Knock-out options offer short-term trading opportunities with easy to understand risk management. Beginners benefit from a straightforward entry point with a pre-determined exit plan. This guide explains how knock-out options trading works, plus the pros and cons. We also list the best brokers for trading knock-out options in 2023.

Knock-Out Options Explained

Knock-out options are financial contracts with pre-defined profit targets. Each contract has a floor price and a ceiling price to lock in profits and limit potential losses. Positions are automatically closed out when the price hits one of these thresholds.

On the top platforms, like Nadex and IG, knock-out options are offered on popular markets, including major forex pairs, commodities and large US stock indices. When traders open an order ticket, they can choose the price and size. This will then display the maximum risk and potential returns.

Example

A Dow Jones contract’s underlying price is 34,420, with a floor of 34,410 and a ceiling of 34,460. The value of the contract is the ceiling minus the floor: 34,460 – 34,410 = 50 points, worth $500.

Now, to determine the maximum risk and cost of entering the trade, you need to understand the difference between the buy price and floor price, which in this case, is 34,420 – 34,410 = 10.

This is equivalent to $10 per point, so the total needed to open the position is $100.

The maximum potential return is the difference between the buy price and the ceiling price: 34,460 – 34,420 = 40 points, or $400.

Contract Types

There are several popular types of knock-out options available to retail investors:

Up & Out

Up and out knock-out options void the contract if the underlying asset’s value is greater than the barrier before the expiration time. This makes it popular with traders who have entered a put contract, helping to reduce potential losses.

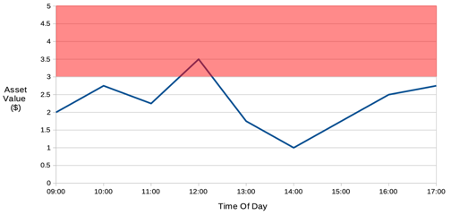

In the chart below, the contract starts at 9 a.m. with a 5 p.m. expiration. The asset is trading at $2 and the barrier level is $3 at the time of entry. The asset’s value surpasses $3 just after 11:30 a.m., therefore, the position is automatically closed.

Down & Out

With a down and out option, the position is closed once the asset’s value drops below a certain level at any time between the opening of the contract and the expiry. This type of knock-out is attractive to investors entering a call contract.

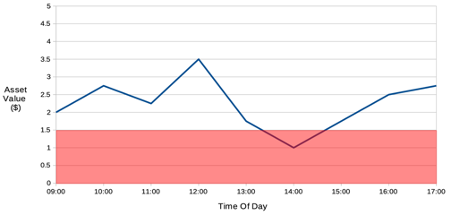

Let’s look at an example below. You will see the asset is trading at $2 with the price barrier set at $1.5. The contract would end as soon as it reaches the barrier just before 1:30 p.m.

Reverse

A reverse knock-out option (RKO) involves a barrier level that is in-the-money when it hits the strike price.

Knock-In Options

Knock-out options and knock-in options are two types of barrier options.Knock-out options become void if the asset’s value reaches a certain price, while knock-in options only become active if the asset’s value reaches a certain price.In other words, knock-in options are activated when the asset crosses a pre-set threshold.

Both types of options can be used to hedge against potential losses or to speculate on future price movements.It is important to understand the differences between these two options and to carefully consider which one is best suited to your trading strategy.

Knock-In Options

Both financial contracts are forms of barrier options. The main difference between knock-in options and knock-out options is how the option changes once the asset’s price reaches the barrier level. With knock-outs, the contract is nullified. With knock-in options, the contract is activated. This means that the contract is essentially inactive until the barrier level price is reached.

Pros of Knock-Out Options

Benefits of trading knock-out options include:

- Fixed exit plan

- Lower premiums

- Beginner-friendly

- Offered by top brands like Nadex and IG

- Can be used as part of hedging strategies

- Agreed limits mean you don’t have to monitor positions

- Available on popular markets like forex, stocks and commodities

Cons of Knock-Out Options

Downsides of signing up with a broker that offers knock-out options include:

- Contracts can reduce profit potential

- Practising on demo accounts doesn’t always prepare you for real-time trading

Final Word on Knock-Out Options

Knock-out options are popular with beginners, offering dynamic short-term trading opportunities on forex and stocks, among other major markets. Contracts have built-in risk management meaning investors know how much they stand to win or lose before entering a position. Knock-out options are also offered by some of the best online brokers in 2023.

Use our guide to start trading today.

FAQ

What Are Knock-Out Options?

Knock-out options are a type of financial contract with fixed profit and loss targets, also known as ceiling and floor prices. Once one of these barriers is hit, the contract is automatically closed out and the trader either receives their winnings or loses their deposit.

Are Knock-Out Options Legal?

Knock-out options are available in most major trading jurisdictions, including the US, UK, Australia, Europe and Asia. With that said, it is always worth opening an account with a regulated brand.