Long-term trading is a popular investment strategy lending itself to various instruments, including stocks, mutual funds, and bonds. This guide for beginners unpacks the best vehicles for long-term trading, example strategies, investing tips and more. Use our ranking of the best long-term trading brokers and apps to get started.

What Is Long-Term Trading?

While there is no universal definition, any period spanning more than two months can be considered long-term in the online investing world. With that said, it is common for investors to hold long-term stock positions for upwards of 20 years, especially when saving for retirement.

The difference between short-term and long-term trading is fundamental, as day trading for instance is often based on leveraged derivative speculation on volatile markets, such as forex and cryptocurrency. In contrast, long-term trading is more centred around lesser, but stable returns.

Popular long-term trading strategies typically involve buying and holding an asset, though there are several types of long-term trading, such as dividend investing and value investing.

A good example is a play on long-term energy trends, where a trader sets up regular investments to capitalize on the high dividends paid by energy companies such as Shell and BP.

Best Long-Term Trading Instruments

While many instruments can be used in conjunction with a long-term trading strategy, some products and markets will be more suited to long-term investment goals.

Stocks

Often considered the most versatile investment vehicle, stocks are suitable for speculation across all time frames. However, long-term stock trading strategies differ from intraday or swing trading approaches, such as scalping.

Long-term traders often focus on equities that represent good “value”, putting fundamental values into formulas to approximate the fair price of a share. In the long term, value investors expect the price of a stock to align with this estimation.

Mutual Funds & ETFs

Mutual funds and ETFs are both popular long-term investment vehicles. Whether tracking indices, commodities or a market sector, these products are an excellent way to gain portfolio exposure to a wide range of underlying assets while minimizing risk.

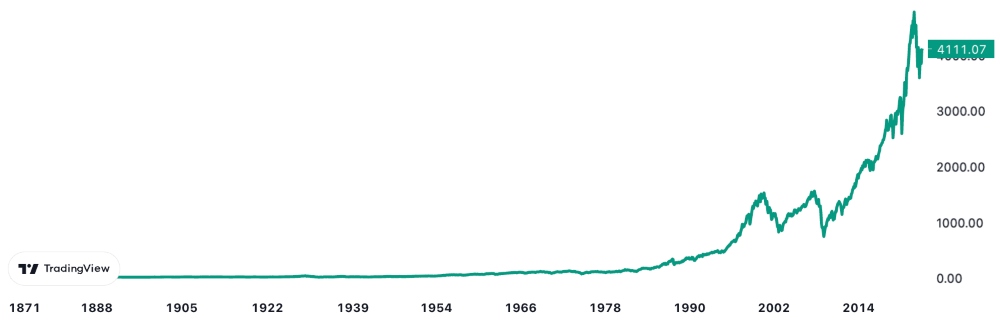

The S&P 500, for example, has risen significantly over the long term.

The values of funds and ETFs also compound during long-term trading, meaning that any dividends or gains are normally reinvested into the position.

Bonds

Bonds are debt securities traded on exchanges or over the counter by broker-dealers.

When it comes to investing in bonds, investors provide governments and corporations with their funds in exchange for regular interest payments and repayment of the principal amount upon maturity.

Bond investments usually span over several years and are a crucial part of a long-term and stable trading strategy for most investors.

Futures Trading

Another long-term trading instrument that traders can consider are futures. Futures are leveraged derivatives that allow trading in commodities, indices, and currencies at a predetermined price and expiry date.

Futures are often used for hedging purposes and with contracts that are settled years away, long-term futures trading can be a reliable trading strategy.

Cryptocurrency Trading

Similar to stocks, cryptocurrencies can be suitable for both short-term and long-term investments. A popular long-term strategy is crypto staking, where investors are rewarded with tokens for allowing blockchain networks to use their tokens for validating transactions.

Although it is still early days for the crypto market, some investors believe that emerging digital assets could be an excellent long-term investment. Investors can buy popular tokens like Bitcoin or Ethereum, hold them in a secure wallet, and then sell them later down the line if their value rises.

Trading Fees

Long-term trading instruments can be classified into two main categories based on trading fees.

These are long-term spot position trading and long-term margin trading.

For spot instruments such as stocks, mutual funds and ETFs, fees are usually incurred when assets are bought or sold. This makes long-term investing a low-fee trading strategy.

However, long-term charges for margin or leveraged assets can be high. Even the best brokers for long-term trading will charge substantial swap fees for holding CFD positions for several months.

Advantages Of Long-Term Trading

- Passive Income Potential – One of the most popular long-term trading strategies is to generate passive income through stock dividends, bond interest, options or crypto staking.

- Compounding Interest – Investors can utilize the power of compounding interest when looking to make long-term capital gains on share trading. This involves reinvesting profits from stock value gains, dividends or interest to enhance total gains. Compound interest is one of the forces that makes active trading less attractive than long-term investing.

- Time For Comprehensive Technical Analysis – When trading based on long-term trading patterns, there is less of a rush to get into a position and, therefore, investors have more time to conduct thorough analysis.

- Tax Advantage – In some regions, there are significant reductions when comparing day trading tax vs long-term capital gains tax.

- For example, in the US, income tax on long-term share trading is far lower than short-term trading taxes.

- Less Active Trading Needed – Short-term trading requires a higher amount of active trading vs long-term investing, leaving traders free to pursue other interests or jobs.

Disadvantages Of Long-Term Trading

- Opportunity Cost – While some brokers may allow you to use long-term positions as trading collateral, investors should understand that long-term trading can lock capital up for years. As a result, funds will not be available for other trading opportunities or to withdraw for use in a trader’s daily life.

- Limited Instruments & Capital – Long-term margin trading can accumulate substantial fees, so investors are often restricted to spot instruments with low or no leverage.

- Lower Profit Potential – As markets tend to be less volatile in the long term, there are fewer opportunities to make comparable gains to short-term speculation. In addition, many investors’ long-term trading goals are more aligned with sustainable, regular profit rather than the all-or-nothing speculation of intraday or swing trading.

- Slow – While this may be implicit in long-term trading, investors must be patient enough to leave their funds to accumulate slowly. As a result, long-term trading is a slow and less exciting form of investing than day trading or swing trading.

Long-Term Trading Strategies

When investing over the long term, trading on volatility and momentum is impractical.

Instead, investors can draw upon time-frame-specific techniques and options to generate passive income and predict long-term gains in stocks, for example.

Popular long-term trading strategies:

Dollar Cost Averaging

Many long-term traders rely on the perpetual growth potential of indices such as the S&P 500, FTSE 100, or historically stable stocks.

One of the unique advantages of long-term investing vs day trading is the ability to set regular investments.Using a dollar-cost averaging strategy, investors can set up automated purchases of an equity using set times and amounts instead of trying to time the market.

This strategy automatically purchases more company shares when prices are low and less when prices are high, ensuring that investors get good, consistent value in their long-term positions.

Value Investing

Value investing involves purchasing equities that are undervalued by the market compared to competitors and their underlying financial data.The manifestation of these pricing errors is one of the key differences between swing trading vs long-term trading.

Value investing can provide excellent trading opportunities on stocks, ETFs, options, or as a long-term crypto trading strategy.

Passive Income

One of the unique advantages available to long-term traders is the ability to generate passive income.

Investors can generate income just by holding an asset, whether through stock dividends, crypto staking, bond interest, and more.

Unique Long-Term Trading Strategy

Our innovative long-term trading approach is based on technical indicators.

Long-term trend trading involves using signals like moving average indicators, Fibonacci overlays, and trendlines to identify patterns. The best indicators for long-term trading can help assets return to trend lines after bouts of short-term volatility.

Long-term trends may be seasonal, cyclical, or continuous. Rather than timing the market, our strategy relies on a long investment period for directional gains.

Effective Trading Tips

For long-term traders to stay ahead in the market, here are some valuable tips:

- Tax-Advantaged Accounts – Many long-term traders save for significant life events such as retirement, education, buying a home, or setting up trust funds for their children. Specialized trading accounts like the lifetime ISA in the UK or 401(k) in the US offer tax advantages that reduce or eliminate income tax on long-term trading gains.

- Stick To Your Strategy – Short-term volatility can make even experienced investors doubt their analysis and strategy. Stay focused on your long-term plan.

- If your analysis is comprehensive and well-reasoned, let the trade play out rather than reacting to short-term volatility.

- Automation – Long-term trading is a largely passive strategy, with little input needed from traders. To further reduce the level of activity needed, traders can utilize algorithmic trading programs to automate their investing. While this may be difficult for beginners, preset deposits and investments or setting trailing stops or trailing buy orders can also help.

Final Word On Long-Term Trading

Long-term trading strategies can yield regular or compounding returns for investors who are willing to lock up capital for long periods. In addition, strategies such as crypto staking and dividend investing can generate lucrative passive income. Another key benefit of long-term trading is the potential to use tax-advantaged accounts to maximize gains.

Use our table of the best trading platforms for long-term investments to get started.

FAQ

What Is Considered Long-Term Trading?

A trade can be considered long-term if it exceeds two months.