Liquidity providers are an important cog in the financial markets machine. Whether you are trading in London or Beijing, liquidity is a concept you will likely have come across. Ultimately, it is an indication of how easy it is to buy or sell an asset and liquidity providers ensure that the markets work smoothly. This article will delve into what they are, how they work, the part they play and why they are important for traders.

Liquidity Providers Explained

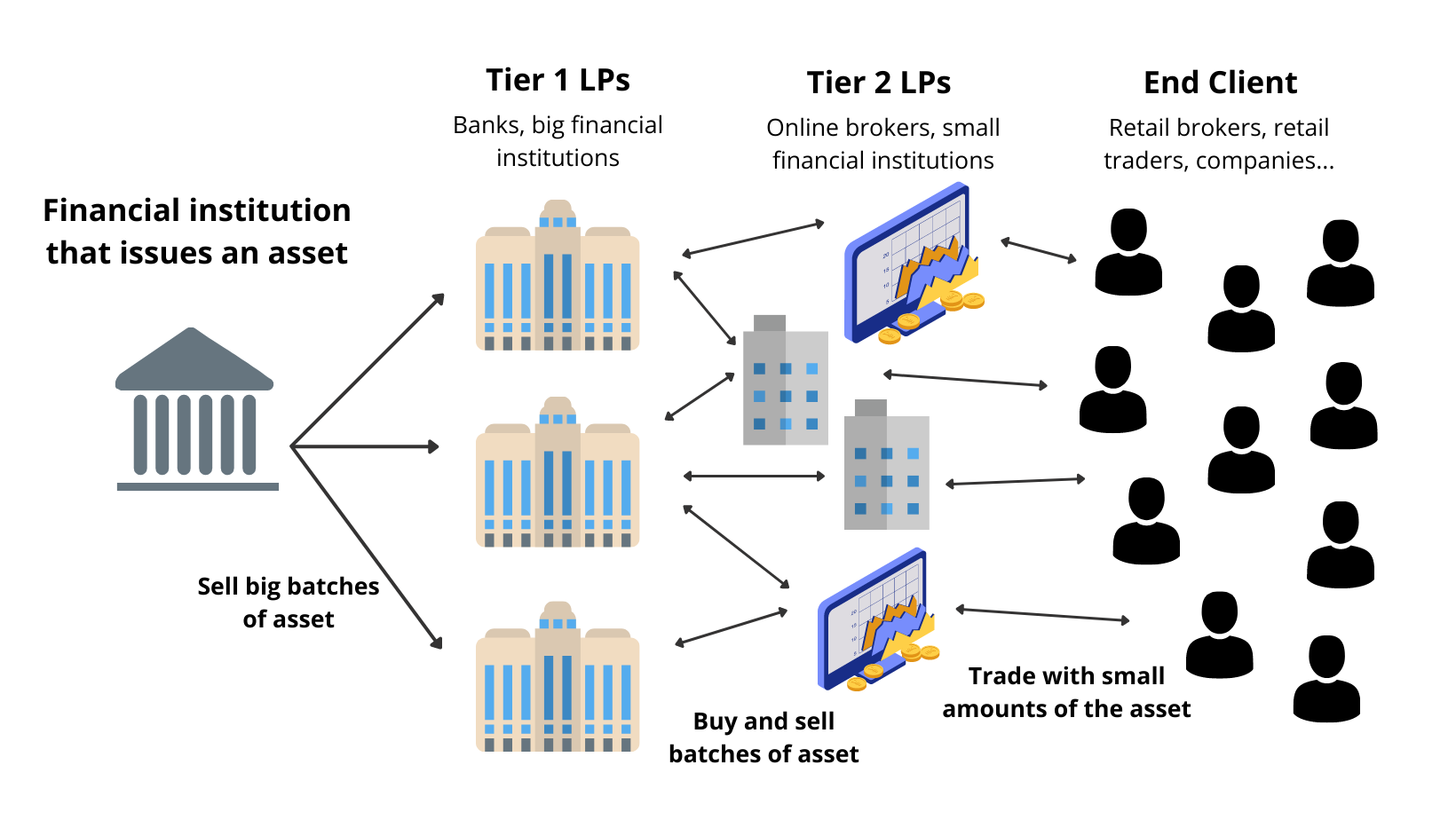

Liquidity providers act as intermediaries between the institutions that issue an asset, like the NYSE or CME, and the customer wishing to purchase it. Suppose a new company issues some shares, a liquidity provider will buy them and sell them off in smaller batches to individuals and brokers. If you have some of those shares and are looking to sell them, a liquidity provider will also buy them from you to sell on again.

For each asset, a liquidity provider will have a pool that investors can trade in and out of. For example, a cryptocurrency liquidity provider might have a liquidity pool with $100,000 worth of Ethereum (ETH) and $100,000 worth of Bitcoin (BTC). If an investor wanted to buy the ETH/BTC pair, they will pay their Bitcoin into the pool and receive Ethereum.

Without liquidity providers, this same trader would have to wait for another investor that was looking for the opposite transaction and mutually agree on a price.

Pricing

So how do liquidity providers make money? This is where spreads and commissions first arise. The spreads are usually very small but magnified by the volume of the trade. Therefore, the more trades a liquidity provider has, the more additional liquidity they can provide and the more profit they will make.

Some liquidity providers invest in a wide range of markets and others focus on specific assets, like forex, ETFs or stocks. Some providers work mostly with derivatives, like CFDs.

Types Of Liquidity Providers

Tier 1 Liquidity Providers

Primary liquidity providers buy big batches of assets from the institutions that issue them. Most of these are banking and financial institutions, like Dukascopy and Venture Liquidity Providers Inc., as they hold large amounts of capital. For example, Deutsche Bank and Morgan Stanley are global, leading providers in forex. Not all tier 1 providers are financial institutions, however, there are some non-bank forex providers, generally meaning companies with high purchasing power.

Tier 2 Liquidity Providers

Secondary liquidity providers are brokers and smaller financial institutions that act as intermediaries between tier 1 providers and the end customers. Tier 2 providers have partnerships with one or more tier 1 providers.

The more partnerships a tier 2 provider has, the more aggregated liquidity and market depth they can offer.

Some online brokers act as tier 2 liquidity providers and, when you trade on their platforms, you will buy and sell assets directly from and to them. IG is a good example of a broker that has a subsidiary liquidity provider, called IG Prime. Such brokers are sometimes known as retail liquidity providers. Not all brokers are providers though, with other online brokers simply working with tier 2 providers, so any trades made through them will actually be placed with the provider, rather than the broker.

Supplemental Liquidity Providers

You may have also heard of supplemental liquidity providers (SLPs). These also create liquidity in the stock market but do so using a different technique from the above. Instead of creating liquidity by having an available liquidity pool of the asset, they increase trading volume by executing high-frequency, high-volume trades using various algorithms. These are sometimes known as electronic liquidity providers, not to be confused with ECNs (electronic communications network brokers), like Match Trade.

Crypto Liquidity Providers

Liquidity provision for cryptocurrency exchanges works slightly differently as crypto is decentralized (not issued by a single organization) and generally carried out OTC (Over The Counter).

Therefore, DeFi liquidity providers cannot purchase large amounts directly. Instead, exchanges create liquidity pools and request that traders fund them by depositing their unused cryptocurrencies in exchange for token fees. Examples of such schemes include Uniswap, Binance, Pancakeswap, and Bancor liquidity providers. Individual traders earn tokens and become providers by receiving a fixed fee every time someone trades with that pool. However, being an individual liquidity provider carries risks, as sudden volatility in an asset can cause an “impermanent loss” for the liquidity providers.

There are numerous online courses available, such as the Liquidity Provider Concepts and Systems Course (LPC), that aim to educate traders on liquidity. However, not all material will be helpful, so ensure you know what you’re signing up for before committing any capital.

Benefits of Liquidity Providers:

– Avoid Chaotic Price Movements: Liquidity providers help set the price at which an asset can be bought or sold. While demand is the primary driver, providers ensure that prices change smoothly rather than having large gaps. This leads to lower volatility, limited price instability, reduced slippage, and tighter spreads.

– Dynamic Trading: Liquidity providers ensure that the market is dynamic and that traders can always execute their orders.

Without them, investors would have to wait for a counterparty, or counterparties, to fill their order and then negotiate the price.

A liquidity provider will buy the 100 Apple shares at an established price, and then sell them to other traders when they ask.

- Keep Prices Low: Providers are in constant competition with each other to offer the most attractive prices. Having traders buy and sell from them means higher trade volumes and in turn more profit and better liquidity.

Why Liquidity Providers Are Important For Traders

When looking for a new broker, you should find a company that offers excellent liquidity. Brokers can achieve this by partnering with multiple tier 2 providers or by being tier 2 liquidity providers themselves and partnering with tier 1 providers. So whether you are looking to open an account with Pepperstone, FXCM, Oanda, ICMarkets, HotForex or LMAX, ensuring that your broker has great liquidity will have the following benefits:

- Instant Trades: Higher liquidity means faster fulfilment of an order.

- Reduced Slippage: If an order takes too long to be processed, the price of the asset might change before it is fulfilled.

This is known as slippage and eats away at profits. High liquidity reduces slippage by ensuring orders are processed quickly.

- Best Prices: Finding a broker with several liquidity partners usually means the prices will be attractive and stable, without sudden movements.

- Lower Fees: The top liquidity providers with several partnerships offer very tight spreads and low fees.

Brokers will be interested in reputable, regulated partners that can be used with standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).Liquidity providers should also offer live information feeds and market data and the best will have good market depth, meaning they can handle big positions without a substantial change in the asset price.

Final Word On Liquidity Providers

Liquidity providers play a vital role in the market, ensuring smooth trading conditions and asset availability. Choosing a broker that has partnerships with multiple liquidity providers is a smart way of ensuring you are getting the best possible prices and spreads and that slippage will be minimised. Whether you are trading forex, cryptos, stocks, or indices like NASDAQ, the liquidity of your assets is an important factor to consider.

FAQs

How Do Liquidity Providers Work?

Liquidity providers act as intermediaries between the institutions that issue an asset and the customer.

They increase liquidity by having large quantities of the asset available and selling them to traders.

What Types Of Liquidity Providers Are There?

There are two main types of providers.Tier 1 liquidity providers are big banks and corporations that buy the asset from the issuers.Tier 2 liquidity providers are brokers and smaller companies that facilitate trading to retail brokers and traders.

What Is The Difference Between Liquidity Providers Vs.Market Makers?

Market makers are a form of liquidity provider that follow the traditional tier 1 and tier 2 provider models and filling out trade orders.Liquidity providers is a term that encompasses market makers as well as SLPs and crypto liquidity pools.

Why Are Liquidity Providers Important For Traders?

Liquidity is an important concept for the market as it keeps costs down.

Перепиши текст, сохраняя все html теги и делая его уникальным:

Ликвидность обеспечивается провайдерами, которые держат большие объемы активов, что означает их готовность к торговле по стабильной цене. Трейдеры могут получить выгоду, выбрав брокера с хорошей ликвидностью, так как это снизит спреды и избежит проскальзываний.

Как работают провайдеры ликвидности для криптовалюты?

В крипте предоставление ликвидности осуществляется путем поддержания пулов ликвидности, куда индивидуальные инвесторы вкладывают свои средства. Инвесторы получают фиксированную комиссию за каждую сделку.

Кто является лучшим провайдером ликвидности?

Существует огромное количество вариантов. Лучшие провайдеры имеют партнерства с несколькими провайдерами второго уровня или являются самостоятельными и партнерами провайдеров первого уровня. Независимо от того, это eToro, Alpari, IC Markets, Euronext, 360T, TradeWeb, Exness или Polymarket; каждый из них будет иметь свои отношения с провайдером ликвидности первого или второго уровня, и их услуги будут определены соответственно.