Day trading for beginners can feel daunting. Fortunately, our guide for newbies covers straightforward intraday strategies, tips on risk management, plus reviews of the best software. We’ve also listed our top brokers for day trading beginners directly below. So, if you’re looking to generate profits from the financial markets, use this tutorial to get started.

Day Trading Explained

Day trading involves speculating on the price of assets, such as stocks, forex, or cryptos, within a single trading day. Traders open and close multiple positions in a session to generate profits from short-term market movements. Importantly, no positions are held overnight.

Day trading strategies can be applied to most financial markets, though they are particularly prevalent in forex and stocks. And whilst day trading for beginners is often marketed as a ‘get rich quick’ scheme, it requires commitment, both in time and capital. Take professional day traders, for example. They are generally well-informed with significant financial backing. They also often day trade for a living, rather than as a hobby, and use leverage to capitalise on small price fluctuations that occur in highly liquid stocks or currencies.

Day trading is significantly risky for traders of all experience levels, but particularly for beginners.

It requires an in-depth understanding of how various markets work and why strategies can turn a profit. Aspiring day traders must carefully choose entry and exit points while employing effective risk management techniques to preserve their capital.

The Best Day Trading Markets For Beginners

Whilst the stock and forex markets are the most popular with day traders, all markets offer profit potential. The intraday trading of cryptocurrencies, for example, is on the rise. Equally, commodities and binary options provide opportunities for switched-on investors.

A key tip when day trading for beginners is to focus on one market. Concentrate on digital currencies, such as Bitcoin, for example. Learn how the value of BTC reacts throughout the day to news announcements or wider crypto trends. Once you have developed and refined an effective strategy for day trading one market, you can then turn your attention elsewhere. Spread yourself too thinly at the beginning and you may struggle to make progress.

When To Trade

Most successful day traders don’t open and close positions all day. Instead, they focus their efforts on periods that present the most opportunity, generally offering significant volume and volatility. For example, when intraday trading stocks, the first couple of hours after the markets open and the last hour before they close, tends to see the most price action.

Of course, how long you trade for and when will ultimately depend on your strategy, but the key takeaway is that you don’t need to be glued to your computer all day.

Many professionals recommend only actively trading for between two and three hours each day.

Risk Management For Beginners

How to manage risk is an essential lesson when day trading for beginners. Before putting money on the line, you should have an approach to risk management. Ask yourself: how much exposure are you willing to take on a single trade or over one trading session?

One sensible risk management technique is to limit the amount of capital invested in a single trade. Professional traders often set that limit at between 1% and 2%. This ensures that even in a run of bad losses, your total trading capital won’t be wiped out.

Limit orders and stop losses are also effective for curbing losses. These pending orders are essentially pre-determined points at which your platform will automatically buy or sell an asset. Let’s say the price of Tesla, which you bought for $1,050, is falling. A stop loss at $950 would automatically sell the share once the $950 price point is hit, capping your losses at $100, minus any fees.

A free demo account, offered by many of the top brokers for day trading beginners, is an excellent place to refine risk management techniques before putting capital on the line.

Best Day Trading Strategies For Beginners

Day traders can employ a range of intraday strategies, including technical and fundamental approaches. We’ve explained the key concepts when day trading for beginners below.

We have also compiled some essential advice for beginners to keep in mind.

Begin with Small Steps

Day trading beginners should start by focusing on a specific asset. If you are interested in stocks, concentrate on a particular sector, such as renewable energy, or even specific companies, such as Facebook and Amazon. Focused research will help you quickly catch up with company news, historical financial performance, upcoming investment plans, and more. This will make it easier to identify and take advantage of opportunities.

Fractional shares are also an excellent way for beginner day traders to get started. A fractional share is a portion of a full share, enabling you to invest in companies that you may not be able to afford otherwise. Investors can take less risk, focusing on percentage returns while building up their trading capital.

Technical Analysis

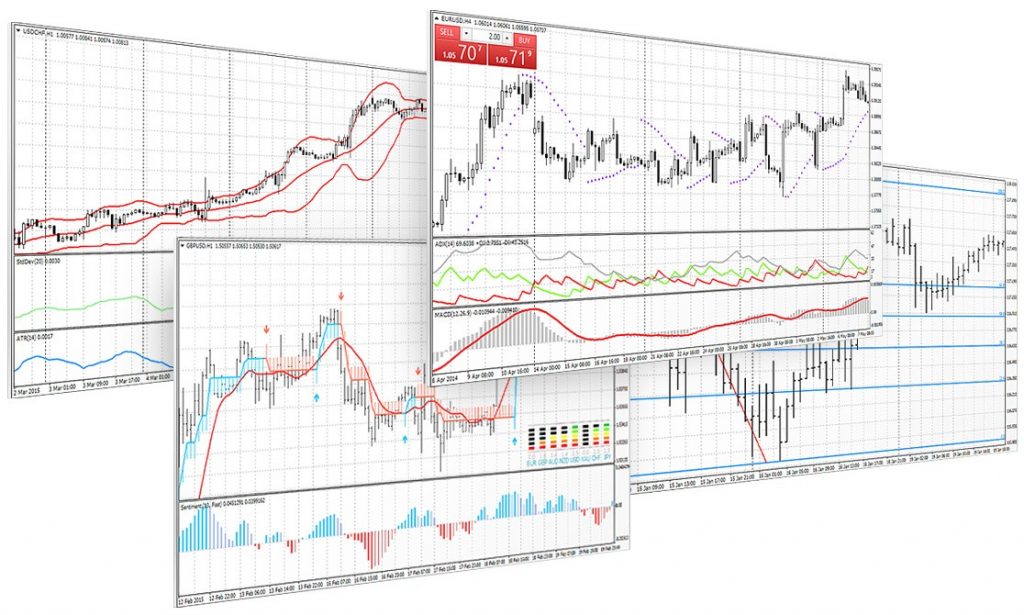

A consistent and effective strategy often relies on in-depth technical analysis, using charts, indicators, and patterns to predict future price movements. The MetaTrader 4 platform, available from many top brokers for day trading beginners, is an excellent place to start.

The user-friendly terminal is equipped with 30 built-in indicators, more than 2,000 free custom indicators, and 700 paid options for newbies to explore. MetaQuotes also provides a wealth of video tutorials and tips for those getting to grips with the platform.

Stay Calm and Disciplined

A profitable day trading strategy requires discipline and calmness to produce consistent gains.

When day trading for beginners, it is crucial to control your emotions and prevent them from influencing intraday trading decisions. This can be challenging as pressure and sharp market fluctuations can be stressful. However, sticking to your plan is key. Use stop losses and limit orders, and when your strategy needs refining, make changes at the end of the trading session when you have had the opportunity to analyze the day’s events with a level head.

Scalping

Scalping is one of the most popular strategies for beginners in day trading. It involves exploiting small price gaps created by the bid-ask spread. Traders close a position as soon as the trade becomes profitable, accumulating many small gains over the course of the trading day. Scalping is particularly popular in forex markets, where there is usually substantial volume and volatility. Due to the fast-paced nature of scalping, rapid order execution and reliable trading software are required. See our full guide to scalping here, including a list of the top brokers and sites.

Momentum Trading

Following a straightforward trend is a good place to start when day trading for beginners. This strategy can involve trading on news releases, such as Facebook changing its name to Meta and investing in the Metaverse. A momentum trader could buy on the announcement, or in anticipation of the announcement, and ride the trend until it exhibits signs of reversal.

Fade the Price Surge

If you want to reduce the price surge, you can try fading it by identifying when trading volumes are likely to decrease. Check out our online tutorial on momentum trading here.

Top Brokers for Novice Day Traders

The best day trading platforms for beginners are those that are user-friendly and offer a range of educational materials and research tools to help you learn. Before opening a live account, consider the following factors:

- Low Minimum Deposit – The leading day trading brokers for beginners typically offer a low minimum deposit, such as $10 or no deposit requirement at all. This, coupled with a small minimum trade size, can help day traders with limited capital get started.

- Reliable Customer Service – Dependable customer support is crucial for day trading beginners. A hands-on support team can help you with account requirements and advise on platform issues or mobile app download instructions. Ensure that the broker’s support channels are available during your planned trading hours.

- User-Friendly Tools – The best brokers for day trading newbies provide excellent educational tools, such as free demo accounts, stock pickers, and forex heat maps. Webinars hosted by day trading veterans, strategy PDFs for trading beginners, and risk management tips in the form of articles and online guides can also be helpful.

Please note that we do not recommend day trading on Robinhood for beginners due to negative customer reviews.

Getting Started with Day Trading

Follow the steps below to begin day trading as a beginner:

1. Fade the Price Surge

If you want to reduce the price surge, you can try fading it by identifying when trading volumes are likely to decrease. Check out our online tutorial on momentum trading here.

Sign Up For An Account

Once you have chosen a suitable broker, register for a live account and deposit funds. Remember, if you do not feel ready to start trading on live markets, make use of a free demo account.

Once you have finalised your strategy and chosen a market to concentrate on, identify a suitable opportunity.

2.Open A Position

Choose from an instant or pending order type and follow the on-screen instructions on your software to open a position. Remember, if you are day trading, you may want to place both long and short positions, depending on your market prediction for the day.

3.Monitor & Close

Financial markets can move rapidly, so make use of any news streaming services and charting tools to monitor the day’s activity. Once you’ve reached your desired profit target (or loss threshold), exit your positions.

It’s worth keeping in mind that positions generally need to be closed by the end of the trading day to avoid overnight holding fees.

Day Trading Tips For Beginners

Journal

When looking at day trading for beginners, a useful tip is to maintain a trading journal of all the positions opened and subsequently closed during the day. It’s worth including information on the time and size of entry and exit positions, the direction of trades, plus respective profits and losses.

This will assist you in analyzing your performance and updating your day trading strategy as required.

Books

An extensive day trading education can prevent costly mistakes. It can be overwhelming for beginners to start day trading, with a wide range of charts, pricing structures, and platform choices to understand. Fortunately, there are several books available that are geared toward novice day traders.

The best day trading books for beginners are straightforward, providing step-by-step instructions and explaining key concepts. Some of the best books can be purchased on Amazon, and eBooks are frequently available as PDF downloads or can be read for free on Kindles.

Some of our favorite books for novice day traders include:

- A Beginner’s Guide To Day Trading Online by Toni Turner

- How To Day Trade For A Living: A Beginner’s Guide To Trading Tools and Tactics, Money Management, Discipline, and Trading Psychology by Andrew Aziz

- Day Trading For Beginners & Dummies: How To Be Your Own Boss by Glenn Nora

- Day Trading For Dummies by Ann C Logue

These books are especially beneficial if you want to start day trading in the UK, US, Canada, and Europe. Some are also available as eBooks and audiobooks. However, there are also other excellent choices for day traders based in India, Australia, the Philippines, and beyond. Before purchasing a book, check online reviews for customer ratings.

Note that many of the best day trading books, courses, and videos are also available in Hindi, Tamil, and Telugu.

Videos & Courses

Day trading strategy videos and webinars can also be beneficial.

Fortunately, there are plenty of free courses available on YouTube for intraday traders who are just starting out. Successful traders like Ross Cameron from Warrior Trading often upload videos of their verified trades on their channels.

Audio Learning

Aside from purchasing books and taking online courses, there are numerous other resources available. Audiobooks and podcasts, for instance, are an excellent way for novices to learn about day trading while on the go, at the gym, or during the school run.

Forums

Some individuals learn best from online forums like Reddit and Quora. Day trading can be a lonely experience for beginners, so an interactive community where you can exchange ideas and discuss new opportunities (such as the latest emerging cryptocurrency) can prove to be valuable.

Final Word on Day Trading for Beginners

Patience is required for day trading. Novices should not anticipate making significant profits right away. Aspiring day traders should take advantage of the plethora of resources available online, including free demo accounts and educational materials. Use our list of the best brokers for day trading beginners to get started today.

FAQ

Is Day Trading Suitable for Beginners?

Every trader has to start somewhere, including day traders.

What Do I Need To Start Day Trading?

Beginners need very few tools to start day trading. On the hardware side, a computer and a trusty internet connection are all that is required. The online broker you sign-up with will provide the trading software needed to monitor the markets and execute positions.

How Much Money Do Day Traders Make?

The short answer is that it varies. Experienced veterans can make substantial sums while absolute beginners may generate limited extra income on top of their current jobs. It’s also worth remembering that profits and losses fluctuate so it’s important to focus on long-term results rather than returns on a particular day.

Should Beginners Take A Day Trading Course First?

Day trading courses can be a valuable tool for beginners.

The best providers detail suitable strategies, explain risk management techniques and provide insights into particular markets, such as forex, stocks, cryptos or futures. An excellent range of free and paid-for courses are now available online, including at Warrior Trading, Bear Bull Traders, and Udemy.

What Are The Best Day Trading Apps For Beginners?

A mobile day trading application is a great way to implement strategies while on the move. The eToro app, in particular, is great for newbies as you only need $50 to start trading on stocks, commodities, indices and forex markets. ETX is also a good day trading platform for beginners with 101 investing guides.