Managed trading accounts are a hands-off way for traders and investors to manage their money and securities. Individuals give control to an investment manager that will buy or sell securities and assets with an investor’s specific goals, risk tolerance and financial position in mind. Conversely, unmanaged accounts require you, the investor, to take action.

In this 2023 guide, we will explain what they are, how they work, the pros and cons of investing in managed trading accounts and how best to compare them.

Managed Trading Accounts Explained

Managed trading accounts, or separately managed accounts (SMAs), are investment accounts that are owned by an investor but managed by an advisor, team of advisors or robo advisor at a professional investment firm. Also known as wrap accounts, these can bundle investments together for you. By definition, these are not the same as managed bank accounts, which are consumer banking products in the UK.

The financial advisor has discretionary authority over the managed money account and its trading activity on behalf of the investor. Managed trading accounts merely consider the objectives of the account holder, be that an institutional or retail investor. Participants must provide this information so the advisor can tailor the investments, making them preferred QDIA (Qualified Default Investment Alternative) choices.

Such accounts may contain financial assets, cash or real estate title documents.

A managed account brokerage can provide a variety of services to investors like retirement plans (including 401k plans for retirees), 529 college savings plans, research, financial advice and tax efficiency & planning.

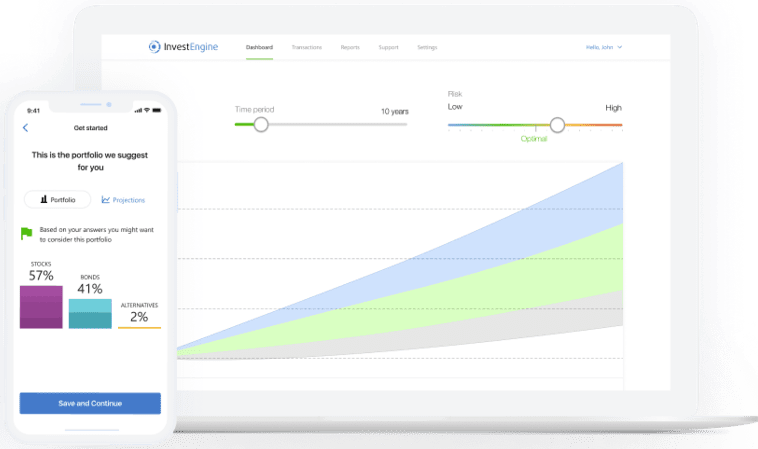

Managed trading accounts are popular with high-net-worth individuals as they tend to be expensive and require a large minimum amount of investment. Recent innovations are robo advisors like Betterment or Wealthfront. Robo advisors are digital platforms that provide automated account management with little to no human input. These platforms are typically cheaper and use machine learning to produce and follow growth trends.

How Managed Trading Accounts Work

The dedicated money manager has the authority to buy and/or sell assets without the account owner’s approval. They will make decisions based on the investor’s risk appetite, capital and financial goals. Managed trading accounts involve fiduciary duty, meaning the manager must act in the investor’s best interests or potentially risk facing criminal penalties and lawsuits. The investment manager will provide the client with a report on their account, including its performance and holdings.

This high level of customisation is one of the managed trading accounts’ greatest selling points, especially when it comes to taxable accounts.

For example, investors can specify that they only want to invest in socially responsible portfolios.

Advisors or managed account providers can demand high minimum investments to manage accounts with many starting at $100,000. Managers are also compensated by a fee, often calculated as a percentage of assets under management (AUM).

Pros

There are many benefits to investing in managed trading accounts, including:

- Hands-off approach

- Tailored personal advice

- Investors have maximum transparency and control over assets

- Tax gain/loss harvesting (minimising capital gains tax liability)

- Responsible for account holder’s risk tolerance and financial goals

Cons

Equally, it is important to consider that separately managed accounts have their disadvantages:

- Some require a six-figure minimum in funds

- More of a long-term investment strategy

- High annual fees

How To Compare Managed Trading Accounts

There are various factors to consider when comparing managed trading accounts and the investment firms providing them. The investment process i.e., understanding who makes decisions, how they are implemented and the money manager’s performance data, investment philosophy and approach are key.

As well as doing your research into the organisation of a firm and its compliance history, here are some things to consider when comparing options:

Minimum Capital

Minimum investments are generally quite high for managed accounts.

If you have less capital to spare, AI-based robo advisor accounts tend to have lower limits.

Payment Structure

Fee structures among investment advisors will vary. Managed trading accounts are rarely a cheap option as you are essentially paying a skilled money manager to make your investment decisions for you. Managers are compensated by an annual fee. These can vary considerably but most average around 1% to 3%. Often, investment managers offer discounts on larger investments. These smaller fees may have taxation benefits.

It is worth considering the impact that fees will have on your returns. Ultimately, the higher the charges in a separately managed account, the lower the return it will yield. Generally, it is advised to limit total fees, including manager’s rates, trading costs and fund fees to 2%. Robo advisor account management fees are often cheaper, at around 0.25% AUM and can require as little as $5 to start.

Interface

Some money managers have extensive in-house trading platforms, while other providers outsource their non-core functions to third-party providers like Schwab or Fidelity. Other firms like E*TRADE provide their managed account platform via an app, making it easier to use and track online. This more automated approach, similar to JP Morgan’s recent robo advisor offering, brings costs down and our reviews show that E*TRADE has a low minimum investment of $500.

Customer Support

Make sure that the managed account that you choose has good customer service.

However, they are often managed by a team of professionals who make decisions on behalf of the investors. Managed trading accounts, on the other hand, are typically managed by a single advisor who has a more personalized approach to managing your investments. Index funds, meanwhile, are passively managed and simply track a particular market index. While they can be a good option for some investors, they may not offer the same level of customization and personalization as a managed trading account.

Conclusion

Overall, managed trading accounts can be a great option for investors who want a more personalized approach to managing their investments. With professional guidance, customized portfolios, and regular updates, these accounts can help you achieve your financial goals more effectively. Just be sure to do your research and choose an advisor with a proven track record of success.

Both mutual funds and separately managed accounts are actively managed portfolios. However, mutual funds are open to anyone with the means to purchase shares in the fund, while separately managed accounts are customized for specific investors.

Mutual funds do not cater to an individual investor’s objectives. Instead, they have set investment and return objectives. When investors buy shares in a mutual fund, they own a percentage of the fund’s value, not the assets within it. In contrast, managed accounts for trading allow the account holder to own securities directly.

Managed funds have shared costs with a pool of investors, reducing overall expenses. However, most funds are open to anyone who wishes to invest. Similarly, managed ETF accounts use exchange-traded funds as investment vehicles. ETFs have lower expense ratios than mutual funds, making them more appealing to cautious investors.

Index funds aim to match the performance of a specific market benchmark. In comparison, actively managed funds aim to outperform it. Index funds align strategy and risk for those involved in specific stocks or bonds.

Managed Forex & CFD Accounts

Managed forex and CFD trading accounts have become increasingly popular among the investment community.

A managed forex account is where a professional money manager manages foreign exchange trading on the client’s behalf. As forex is notoriously riskier, many people believe that having a more experienced money manager could give good results and better returns.

Managed forex, crypto, CFD and other short term trading accounts are often referred to as multi-account management systems or MAM accounts. These accounts tend to have an experienced, often professional, day trader that specializes in specific securities at the helm. These managers will themselves have stakes in their performance, pooling their capital with that of their investors to open positions and carry out advanced strategies, so they benefit from doing well for their clients.

These managed trading accounts can then be divided into two subcategories, PAMM and LAMM accounts. Lot allocation management modules (LAMM accounts) entail matching the manager’s positions lot-for-lot for each investor, so one lot of USD purchased by the manager would result in one lot being purchased by each investor.

However, in cases where the equities of each investor outpace those of the manager, this system becomes less effective.

Thus, the percentage allocation management module (PAMM account) was created to better scale the system to each investor’s net worth. In this system, investors assign a percentage of their capital to the pool of funds for the manager to invest.

The minimum investment for a managed forex account can be lower. For example, eToro provides a list of forex traders that meet specific criteria, and investors can choose from them to manage their money. Learn2Trade’s minimum is $5,000.

Final Word On Managed Trading Accounts

Managed trading accounts offer a more hands-off approach to investing, tax benefits, and flexibility that few manual investment platforms can provide. However, these accounts come with a price, as investors generally need a high minimum account level. Cheaper options are provided by robo advisors. When comparing providers of managed trading accounts, it’s important to consider customer support, interfaces, and fees that align with your requirements.

FAQ

Are Managed Trading Accounts Worth The Fees?

Managed trading accounts allow investors to hand over their capital to skilled financial advisors who will tailor the account to their financial goals.

Should I Choose A Managed 401k Account Or A TDF?

Does Fidelity Offer Managed Trading Accounts?

Managed accounts at Fidelity are known as discretionary investment management services.

Can I Find Managed Trading Accounts Outside The US And UK?

Yes.In Australia, the ASX offers managed funds and both CFS and Macquarie offer managed investment accounts.In Canada, Franklin Templeton offers managed investment accounts.

Which Financial Advisors Offer Managed Trading Accounts?

In the US and UK, the following firms offer managed trading accounts: Interactive Brokers, E*TRADE, TD Ameritrade, Questrade, Vanguard, Atlassian, BlackRock, BB&T, Cerulli, Edward Jones, Empower, JBWere, JP Morgan, Juilliard, KeyBank, Morgan Stanley, Morningstar, Nationwide NetWealth, NextCapital, Nuveen, Pershing, Quilla, T Rowe Price, TIAA, UBS, XPlore Wealth, Zacks and Zenith.

Further Reading