Day trading risk management generally follows the same template or line of thinking. It is most commonly some form of the “one percent rule”.

Namely, it is a rules-based system stipulating that no more than one percent of your account can be dedicated to any given trade. This is done as a matter of prudently managing capital and keeping losses to a minimum.

The “one percent rule” ensures that a trader’s “off days”, or scenarios where the market goes against the trades in the account, don’t damage the portfolio more than necessary.

Effective day trading risk management is the most important skill to learn. And much of what’s involved in sustaining gains over the long run means avoiding material losses of capital.

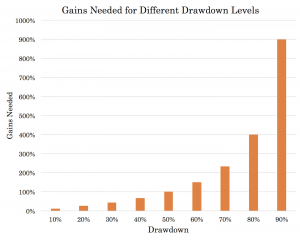

If you have a 50 percent drawdown, that means a 100 percent gain is necessary just to get back to breakeven. On the other hand, if you lose just 10 percent – ideally over a patch spanning several months, not days or weeks (which would signal poor risk management or perhaps bad luck) – you need just an 11.1 percent return to get back to breakeven.

You can observe that this relationship works not linearly, but in steepening non-linear fashion.

Keeping your losses shallow is imperative.

When losses deepen, this is also usually when psychology starts playing more of a role, and always in an adverse way. Traders start making worse decisions and can spiral into a “risk of ruin” scenario.

Everything is a probability. Accordingly, you want to avoid betting too much on any given thing, because there is the chance that it’ll go against you. The general strategy in trading or investing more broadly is to make multiple uncorrelated bets where the probability is in your favour. If you can execute this, you will be successful.

One Percent Rule Example

The one percent rule for day traders means that you never risk more than one percent of your account value on any given position. This one percent often means equity and not borrowed funds. However, this can be used in a way such that leverage can be deployed, but the loss is automatically stopped out if it hits one percent of the net liquidation value of your account.

So, for example, if you have a $20,000 account, this means either one of the following:

(1) No position can be greater than one percent of the account value, even if that includes borrowed money. In other words, the position has to be limited to $200 of stock, forex, or whatever instrument is being traded.

Or:

(2) Leverage can also be employed such that the position is greater than $200 in value. But the stop-loss on the trade is set such that the monetary loss cannot exceed this.

For instance, if you take an $800 position, your stop-loss can never exceed a 25% drop in market value (25% * $800 = $200), or the value equal to 1% of the net liquidation value of your account.

How to Apply the One Percent Rule

Using stop-losses and take-profit levels, you can calculate how to apply the one percent rule ahead of time.

Example

Let’s say a stock you have interest in trading is priced at $20.00. You want to go long the stock at $19.90.

Your take-profit is $20.05. Your stop-loss is $19.85.

The account value is $20,000.

How many shares of this stock could you theoretically buy to keep the one percent rule in place?

First, determine how much you’re allowed to lose on any given trade:

$20,000 * 1% = $200

The maximum loss you can achieve per share is the difference between where you get in and where your stop-loss is. In this case, the difference is $0.05 ($19.90 – $19.85).

Then take your maximum loss amount and divide it by the maximum loss per share:

$200 / $0.05/share = 4,000 shares

Therefore, if your broker would allow your purchasing power up to this amount, you could buy up to 4,000 shares of this stock. (You would need a leverage ratio of 4:1 in this particular example.) Since your loss is minimized to just $0.05 per share, your maximum loss is kept within your parameters.

Things to Keep in Mind

Nevertheless, due to order slippage, where orders don’t always fill at the exact price you want, you might wish to order a smaller number of shares to account for this. Slippage will mean that the one percent loss threshold will likely be exceeded.

Also, if you plan on holding multiple positions – or potentially holding multiple positions – you will need to cut back on how many shares you plan to trade in order to have available capital for those.

Exceptions From the One Percent Rule

Exceptions from the one percent rule depend on liquidity of the market in which you trade.

If you’re trading a liquid stock – usually the higher the market capitalisation the more liquid the stock will be – it will have no trouble taking $10,000-$100,000 orders. (And obviously if you are just starting out, you won’t be trading near these levels of capital.)

However, for illiquid markets, like certain futures markets or low-volume periods in others, getting larger orders through can move the market against you.After all, it is buying and selling activity that moves markets.And that buyer or seller in certain cases can be you.

For larger accounts, in the six-figure range on up, that are trading larger positions, they might actually go lower than the one percent rule to, in effect, the half-percent rule or similar.

If you’re taking positions in very liquid markets, such as large cap stocks, this isn’t an issue until the position sizes are in the millions of dollars, though in a small-cap stock, an exotic currency pair, or thinly traded futures market it can be a different story.

But whatever the case, it is imprudent for day traders to risk more than about one percent of their account on any given trade.

Conclusion

In day trading risk management, the one percent rule can be adjusted to fit each individual trader’s preferences or needs based on the markets they trade and the size of the positions traded.This amount can be calculated using your entry price and stop-loss, knowing you can trade X amount of a security and take a loss of so much before your risk management rule gets you out of the market traded.

Ideally, it should not be more than about one percent.