Rodeler Limited, the company behind 24option.com, has been fined €15k for failing to comply with an investigation by the Dutch financial supervisory authority. The regulator decided not to impose the maximum penalty of €2 million, citing the company’s current financial condition. Read on for the details.

More Bad News For 24Option

The administrative fine was levelled against Rodeler Limited and its local entity, Rodeler (NL) BV, for violating the country’s General Administrative Law Act. The Netherlands Authority for the Financial Markets (AFM) began investigating the now debunked CFD trading platform for engaging in unfair commercial practices. The regulator also sought to determine whether the brand needed an AFM license to offer retail trading services.

During the investigation, the AFM requested recordings of telephone conversations between Rodeler and its clients. However, the firm failed to provide the requested recordings, breaching its regulatory obligations.

The fine was imposed on the Cypriot parent organisation as the AFM believed the management team at Rodeler Limited played a key role in the local Dutch violations.

This isn’t the first regulatory issue Rodeler has encountered. The company voluntarily withdrew its Cyprus Investment Firm license earlier this year following a series of issues and complaints.

Rodeler has also received multiple fines from the Cypriot regulator for various compliance breaches.

Alternatives To 24Option

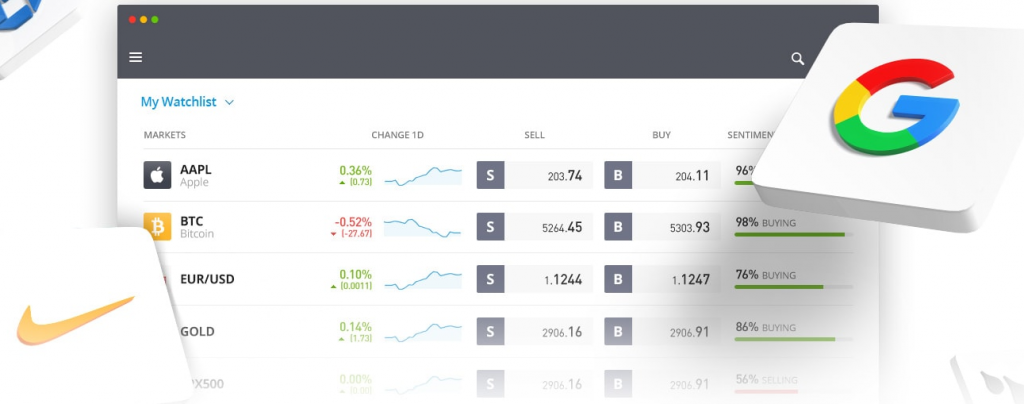

As 24Option continues to face regulatory hurdles and has closed its trading doors to retail clients, investors are understandably seeking alternative providers. Fortunately, several reputable brokers offer a similar selection of trading assets and tools with competitive fees:

- Plus500 – The multi-regulated trading firm offers CFDs on a range of popular financial markets, including stocks, indices, commodities, and cryptocurrencies. Commission-free trading alongside tight spreads has made Plus500 a top-rated global broker.

- AvaTrade – The online brokerage is regulated in Australia, the UK, and Europe, among others. Leveraged CFD trading is available on the popular MetaTrader 4 platform with social trading services also offered to beginners.

- eToro – The multi-asset trading firm provides access to hundreds of stocks, as well as crypto assets and forex. Trading fees are low, and eToro offers a user-friendly mobile app for investing on the go.

With 24Option no longer a viable option for aspiring traders, the platforms above are a good place to start for beginners and seasoned investors alike.