Dividend income from stocks offers an attractive way to earn passive revenue while building a diverse portfolio. But what is dividend income and how can you get started dividend investing? In this guide, we look at the types of stocks with the highest dividend yields, key metrics and definitions to aid investment decisions, coverage ratios and more. We also consider the taxability of dividend income, looking at whether returns are taxable and common rates of tax in 2023.

Use our list of brokers that offer the best dividend stocks to start investing today.

What Is Dividend Income?

Dividend income is the distribution of a domestic or international company’s or corporation’s earnings to its shareholders in the form of cash dividends. Dividends are typically paid out quarterly, but some companies estimate and pay them out more or less frequently.

Dividend payments are usually made to shareholders who own the stock on the dividend record date, which is usually two days before the dividend payment date. The dividend yield is the percentage of a company’s share price that is paid out in dividends. For example, if a company has a dividend yield of 3 percent, that means it pays out $3 in dividends for every $100 of stock price.

The dividend coverage ratio is a measure of a company’s ability to pay its dividend.

It is calculated by dividing the company’s cash flow or cash flow proxy such as its earnings before interest, taxes, depreciation, and amortization (EBITDA) by its dividend payments. A coverage ratio of 1.5 or higher is considered healthy.

Dividend Investing

Dividend investing is the generalized process of buying shares in dividend-paying companies to receive dynamic dividend income. Dividend investing can be a great way to earn passive income and build an enhanced, diversified investment portfolio.

When choosing dividend stocks and funds, it is important to consider a company’s dividend history, as well as its current dividend yield and its ability to cover that payment with the earnings of the business. A company’s dividend history can give you insight into its financial stability and dividend-paying ability. A company’s current dividend yield is a good indicator of its current dividend payments.

Pros Of Investing In Dividend Stocks

Dividend stocks offer several benefits:

- A source of regular income – Dividend stocks can provide you with a source of regular income that can help you meet your financial goals. For example, once you’re making $3,000 per month in income from your investments that can about cover your monthly living expenses if you live a fairly modest lifestyle.

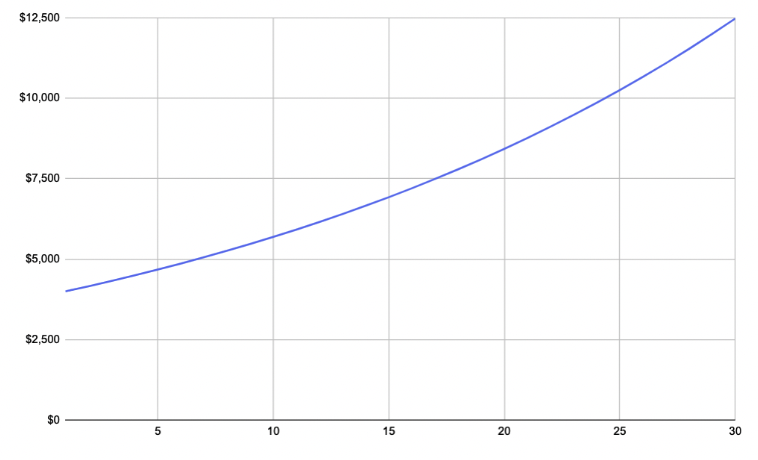

- Potential for capital appreciation – While dividend payments are typically rather small, over time they can add up.

- Additionally, as the company’s stock price increases, so does the value of your dividend payments.

- A hedge against inflation – Dividend payments tend to increase over time, which can help offset the effects of inflation. A well-diversified dividend portfolio can also approximate total spending in an economy, which should roughly net out to nominal growth, which is real growth plus inflation.

- A way to diversify your portfolio – Dividend shares can help you diversify your portfolio and reduce your overall risk.

Receiving Dividends

If you own shares in a company that pays dividends, you will receive dividend payments based on the number of shares you own.

For example, if you own 100 shares of ABC Company and ABC Company pays a dividend of $1 per share, you will receive $100 in dividend income.

Dividend Calendars Explained

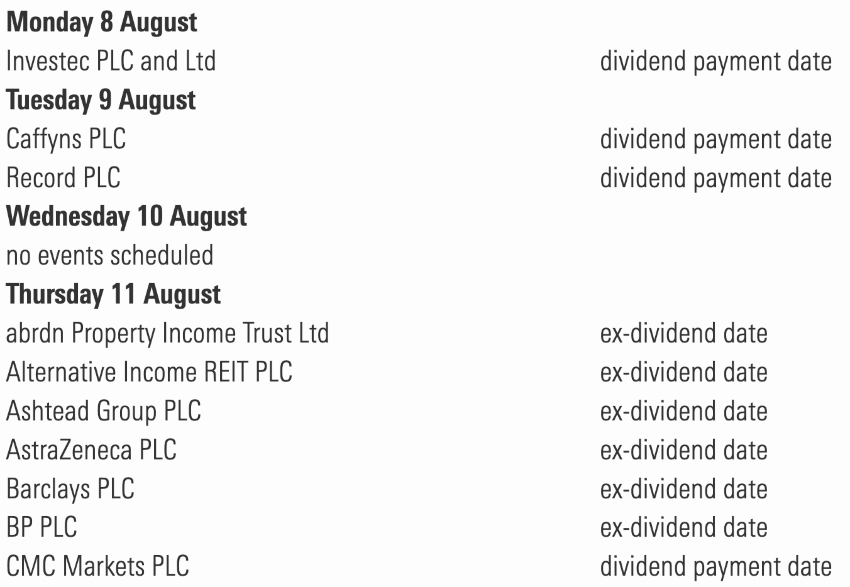

A dividend calendar is a schedule of when companies are expected to announce and pay out their dividend payments. This information is important for dividend investors, as it allows them to plan for when they will receive upcoming dividend income.

The dividend calendar can be found on most financial websites, including Yahoo Finance and Morningstar.

Dividend Timings

Dividends are most commonly paid quarter, or four times per year.

However, there are some stocks that pay monthly dividend income.

Some investors also choose to stagger their dividend investments such that they receive roughly equal allotments of dividend income each month. This is called dividend laddering. That way they can match up better with their monthly payments, since most bills are due on a monthly timeframe despite dividend income coming in quarterly. (Bonds often pay only semi-annually, or every six months.)

Some companies issue dividends January, April, July, and October. Others do February, May, August, and November. Others do March, June, September, and December.

The first group is often the most common since they often pay out after closing a quarter. But it varies. By combining the three groups, you can spreads thing out more equally. Nonetheless, what’s most important is the quality of the investment, not when it pays out.

Important Dividend Dates

Ex-Dividend Date

The ex-dividend date is the date on which a dividend-paying equity goes “ex-dividend”. This means that the stock no longer comes with the right to receive the dividend payment. If you want to receive the dividend, you must own the stock before the ex-dividend date.

The ex-dividend date is commonly two business days or so before the dividend is paid. For example, if a company declared a dividend payable on December 15, the ex-dividend date might be December 11. This is because the dividend will be paid to shareholders of record as of December 12.

If you purchase a stock on December 11th, you won’t receive the dividend payment. Instead, the seller of the stock will receive it. However, if you buy the stock on December 10th, you will be eligible to receive the dividend payment.

Record Date

The record date is the date on which a dividend-paying company’s shares must be held in order to receive the dividend payment. For instance, if a company declares a dividend payable on December 15th, then the record date will be December 12th. This is because the dividend payment will be made to shareholders of record as of December 12th.

If you own the stocks on December 12th, then you will receive the dividend payment. Conversely, if you sell the stocks on December 12th, you will not be eligible to receive the dividend payment.

Dividend Payment Date

The dividend payment date is the date on which the dividend is actually paid to shareholders. For example, if a company declares a dividend payable on December 15th, then the dividend payment date will be December 15th. This is the date on which the dividend payment will be made to shareholders of record as of December 12th. If you own the stock on December 12th, then you can expect to receive the dividend payment on December 15th.

Benefits of Dividend Income

Dividend income can be a reliable source of passive income. However, unlike interest from a savings account or bonds, dividend payments are not guaranteed. Nevertheless, historically, dividend payments have averaged around 3-4% of the stock market’s overall return.

In addition, dividend income can help to diversify your investment portfolio.

Yield (left)

As you can see from the table, the higher the yield, the less you need to invest to earn the same amount of monthly dividend income.However, it is important to note that higher yields often come with higher risk and may not be sustainable in the long term.

Conclusion

Dividend income can be a valuable source of income for investors, but it is important to understand the risks and drawbacks associated with it.To mitigate these risks, diversification and a long-term mindset are key.

Common Types Of Dividend Stocks

REITs

A REIT, or real estate investment trust, is a type of investment that allows you to invest in the ownership and operation of real estate properties. REITs can be a great way to earn dividend income, as many REITs are required by law to pay out at least 90 percent of their earnings to shareholders in the form of dividends.

There are two main types of REITs:

- Equity REITs – Equity REITs own and operate income-producing real estate properties, such as office buildings, shopping centers, and apartments.

- Mortgage REITs – Mortgage REITs provide financing for income-producing real estate properties through mortgages and other loans.

BDCs

A business development company, or BDC, is a type of investment company that invests in small and mid-sized businesses. BDCs are required by law to pay out at least 90 percent of their earnings to shareholders in the form of dividends.

BDCs can be a great way to earn dividend income from setups similar to stocks, and can typically have high dividend yields. However, BDCs are also high-risk investments, as they are subject to the same risks as the businesses they invest in. As a result, they tend to have higher volatility as they are largely subprime lenders.

MLPs

A master limited partnership, or MLP, is a type of partnership that is publicly traded on a stock exchange.

MLPs are commonly utilized by energy and natural resources companies as a means of raising capital. They are legally obligated to distribute at least 90 percent of their earnings to shareholders as dividends.

While MLPs can be an excellent source of dividend income, they are also high-risk investments.

Common Stock

Many conventional stocks pay dividends. When you purchase common stock, you become a part-owner of the company with voting rights to elect the board of directors.

Although dividend payments on common stock are not guaranteed, many companies pay dividends to their shareholders on a quarterly basis.

Preferred Stock

Preferred stock is a type of stock that grants shareholders priority over common stockholders in the event of a liquidation. Preferred stockholders also typically receive dividend payments before common stockholders. Dividends on preferred stock are typically paid quarterly, but the frequency may vary depending on the company.

ETFs

Many exchange-traded funds (ETFs), including popular indices like SPY, offer dividends. There are also dividend-focused mutual funds and ETFs, although they tend to have higher fees.

Dividend Finance

Dividend finance is the practice of using dividend income to help fund your investment portfolio.

Dividend finance can be a great way to build a diversified investment portfolio without having to use all of your own money.

When dividend investing, it is important to consider dividend financing options. One option is to use dividend reinvestment plans, or DRIPs. DRIPs allow you to reinvest your dividend payments back into the company’s stock, allowing you to buy additional shares over time.

Another option for dividend financing is to use a dividend exchange-traded fund, or ETF. A dividend ETF allows you to invest in a basket of dividend-paying stocks, providing you with exposure to a variety of companies.

Coverage Ratio Explained

The coverage ratio is one of the most important financial metrics when it comes to dividend investing. This pertains to the dividend payout ratio, which is the percentage of a company’s earnings that is paid out in dividends.

Payout ratio = Dividends per share ÷ Earnings per share (EPS)

The coverage ratio is a similar metric, but it looks at the percentage of a company’s cash flow that is paid out in dividends.

The cash flow coverage ratio is a more accurate metric to use when dividend investing because it takes into account a company’s capital expenditures.

A company might have high earnings but low cash flow due to its capex or working capital, which would make its dividend less sustainable. Ideally, you want to look for companies with dividend coverage ratios above 1.5.

This means that the company has enough cash flow to cover its dividend payments and then some.

If a company is paying a dividend and has cash left to spare, then shareholders may enjoy some capital appreciation in the stock over the long run as well, in contrast to a company that is paying out everything and may likely have a flat stock over time.

If a company’s earnings are close to its dividend payout, it could be considered a risk.If earnings (or more accurately, operational or overall cash flow) don’t cover the dividend, a company will need to tap into its cash reserves, issue debt, issue equity, or cut the dividend.

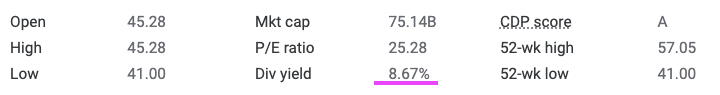

Don’t Overemphasize Dividend Yield

There is a tendency to look at the dividend yield first, but this is not the most important factor.The dividend yield is simply the dividend per share divided by the stock price.

For example, if a company has a dividend of $1 per share and the stock price is $100, then the dividend yield would be 1 percent.If the stock price goes to $200, then the dividend yield would be 0.5 percent.

The dividend yield can go up or down depending on the stock price, but this doesn’t necessarily mean that the dividend itself is going up or down or that the stock is better or worse.A high dividend yield could be a sign that the market is bearish on the stock and expects the dividend to be cut in the future.Therefore, you should always look at the dividend coverage ratio before making any investment decisions.

So you don’t want to just focus on cheap stocks with a high dividend.

And also make sure that the data you’re getting is accurate. Dividend payouts change all the time, so information on some websites (or the data displayed directly in Google search results) can be outdated. Always cross-check any information you see.

Dividend Payables

Brokers will often add a dividend payable to a customer’s account to keep an account balance steady. The dividend payable is the dividend per share multiplied by the number of shares owned. For example, if a company has a dividend of $1 per share and you own 100 shares, then the dividend payable would be $100. This dividend will be paid to you on the dividend payment date.

It is important to note that the dividend payable is not the same as cash flow. Dividends are paid out of a company’s earnings, not its cash flow. Therefore, a company can have strong cash flow but low earnings, which would make its dividend less sustainable.

Average Return On Dividend Stocks

The average dividend stock yielded 2.9 percent per the most recent data points.

What If I’m Already Retired?

If you’re already retired, you won’t have the benefit of having decades to compound returns like someone who is younger.

In this case, for retired investors looking to live off their dividends and investments, they may want to increase their portfolio’s yield.

At the same time, don’t overemphasize yield. Some stocks and investments that have high dividend yields have seen their fortunes recently turn and may be likely to cut their dividends. Or the principal may be likely to erode.

For other types of investments outside stocks and bonds, we have an article on unique investments located here.

Dividend Income Tax

Taxation of dividend income varies between jurisdictions. However, dividends are normally subject to income tax. In the UK, for example, that means investors can make use of the Personal Allowance (£12,750 in 2022/2023), plus the £2,000 individual dividend allowance. After this, profits are charged in line with the relevant income tax bracket.

Annual dividend income tax calculators can also be found online for free. These estimators can help draft tax statements, taking into account your taxation allowance. It is also worth considering that taxation rules vary in different countries, from the UK and Canada to Australia, Hong Kong, Malaysia and India.

Alternatively, investors can consult a local accountant for guidance. Accountants can answer questions such as ‘do I need to pay and report tax on dividend income?’ and ‘how much dividend income is tax free?’.

They can also work through accounting and journal entry requirements, deductions and relevant exemption limits, advance tax, rates for foreign dividend income (non resident), and more.

Note, corporation tax and its impact on cash flow statements and balance sheets may be treated differently. Also keep an eye on new tax rules relating to dividend income.

Final Thoughts On Dividend Income

Dividend income can be a great way to earn passive income and build a diversified investment portfolio. When choosing dividend stocks, it is important to consider a company’s dividend history and its current dividend yield. REITs, BDCs, and MLPs can be great sources of dividend income, but they are also high-risk investments. Common stock and preferred stock are two other types of dividend-paying investments.

Use our list of top-rated brokers to start investing in dividend stocks.

FAQ

What Are The Distributions Of Either Cash Or Stock To Shareholders Called?

They are called dividends.

What Is The Dividend Yield?

The dividend yield is the dividend rate divided by the current share price.

What Is Dividend Income?

Dividend income is the payments made to shareholders by companies in which they have invested.

When you buy shares of stock in a company, you become a shareholder. If the company pays dividends, you will receive dividend payments based on the number of shares you own. Dividend payments are not guaranteed, but many companies do pay dividends to their shareholders as a way to give distribute cash back.

Dividends are typically paid quarterly, but they may be paid more or less often, depending on the company. Dividend income can be a great way to earn additional income on your investment portfolio. It’s nonetheless important to remember that dividend payments are not guaranteed and they can be reduced or eliminated entirely at any time by the company. Big names like Berkshire Hathaway, for example, do not pay dividend income (though Warren Buffett regularly collects a large amount in dividends).