Range trading takes advantage of non-trending markets by identifying consistent high and low prices, known as resistance and support bands. The idea of trading within a narrow range can be applied to a variety of markets including forex, stocks and cryptos, enabling the trader to buy and sell when an asset is oversold or overbought.

In this tutorial, we explain how to range trade, with an example strategy using range bars. Additionally, we discuss how expert advisor robots can assist range trading strategies during price action. Use to our list of top-rated brokers below to get started today.

What Is Range Trading?

Market prices often move horizontally, meaning there can be limited opportunities to enter a market. In fact, it is estimated that financial markets only trend about 30% of the time. Range trading capitalizes on the fact markets fluctuate within a range during sideway trends, defined by a resistance band and support band.

Importantly, traders can take advantage of the range by buying at the support price and selling at the resistance price until a breakout occurs. Volume plays a key role in developing an effective range trading method.

Range Trading Vs Trend Trading

Range trading can be used on any timeframe from minute to monthly and is frequently used as a day trading strategy.

Investors typically implement a system where they hold both long and short positions at different times. This is in contrast to long-term investors who hold a position that reflects the overall trend direction.

Range Trading Markets

Range trading strategies can be used in any market, including currency, stocks, and cryptocurrency. The primary difference between these markets is volatility and, as a result, the range. Instruments with higher volatility, such as Bitcoin, entail increased risk but can also produce greater profits.

The best range trading forex pairs are those that do not include USD in the pair and, as a result, have a weaker trend. EUR/CHF is an excellent example since the European and Swiss economies have similar growth rates.

Although indices like the Nifty Bank and the S&P 500 exhibit overall growth trends, they can be suitable for intraday range trading.

Range-bound trading can also be used in binary options, where the payout is either a fixed amount or nothing. With binary options, traders speculate whether the price will remain within the investment range.

Range Trading Strategies

Despite the widely accepted definition of range-bound trading, there are numerous technical indicators and expert advisor solutions available that can be overwhelming. Here, we present a step-by-step example of a range trading strategy using bars.

How To Range Trade

Identify A Suitable Market

Firstly, traders must identify a non-trending market.

This can be done using a moving average indicator, with a timescale no greater than the period being analyzed.

Below, the 50 day moving average indicator line in blue shows an uptrend followed by a flatter line, which signals a sideways market suitable for range trading.

The Average Directional Index (ADX) is another way to measure the strength of a trend, without taking into account its direction.

It uses a scale from 1 to 100, with an index below 20 often considered to be a sideways market.

The red line in the lower graph shows the ADX dropping to below 20 as the market flattens.

Online screeners are another way to filter stocks to identify those suitable.

Identify The Trading Range Area

The next step is to identify the range area for trading.

This usually requires a price to have recovered from the support band and dropped from the resistance band at least twice, to ensure that the price is not temporarily rising or dropping as part of a longer trend.

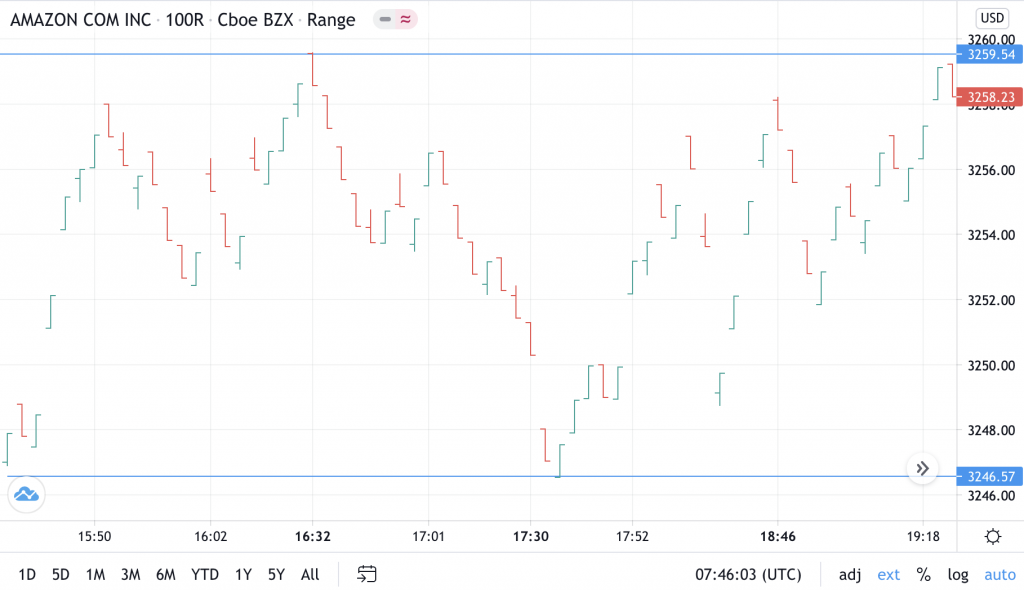

Range areas can be identified on a candlestick chart, though a range bar chart which is based on price movement rather than time allows the trader to view the volatility of a market too.

A bar is completed and a new one is started each time the price moves within a specified range. This means that a highly volatile market will be displayed with a higher number of bars.

Importantly, the range bar trading strategy helps by removing noise from charts, especially if a price is oscillating in a narrow range, which will be displayed as a single bar only. Turning points become clearer and support and resistance bands are emphasised.

Wide trading ranges indicate volatile markets, which, although may yield greater returns, come with increased risk. In forex trading, the Average Daily Range (ADR) indicator shows whether the market range is higher or lower than usual, helping to quantify the risk of trading a particular currency pair. The Average True Indicator (ATR) does the same but includes price gaps in its calculation.

TradingView is a website offering a useful interactive charting tool, where indicators such as average daily range and central pivot range can be applied to filter suitable trading areas.

Execute Range Trading

Once the trading area has been set up, range trading can be executed by simply buying and selling when the price hits the support and resistance bands. Placing stop orders at or just outside the trading range is good practice.

However, using indicators in parallel can provide further insights.

Breakout

As a rule, the range trading pattern will eventually cease and the market will break out of the range. Predicting how and when this trading range breakout will play out is difficult, but indicators can be useful here too.

Bollinger bands are lines applied usually two standard deviations above and below the price, indicating how volatile the market is. While a Bollinger band range expansion suggests an extension of the price pattern, a contraction or narrowing is often seen immediately prior to a breakout.

This technique is very similar to Narrow Range (NR) bar trading, which is a calculation also based on the philosophy that a volatility contraction is often followed by an expansion.

Opening Range Breakout

It is possible to take advantage of range breakouts, in particular when the market opens, as this is often the most active trading period of the day.

By looking at the short period after the market opens (usually 15 or 30 minutes), traders can identify the opening high and low range.

The direction from which the price breaks out from this opening range is an indication of the trend for the rest of the day.

Range Trading With Bots

Algorithmic robots can be used to range trade automatically. For example, the strategy bot can be set to buy as the price crosses above the support band, and sell when it crosses below the resistance level. A new sell trade can be automatically opened at the same time too.

Trading bots can be downloaded from various libraries, depending on which platform the trader is using. For example, MetaTrader has a selection of bots that can be used for range trading called Expert Advisors (EAs). Each comes with the option to configure variables such as lot size, plus resistance and support limits.

Traders can also generate bespoke bots by coding their own trading algorithms, providing full control over setup of the range and risk management. The programming languages used to develop these robots are platform-specific, with MQL offered by the MetaTrader platforms.

Pros & Cons Of Range Trading

Benefits

There are many reasons range trading is a popular strategy:

- Investors can take advantage of regular periods where markets aren’t trending

- Range trading can be applied to any market, meaning the user is not limited to specific hours

- Once the range is defined, the trader has clear entry and exit points, making it easy to invest and place stop losses

- Generally, range trading chases smaller profits across shorter timescales, which reduces the risk of the price being dramatically affected by economic news

Drawbacks

There are also several risks associated with range trading:

- Knowing when a market is within a range and when it will break out is difficult, even for experienced investors.

- Precise timing is essential to generate returns

- Range trading requires frequent investing, increasing commission fees that can eat into profits

- Identifying suitable markets and ranges can be time-consuming

Because of this, it’s recommended that users test their range trading strategies using a demo account with virtual funds first.

Final Word On Range Trading

Range trading is a versatile method that can be applied to all financial markets when there is no clear trend direction. The hardest part can be identifying the support and resistance bands for a range, though once these have been defined, the buying and selling points are clear. Demo accounts are an excellent way to practice defining range areas and predicting breakout points.

Use our list of leading brokers in 2023 to get started today.

FAQ

What Is Range Trading?

Range trading takes advantage of markets that fluctuate within a scale of consistent highs and lows. By setting support and resistance bands, traders can buy and sell at these limits.

Range Trading Vs Swing Trading – What’s The Difference?

Swing trading is a short to medium-term strategy which can be applied to range investing.

Specifically, traders will be interested in price fluctuations within a range across daily or weekly timescales.

Which Assets Can I Range Trade?

Range trading can be applied to all assets including forex, stocks, indices and a commodity such as gold. While the same principles apply, the range area and timescales will depend on the market. For example, intraday trading is better for indices that have an overall growth trend such as Banknifty or the FTSE 100.

Where Can I Range Trade?

Range trading can be carried out on any broker that offers access to the market of interest. The TD Ameritrade thinkorswim platform is a popular choice for US range traders, who offer a free demo account and PDF guides with extra guidance information. See our list of other recommended brands here.

Is Range Trading Easy?

The difficult part of range trading is setting appropriate limits and predicting when the market will break out.