Short-term trading is an increasingly popular way for independent investors to try and make money from the financial markets. In this guide, we look at the pros and cons of short-term trading, and how beginners can use various strategies and techniques to generate a decent profit margin. We also look at some of the patterns, indicators, and assets used, as well as comparisons between short-term trading vs long-term investing. Use our list of best brokers in 2023 below to get started.

All Brokers for Short-Term Trading

Short-Term Trading Explained

Short-term trading refers to the strategy of buying and selling an asset within a short time frame. Unlike long-term investing, the duration between exit and entry may last anywhere from several minutes to several days. Short-term trades can potentially generate large profit margins but are considered to be riskier than long-term investments.

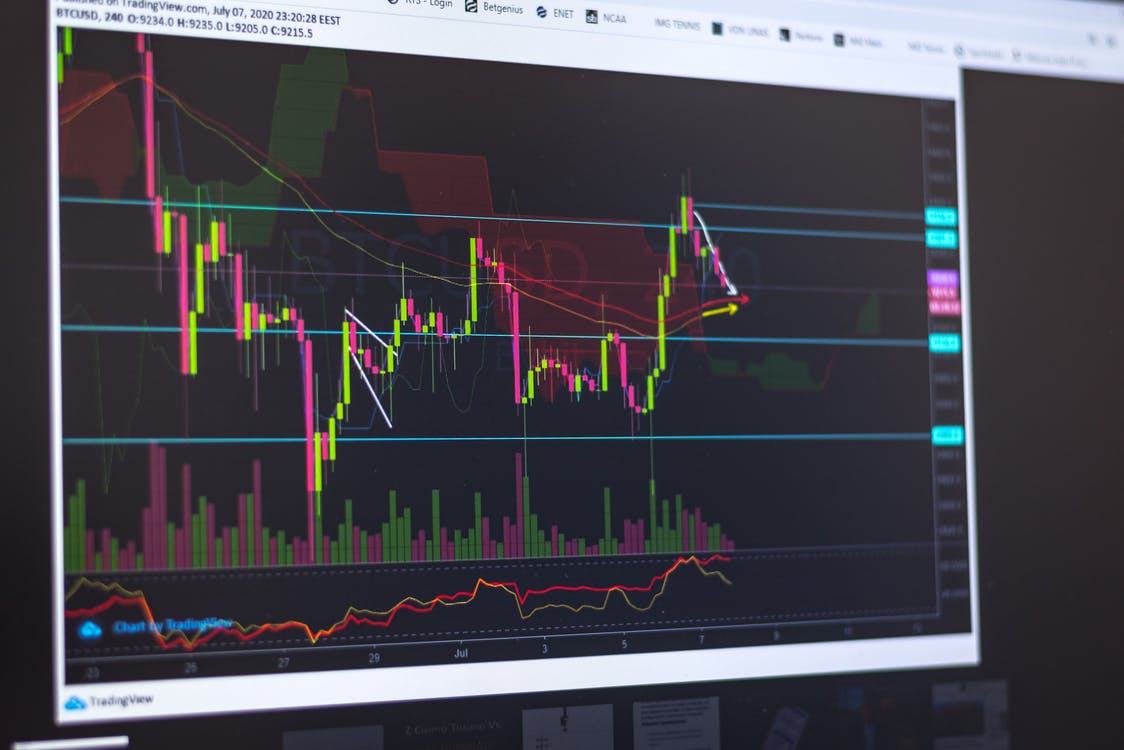

One popular short-term strategy is day trading, in which all positions are entered and exited on the same day. Common vehicles used for short-term trading include stocks, forex, cryptocurrency (such as Bitcoin), ETFs, options, and commodities.

The financial markets often display a large degree of volatility in a short time frame.

Price movement is driven by many factors, from simple supply and demand to news cycles. This complexity makes it difficult to accurately predict how the market will behave over brief periods. However, with the right technique, technical analysis, and a solid grasp of the basics, it is possible for even beginners to make an earning from short-term trading.

Types Of Short-Term Trading

High-Frequency Trading

What’s mostly known as High-frequency trading (HFT) is the ultimate in short-term trading, as an asset might only be held for seconds or even less. It is only possible through the use of automated computer algorithms that act upon market data entirely autonomously according to pre-set rules and conditions. When taken to the extreme, it is even important to physically be as close as possible to the exchange that is being used for trades, so that data and orders arrive in the shortest time possible over the computer network wires.

Ordinary traders, that are mostly fine with a delay of a few seconds, can get involved in a less extreme form of HFT, by using tools for automated trading. Trusting a forex trading robot to manage your finances is not for the beginner trader however, and should involve a lot of testing and tweaking before allowing it to make real trades.

Scalping

Scalping is an ultra-short-term style of trading, with the aim of capitalising on small intraday differences in price.

Scalp trades usually last less than a few minutes. As the amount of profit made per trade is small, scalpers need to execute a high volume of trades.

Traders also need to employ a strict exit strategy to limit the impact of a potential loss. Generally speaking, the more volatile the market, the higher the risk associated with scalping. Liquid markets, such as forex, are often preferred.

Successful scalping strategies typically rely on technical analysis, with short time-frame charts often used. Momentum indicators such as the stochastic oscillator or the relative strength index (RSI), as well as price chart indicators like moving averages, are also popular. Scalpers look for tight spreads to avoid handing over too much of their profits to brokers.

Day Trading

Day trading involves buying and selling securities within a single day. Traders avoid holding positions overnight, which may incur costs or involve unpredictable jumps in price. Day traders tend to leave a longer duration between exit and entry than scalpers, but also make money through repeated small-profit trades.

Day traders often incorporate both fundamental and technical analysis into their strategies. Many experienced short-term day traders use leverage to increase their profits. This style of trading can also magnify losses, however, meaning that leveraged trading is best suited to experienced investors.

Swing Trading

As one of the longer types of short-term trading, swing trading may involve holding positions for periods lasting several days.

This style of trading aims to exploit the price volatility associated with the end of a trend, and usually uses a set of rules based on fundamental and technical analysis.

As it requires less attention than very short-term trades, a swing trading strategy is popular among part-time investors who have other personal commitments or full-time jobs. There are no restrictions regarding how many days you can remain in a trade for since there are various factors that will affect its movement.

Best Markets For Short-Term Trading

Forex

Forex is perhaps the most popular short-term trading market. Currencies can be traded 24 hours a day throughout the working week, and forex traders can choose from a large number of currency pairs.

The forex markets are also highly volatile, meaning price fluctuations can occur more frequently and/or dramatically. This can create opportunities for potentially large profits, but it also comes with significant risks.

Forex traders usually buy and sell major pairs like EURUSD due to their high liquidity, making it easy to enter and exit positions quickly. Major pairs also tend to have lower spreads, reducing the costs associated with repeated short-term trading. Many online platforms and websites support forex trading for retail customers.

Stocks

Stocks (also known as equities) consist of shares that represent the ownership of a fraction of a company.

Stocks can be purchased or sold on various stock exchanges, including the New York Stock Exchange (NYSE) and the Australian Securities Exchange (ASX).

Short-term equity trading in the stock market usually involves strategies that require opening and closing positions within the same day to avoid paying overnight fees. Day traders may use derivatives like options or CFDs to maximize their profits based on the underlying asset’s price, while some traders prefer buying and selling actual shares.

Short selling is one type of short-term stock trading that involves traders profiting from a decrease in price. Day trading in stocks has a minimum capital requirement in some countries, with the US requiring at least $25,000. Some of the best stocks for short-term trading on most global exchanges, such as the NASDAQ or National Stock Exchange of India (NSE), include Google, Apple Inc., and The Walt Disney Co.

Indices & ETFs

Indices, or indexes, measure the performance of a group of stocks. They are highly liquid markets, making them suitable for short-term trading. Indices are generally less unstable than stocks, reducing trading risks. However, some index prices can be volatile around earnings reports and important announcements.

Index funds are similar financial products to stock market indices. They are mutual funds that buy stocks and hold them in a portfolio that approximates the index.

However, mutual funds are generally not regarded as suitable for short-term trading due to their fee structures.

Instead, many traders opt for ETFs, securities that track the price of an index (or another asset) but can be traded like stocks. ETFs are becoming increasingly popular for short-term trading because of their cost-effectiveness and high liquidity.

Commodities

Many different commodities are used in short-term trading markets, from precious metals like gold to energies such as gas. There are several ways to invest in commodities, such as futures contracts like options.

Trading directly in futures contracts is particularly risky but could be potentially profitable. On the other hand, options trading can be cheap (as the asset is never owned directly) but may limit potential profits. Futures contracts with a short duration are good for high-volume day trading.

Cryptocurrency

Short-term crypto traders aim to capitalise on the price fluctuations of digital currencies like Bitcoin, which can be traded round the clock, 7 days a week. To navigate this dynamic market, this style of trading requires dedication, focus, and a well-planned strategy.

Crucially, traders need to be aware of the risks when trading cryptocurrencies on a short-term basis, due to their high volatility and liquidity. Some top crypto brokers for short-term trading include eToro, Trading 212, Robinhood, and Binance.

Pros

There are several benefits of short-term trading, including:

- The approach can potentially lead to large profits in a relatively short time-frame

- The investing style lends itself to a flexible work schedule

- Many apps and platforms support short-term trading

- Day traders can avoid overnight fees and charges

- Profits can be compounded by re-investment

Risks

Nonetheless, short-term trading also involves some potential cons:

- Strategies require dedication and focus

- The approach is generally riskier than long-term investments

- Many find short-term trading to be stressful and emotionally intensive

Strategies

Using a strategy that works is an essential component of successful short-term trading.

Due to their high volatility over short periods, markets often display significant noise. As a result, trading based on guesswork will almost always lead to long-term losses. Professional short-term traders incorporate detailed technical analysis and risk management systems into their decision-making process.

Below are several examples of commonly-used short-term trading strategies:

Momentum Trading

Short-term momentum trading involves detecting and capitalizing on strong market trends. Assets with upward price movements will attract other traders, leading to even higher prices. Similarly, downward trends will draw the interest of short-sellers, pushing the price lower. This trading style frequently employs moving averages to identify entry and exit points. Crossovers of different moving averages are often used as trading indicators.

Breakout Trading

Breakout traders aim to enter a short-term trend very early on by identifying upcoming periods of volatility. This is usually done by keeping an eye on volume indicators like the money flow index (MFI), where increasing volume may signify a possible breakout. Limit-orders are also used to place orders automatically at a particular level of support or resistance.

Range Trading

This popular style of short-term trading capitalizes on markets moving inside lines of support and resistance.

Range-bound markets offer relatively small profits but can be used repeatedly to build a steady profit. Often, range traders use technical indicators like the stochastic oscillator or relative strength index to ride the mini-trends between support and resistance levels.

How To Start Short-Term Trading

Step 1: Choose A Platform

There is a vast array of online brokers to choose from for short-term trading. Always do your research to make sure that a brokerage is trustworthy before signing up.

Different platforms will suit the needs of different traders, depending on the range of assets, leverage, and spreads available. Many companies offer multiple accounts to retail clients, each offering various benefits.

Make sure to also take into account any fees or commissions on trades. Many brokers offer fee-free trading on stocks, such as TD Ameritrade, whilst others may charge account or service fees, such as Fidelity or Vanguard.

Other factors to consider when choosing a trading site include:

- Tax considerations depending on jurisdiction, e.g. capital gains tax

- Deposit and withdrawal methods

- Range of tradable securities

- Mobile app availability

- Customer support

Step 2: Pick An Asset

Factors to consider when picking a security for short-term trading include liquidity, volatility, and volume. Short-term trading experts prefer markets with high liquidity to enable them to enter and exit the market quickly.

Volatile assets can lead to generous profit margins but carry significant risks – sophisticated technical analysis is often required to consistently make correct calls.

Many day traders prefer to use calmer markets to make a steady profit.Trading volume is linked to the degree of interest in an asset and can indicate how its price is going to move.

Many short-term traders use derivatives for trading.These securities can generate significant returns, particularly when leveraged and are often used by professional day traders.However, to be successful, this style of trading requires a sensible risk minimisation strategy (for example, through stop-loss orders).

Step 3: Develop A Strategy

All successful practitioners will use a dedicated short-term trading strategy.There is no one-size-fits-all “best” strategy, as becoming a successful trader is all about learning when to employ different methods.Above all, using a strategy helps traders to avoid unhelpful emotions.

Furthermore, having a sensible money management approach is just as important as the short-term trading strategy itself.Many traders use the “percentage method”, in which a percentage of their balance (usually 1% or 2%) is used per trade, to ensure that their capital never runs dry and their profits grow concurrently with their funds.

Step 4: Execute Your First Trade

Once you’ve picked a short-term trading platform, market, and strategy, all that remains is to open your first position.

Many brokers offer new customers demo accounts pre-loaded with a set amount of virtual capital, which can be a good way for beginners to familiarize themselves with the basics.

In any case, it is advised that novice traders start by investing smaller amounts of capital and use low leverage rates. New traders may also want to spend some time observing how the market behaves before placing any orders.

Short-Term Trading Tips

Here are 3 top tips for successful trading:

1. Stay Calm And Stick To Your Plan

Short-term traders who make market decisions based on intuition or emotion are not likely to generate a significant profit margin. Risky styles of trading can be draining and stressful, so it is important to maintain a calm, neutral mindset. Professional traders will use a clear strategy to make their trading scientific and repeatable. Operating in this way will also help to improve your understanding of the market.

2. Cut Your Losses

Most strategies will not win every single trade, making it important to contain the impact of any potential losses. This is often done through the use of stop-loss and limit orders. Always ensure that you have a pre-planned exit strategy.

3. Manage Your Funds Sensibly

Sensible traders limit their trades to a set percentage of their total funds. New traders should use smaller amounts at first while they perfect their strategies.

Resources & Tools

For those simply looking to expand their knowledge, or to learn short-term strategies from scratch, there is an abundance of resources online or available to purchase.

Some popular books include:

- Short-Term Trading Strategies That Work – Larry Connors and Cesar Alvarez (also available in a PDF version)

- The trading ‘For Dummies’ range, including ‘Day Trading For Dummies’ and ‘Swing Trading For Dummies’

- A Beginner’s Guide To Short-Term Trading, 2nd Edition (hardcover and PDF) – Toni Turner

- Short-Term Trading In The New Stock Market (hardcover and PDF) – Toni Turner

- Short-Term Trading With Price Patterns (hardcover and PDF) – Michael Harris

- Long-Term Secrets To Short-Term Trading, 2nd Edition – Larry Williams

In addition to books, you can also take advantage of any online tools or communities such as Reddit, Quora or the popular Telegram social channel. These are excellent places to find the top picks, ideas and recommendations for short-term trading courses or lessons, from fellow traders.

Final Word On Short-Term Trading

In this article, we have explored some of the best markets, techniques, and rules for short-term trading. This style of trading involves significant risks, but can potentially lead to good earnings with the right strategy and mindset.

Successful short-term trading experts will incorporate sophisticated technical analysis tools and indicators into their practices, as well as trading algorithms. Many online trading platforms and apps offer short-term trading to retail clients, but make sure you thoroughly research the broker’s software, fees and additional features before signing up.

FAQ

Is Short-Term Trading Halal Or Haram?

Some Islamic scholars have argued that, by using a trading strategy, investors can avoid ‘gambling’ while short-term trading.

In addition, many online trading websites offer swap-free accounts to Muslim traders.

Can I Use The Forex Markets For Short-Term Trading?

Yes, many forex traders practice short-term trading.Currency pairs with high liquidity and low spreads are preferred for fast execution and cost-effectiveness.

What Is The Best Strategy For Short-Term Trading?

There is no “holy grail” short-term trading strategy.Successful traders will use a variety of techniques and analysis tools depending on the situation.Each strategy will differ depending on the trader’s preferences, risk appetite, and the asset they are trading.

What Duration Are Short-Term Trades?

Short-term trading can involve periods lasting anywhere from a few seconds to several days.