The Swiss forex and derivatives broker Dukascopy has introduced two upgrades to its trading experience, including more competitive overnight swap charges on DeFi assets and the addition of 10 new cryptocurrency instruments. These new tokens will bring the total number to 19 and will be accessible to both European and global clients through both Dukascopy Bank and Dukascopy Europe JForex.

Enhanced Crypto Trading Conditions

Dukascopy has been an early adopter of cryptocurrencies, even launching its own native token, Dukascoin. The 10 new currencies added to the broker’s list further demonstrate the firm’s commitment to DeFi and include highly popular coins among retail traders, resulting in a total of 19 crypto CFDs.

The new instruments are all digital tokens paired with the US dollar, creating crypto-fiat pairs that showcase the value of cryptos against the US currency. The coins that have been added are Cardano (ADA), Chainlink (LINK), Uniswap (UNI), Yearn Finance (YFI), Aave (AAVE), Basic Attention Token (BAT), Compound (COMP), Enjin (ENJ), Polygon (MATIC), and Maker (MKR).

In the announcement, the broker stated that “Dukascopy continues its crypto expansion by significantly improving its overnight rates for crypto instruments together with launching trading for 10 new cryptocurrency pairs.”

The new crypto instruments will be available to clients with Dukascopy Europe JForex self-trading accounts, which use the broker’s proprietary trading platform, JForex.

However, the broker is hoping to bring them to their other platform, MetaTrader 4 (MT4), on which clients can already trade some existing pairs.

Further demonstration of the broker’s commitment to competitive cryptocurrency trading conditions includes the recent introduction of Tether (USDT) as a payment method, alongside the existing Bitcoin (BTC) and Ethereum (ETH) options, and the increase of maximum deposit limits with cryptos to $100,000.

About Dukascopy

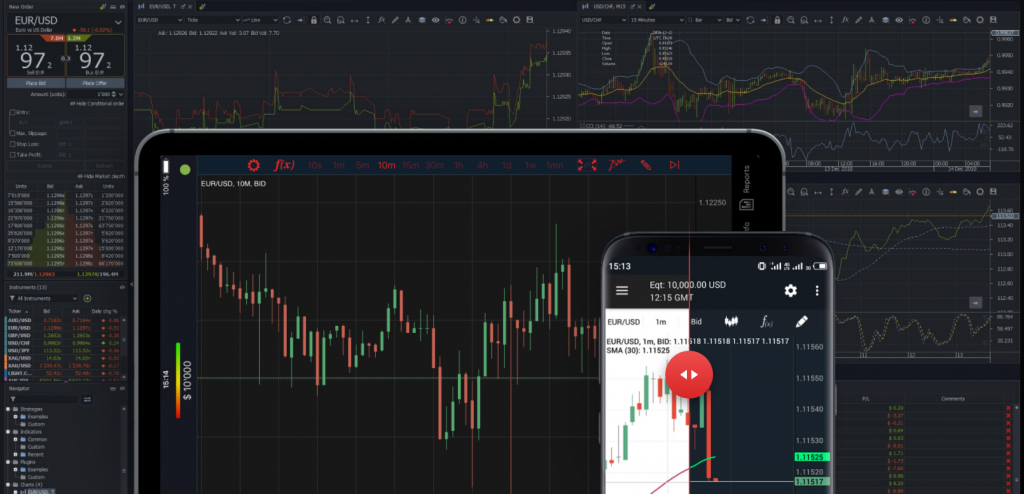

Dukascopy is a regulated, global entity offering competitive forex, CFD and binary options trading across a wide range of markets and countries. Clients can speculate on stocks, indices, ETFs, commodities, bonds and cryptocurrencies using the broker’s own JForex platform, its web-based binary options software or the world-renowned MT4.

The broker is regulated by the Swiss FINMA and the FCMC, providing legal protection to clients in the event of disputes or insolvency. Automated trading and high leverage rates are supported for all assets, alongside competitive spreads, mobile apps and regular promotional events.

To get started with the new crypto CFDs on Dukascopy’s platform, click the button below or check out our full broker review.