctly. Traders should always employ stop-loss and exit strategies.

Low Volatility Trading

Some traders prefer to invest in quieter markets. If this appeals more to you, then low volatility trading could be the best option. Low volatility trading enables investors to act as market makers by contributing to long and short positions to help create liquidity.

You can make money this way by buying lower and selling higher throughout the trading day. Due to its more conservative approach, a low volatility strategy typically generates significantly smaller wins than high volatility trading.

Nonetheless, it’s important to bear a few things in mind when applying low volatility strategies. Firstly, focus on the small wins and try not to concern yourself with high trades, as this could be a huge distraction. Due to the nature and pace of low volatility trading, make sure that you also keep an eye out for breakouts, which can occur when new economic data has been released.

If this happens, it’s best to trade at either the end of the day or on high time frames.

In addition, pay close attention to current affairs and market news.

These will help you to identify forex signals that can impact your strategy.

Final Word On Volatility Trading

Whether you’re a dummie still dipping your toes into trading, or an expert who has already come leaps and bounds in their investing journey, volatility trading could be a good strategy to add to your portfolio.

It goes without saying, though, that you should always consider the risks before starting.

Furthermore, the strategies provided in this article are by no means the right models for everyone, or guarantee continued success.

With the right knowledge and mindset, you should be able to determine the best volatility trading plan for you.

Of course, it’s always good to practice backtesting your strategy within a risk-free demo account first.

FAQ

What Is Volatility Trading?

The definition of volatility is the measure of the dispersion of prices over time.

In trading, volatility refers to the amount of risk involved with the fluctuations in currency exchange rates.

Therefore, rather than trading on whether prices go up or down, traders predict how much the prices will move.

Does Volatility Trading Work?

Volatility trading works with the right skills, experience and knowledge of the markets. However, trading high volatility also comes with greater risk and therefore may not suit certain types of trader. Always use risk management tools to protect your funds.

What Is A Volatility Trading Pause?

A trading halt occurs when the market pauses temporarily due to sudden spikes in price movement. This is often due to the market anticipating a major news announcement or economic event that affects a particular asset.

What Is VIX?

The Volatility 75 Index (VIX) is the key indicator of stock market fluctuations and measures the market’s expectation, or fear, of the volatility of the S&P 500 equity index.

The Volatility 75 Index is available to trade on popular platforms such as MT4 and MT5. You can also observe how the market behaves on a live Volatility 75 chart within TradingView.

How Can I Trade the Volatility 75 Index?

You can analyse VIX 75 manually within trading software, or via automated tools such as a trading robot. There are various strategies you can use, as discussed in this article. Trading volatility can also be executed using the 50-30-20 strategy, a popular method cited by some experts. You can download a PDF research document online.

Further Reading